- Hong Kong

- /

- Food and Staples Retail

- /

- SEHK:948

Most Shareholders Will Probably Find That The Compensation For Alpha Professional Holdings Limited's (HKG:948) CEO Is Reasonable

Performance at Alpha Professional Holdings Limited (HKG:948) has been rather uninspiring recently and shareholders may be wondering how CEO Peijian Yi plans to fix this. One way they can exercise their influence on management is through voting on resolutions, such as executive remuneration at the next AGM, coming up on 08 September 2021. Voting on executive pay could be a powerful way to influence management, as studies have shown that the right compensation incentives impact company performance. In our opinion, CEO compensation does not look excessive and we discuss why.

Check out our latest analysis for Alpha Professional Holdings

How Does Total Compensation For Peijian Yi Compare With Other Companies In The Industry?

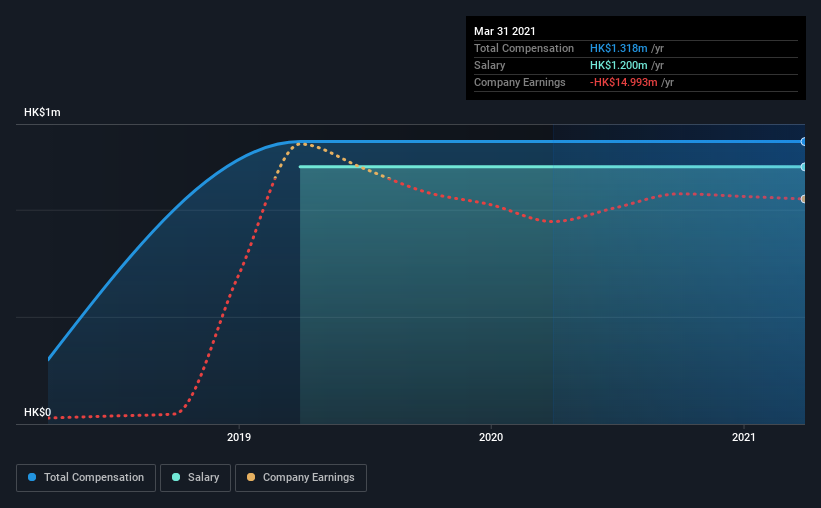

At the time of writing, our data shows that Alpha Professional Holdings Limited has a market capitalization of HK$330m, and reported total annual CEO compensation of HK$1.3m for the year to March 2021. This was the same amount the CEO received in the prior year. In particular, the salary of HK$1.20m, makes up a huge portion of the total compensation being paid to the CEO.

In comparison with other companies in the industry with market capitalizations under HK$1.6b, the reported median total CEO compensation was HK$2.1m. This suggests that Peijian Yi is paid below the industry median.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | HK$1.2m | HK$1.2m | 91% |

| Other | HK$118k | HK$118k | 9% |

| Total Compensation | HK$1.3m | HK$1.3m | 100% |

Speaking on an industry level, nearly 81% of total compensation represents salary, while the remainder of 19% is other remuneration. It's interesting to note that Alpha Professional Holdings pays out a greater portion of remuneration through salary, compared to the industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Alpha Professional Holdings Limited's Growth

Alpha Professional Holdings Limited has seen its earnings per share (EPS) increase by 115% a year over the past three years. In the last year, its revenue is up 81%.

Shareholders would be glad to know that the company has improved itself over the last few years. The combination of strong revenue growth with medium-term EPS improvement certainly points to the kind of growth we like to see. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Alpha Professional Holdings Limited Been A Good Investment?

With a total shareholder return of -59% over three years, Alpha Professional Holdings Limited shareholders would by and large be disappointed. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

To Conclude...

The loss to shareholders over the past three years is certainly concerning. This diverges with the robust growth in EPS, suggesting that there is a large discrepancy between share price and fundamentals. A key focus for the board and management will be how to align the share price with fundamentals. In the upcoming AGM, shareholders should take this opportunity to raise these concerns with the board and revisit their investment thesis with regards to the company.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. That's why we did our research, and identified 3 warning signs for Alpha Professional Holdings (of which 1 is potentially serious!) that you should know about in order to have a holistic understanding of the stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:948

Alpha Professional Holdings

An investment holding company, engages in the milk products, logistics, and property investment businesses in Hong Kong and the People’s Republic of China.

Moderate risk with imperfect balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026