- Hong Kong

- /

- Interactive Media and Services

- /

- SEHK:1024

High Growth Tech Stocks To Explore In October 2024

Reviewed by Simply Wall St

The Hong Kong market has recently experienced a surge, driven by China's robust stimulus measures aimed at revitalizing its economy, which has positively influenced investor sentiment and technology stocks in particular. In this dynamic environment, identifying promising high-growth tech stocks involves looking for companies that are well-positioned to benefit from increased demand and innovation within the sector.

Top 10 High Growth Tech Companies In Hong Kong

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Wasion Holdings | 22.37% | 25.47% | ★★★★★☆ |

| MedSci Healthcare Holdings | 48.74% | 48.78% | ★★★★★☆ |

| Inspur Digital Enterprise Technology | 25.31% | 39.04% | ★★★★★☆ |

| RemeGen | 26.30% | 52.19% | ★★★★★☆ |

| Akeso | 32.58% | 54.53% | ★★★★★★ |

| Cowell e Holdings | 31.82% | 35.43% | ★★★★★★ |

| Biocytogen Pharmaceuticals (Beijing) | 21.53% | 109.17% | ★★★★★☆ |

| Innovent Biologics | 22.24% | 59.39% | ★★★★★☆ |

| Beijing Airdoc Technology | 37.47% | 93.35% | ★★★★★☆ |

| Sichuan Kelun-Biotech Biopharmaceutical | 24.70% | 8.53% | ★★★★★☆ |

Click here to see the full list of 45 stocks from our SEHK High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

Kuaishou Technology (SEHK:1024)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kuaishou Technology is an investment holding company offering live streaming, online marketing, and other services in the People's Republic of China with a market capitalization of approximately HK$258.56 billion.

Operations: Kuaishou Technology generates revenue primarily from domestic operations, amounting to CN¥117.32 billion, with a smaller contribution from overseas markets at CN¥3.57 billion. The company focuses on live streaming and online marketing services within China.

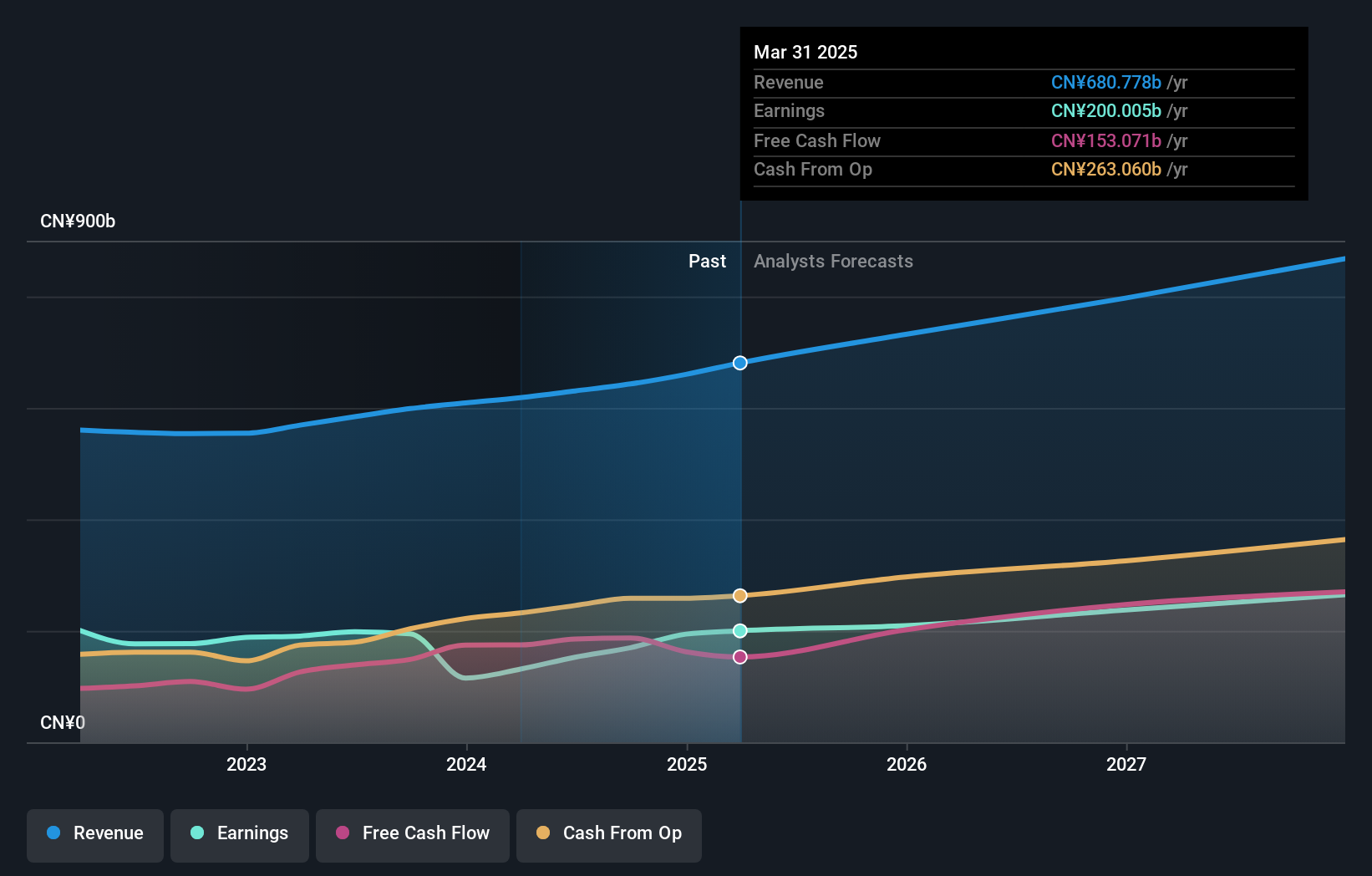

Kuaishou Technology, a player in the Interactive Media and Services sector, has shown significant growth with its Q2 earnings skyrocketing to CNY 3.98 billion from CNY 1.48 billion year-over-year. This performance is underpinned by a robust R&D focus, where expenses are strategically channeled into enhancing its AI capabilities, notably the Kling AI video generation model. The recent upgrades to Kling AI not only improve video quality but also expand its functionality—critical as the firm capitalizes on surging demand among content creators. With revenue projected to climb by 9% annually and earnings expected to surge by 18.7% per year, Kuaishou is leveraging technological innovation to stay ahead in a competitive landscape, setting a strong precedent for sustained growth in Hong Kong's tech scene.

- Take a closer look at Kuaishou Technology's potential here in our health report.

Understand Kuaishou Technology's track record by examining our Past report.

Tencent Holdings (SEHK:700)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Tencent Holdings Limited is an investment holding company that provides value-added services, online advertising, fintech, and business services both in China and globally, with a market capitalization of HK$4.32 trillion.

Operations: Tencent Holdings generates revenue primarily through value-added services (VAS), online advertising, and fintech and business services. The VAS segment is the largest contributor with CN¥302.28 billion, followed by fintech and business services at CN¥209.17 billion, and online advertising at CN¥111.89 billion.

Tencent Holdings, amid a dynamic tech landscape in Hong Kong, has demonstrated robust growth with its Q2 revenue surging to CNY 161.12 billion, up from CNY 149.21 billion the previous year, reflecting an 8% increase. This growth is supported by significant R&D investments aimed at enhancing its software and AI capabilities; indeed, R&D expenses have been a critical component of Tencent's strategy to maintain competitiveness in the fast-evolving tech sector. Moreover, with earnings climbing dramatically to CNY 47.63 billion from CNY 26.17 billion and forecasted earnings growth of approximately 12.8% annually, Tencent is not just growing but also efficiently converting revenue into profit—a testament to its operational prowess and innovative edge in areas like gaming and digital content where it continues to expand market share.

Lenovo Group (SEHK:992)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lenovo Group Limited is an investment holding company that develops, manufactures, and markets technology products and services, with a market capitalization of HK$137.69 billion.

Operations: The company's revenue streams are primarily driven by the Intelligent Devices Group, which generated $45.76 billion, followed by the Infrastructure Solutions Group with $10.17 billion and the Solutions and Services Group contributing $7.64 billion.

Amidst a competitive tech landscape, Lenovo Group has been actively enhancing its R&D capabilities, evidenced by its significant annual investment in research and development. In the latest fiscal year, Lenovo allocated 7.9% of its revenue to R&D efforts aimed at advancing hybrid cloud solutions and AI technologies—a strategic move reflecting an 18.7% expected annual growth in earnings. These initiatives are part of Lenovo’s broader strategy to integrate AI-driven solutions across diverse sectors, positioning it as a pivotal player in transforming traditional IT infrastructures into agile, future-ready systems.

Seize The Opportunity

- Click here to access our complete index of 45 SEHK High Growth Tech and AI Stocks.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kuaishou Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1024

Kuaishou Technology

An investment holding company, provides live streaming, online marketing, and other services in the People’s Republic of China.

Flawless balance sheet and undervalued.