I Ran A Stock Scan For Earnings Growth And VSTECS Holdings (HKG:856) Passed With Ease

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in VSTECS Holdings (HKG:856). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

View our latest analysis for VSTECS Holdings

How Fast Is VSTECS Holdings Growing?

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. That means EPS growth is considered a real positive by most successful long-term investors. VSTECS Holdings managed to grow EPS by 16% per year, over three years. That's a good rate of growth, if it can be sustained.

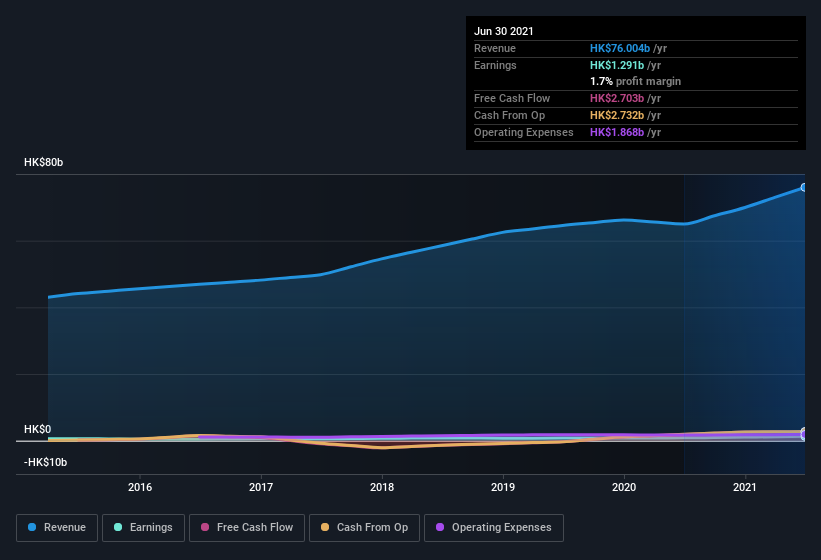

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). VSTECS Holdings maintained stable EBIT margins over the last year, all while growing revenue 17% to HK$76b. That's progress.

In the chart below, you can see how the company has grown earnings, and revenue, over time. For finer detail, click on the image.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for VSTECS Holdings.

Are VSTECS Holdings Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

One shining light for VSTECS Holdings is the serious outlay one insider has made to buy shares, in the last year. Indeed, Chairman & CEO Jialin Li has accumulated shares over the last year, paying a total of HK$15m at an average price of about HK$6.85. It doesn't get much better than that, in terms of large investments from insiders.

On top of the insider buying, we can also see that VSTECS Holdings insiders own a large chunk of the company. Actually, with 41% of the company to their names, insiders are profoundly invested in the business. I'm always comforted by solid insider ownership like this, as it implies that those running the business are genuinely motivated to create shareholder value. And their holding is extremely valuable at the current share price, totalling HK$4.8b. Now that's what I call some serious skin in the game!

Should You Add VSTECS Holdings To Your Watchlist?

One important encouraging feature of VSTECS Holdings is that it is growing profits. Better yet, insiders are significant shareholders, and have been buying more shares. That makes the company a prime candidate for my watchlist - and arguably a research priority. Of course, identifying quality businesses is only half the battle; investors need to know whether the stock is undervalued. So you might want to consider this free discounted cashflow valuation of VSTECS Holdings.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of VSTECS Holdings, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:856

VSTECS Holdings

An investment holding company, develops information technology IT product channel and provides technical solution integration services in North Asia and Southeast Asia.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion