- Hong Kong

- /

- Interactive Media and Services

- /

- SEHK:700

High Growth Tech Stocks In Hong Kong To Watch

Reviewed by Simply Wall St

As global markets grapple with geopolitical tensions and economic uncertainties, Hong Kong's tech sector has shown resilience, buoyed by optimism surrounding Beijing's support measures. In this dynamic environment, identifying high-growth tech stocks involves looking at companies with strong innovation capabilities and adaptability to shifting market conditions.

Top 10 High Growth Tech Companies In Hong Kong

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Wasion Holdings | 22.37% | 25.47% | ★★★★★☆ |

| MedSci Healthcare Holdings | 48.74% | 48.78% | ★★★★★☆ |

| Inspur Digital Enterprise Technology | 25.31% | 39.04% | ★★★★★☆ |

| RemeGen | 26.30% | 52.19% | ★★★★★☆ |

| Akeso | 32.41% | 54.21% | ★★★★★★ |

| Cowell e Holdings | 31.68% | 35.44% | ★★★★★★ |

| Innovent Biologics | 22.24% | 59.39% | ★★★★★☆ |

| Sichuan Kelun-Biotech Biopharmaceutical | 24.70% | 8.53% | ★★★★★☆ |

| Biocytogen Pharmaceuticals (Beijing) | 21.53% | 109.17% | ★★★★★☆ |

| Beijing Airdoc Technology | 37.47% | 93.35% | ★★★★★☆ |

Click here to see the full list of 43 stocks from our SEHK High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

Kuaishou Technology (SEHK:1024)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kuaishou Technology is an investment holding company that offers live streaming, online marketing, and other services in the People’s Republic of China, with a market cap of approximately HK$264.17 billion.

Operations: The company generates revenue primarily from domestic operations, amounting to CN¥117.32 billion, with a smaller contribution from overseas markets at CN¥3.57 billion.

Kuaishou Technology, a contender in Hong Kong's tech arena, has demonstrated robust financial and operational growth. In the recent earnings for Q2 2024, it reported a significant jump in net income to CNY 3.98 billion from CNY 1.48 billion year-over-year, with sales rising to CNY 30.98 billion. This performance is underpinned by an aggressive R&D strategy which saw expenses align closely with revenue enhancements, reflecting a deep commitment to innovation—particularly in AI through its Kling AI platform upgrades and new subscription models aimed at diverse user needs. These strategic moves not only bolster Kuaishou's market position but also enhance its product offerings' sophistication and appeal, setting a strong foundation for future growth trajectories in the highly competitive tech landscape.

- Get an in-depth perspective on Kuaishou Technology's performance by reading our health report here.

Understand Kuaishou Technology's track record by examining our Past report.

Tencent Holdings (SEHK:700)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Tencent Holdings Limited is an investment holding company that provides value-added services, online advertising, fintech, and business services in China and globally, with a market capitalization of approximately HK$4.40 trillion.

Operations: The company generates revenue primarily from Value-Added Services (CN¥302.28 billion), Fintech and Business Services (CN¥209.17 billion), and Online Advertising (CN¥111.89 billion).

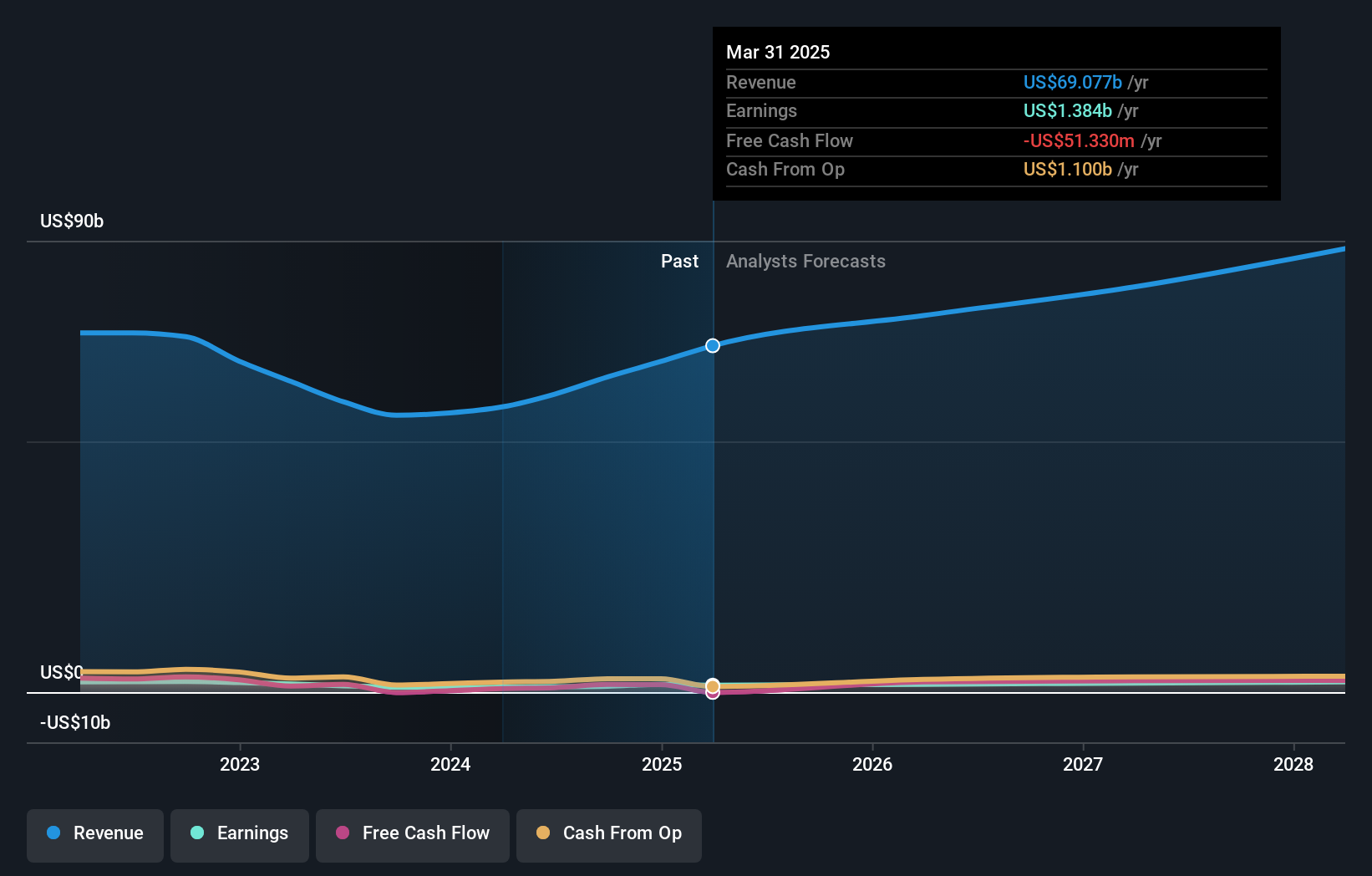

Tencent Holdings, amidst a dynamic tech landscape in Hong Kong, has shown resilience and strategic foresight. Recently, the company reported a significant revenue increase to CNY 161.12 billion for Q2 2024, up from CNY 149.21 billion the previous year, with net income also rising sharply to CNY 47.63 billion from CNY 26.17 billion. These financial gains are underpinned by robust R&D investments which accounted for a substantial portion of their revenue, aligning with an aggressive innovation trajectory particularly in gaming and cloud services sectors—areas where Tencent is poised to expand its market influence further. Additionally, recent M&A discussions regarding Ubisoft suggest strategic moves to stabilize and potentially enhance its portfolio in the competitive gaming industry—a sector that continues to promise high growth potential.

- Take a closer look at Tencent Holdings' potential here in our health report.

Explore historical data to track Tencent Holdings' performance over time in our Past section.

Lenovo Group (SEHK:992)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lenovo Group Limited is an investment holding company that develops, manufactures, and markets technology products and services with a market capitalization of HK$143.65 billion.

Operations: The company's primary revenue streams are derived from its Intelligent Devices Group (IDG) at $45.76 billion and Infrastructure Solutions Group (ISG) at $10.17 billion, complemented by the Solutions and Services Group (SSG) contributing $7.64 billion.

Amidst a transformative tech landscape, Lenovo Group stands out with its strategic focus on hybrid cloud solutions and AI-driven services. Recently, the company reported a robust increase in sales to $15.45 billion for Q1 2025, up from $12.90 billion the previous year, reflecting an impressive growth of 19.8%. This surge is supported by Lenovo's innovative Hybrid Cloud Advisory Services aimed at enhancing enterprise AI capabilities—a crucial driver in today's tech ecosystem. Moreover, with an R&D expense ratio that has consistently aligned with industry innovation demands, Lenovo is well-positioned to maintain its competitive edge in developing cutting-edge technologies for global markets.

- Dive into the specifics of Lenovo Group here with our thorough health report.

Gain insights into Lenovo Group's past trends and performance with our Past report.

Next Steps

- Unlock more gems! Our SEHK High Growth Tech and AI Stocks screener has unearthed 40 more companies for you to explore.Click here to unveil our expertly curated list of 43 SEHK High Growth Tech and AI Stocks.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tencent Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:700

Tencent Holdings

An investment holding company, offers value-added services (VAS), online advertising, fintech, and business services in the People’s Republic of China and internationally.

Flawless balance sheet with reasonable growth potential.