- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:8070

Is Now The Time To Put Keen Ocean International Holding (HKG:8070) On Your Watchlist?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

In contrast to all that, many investors prefer to focus on companies like Keen Ocean International Holding (HKG:8070), which has not only revenues, but also profits. While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Check out the opportunities and risks within the HK Electronic industry.

How Fast Is Keen Ocean International Holding Growing Its Earnings Per Share?

Keen Ocean International Holding has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. As a result, we'll zoom in on growth over the last year, instead. In previous twelve months, Keen Ocean International Holding's EPS has risen from HK$0.045 to HK$0.048. That's a fair increase of 6.8%.

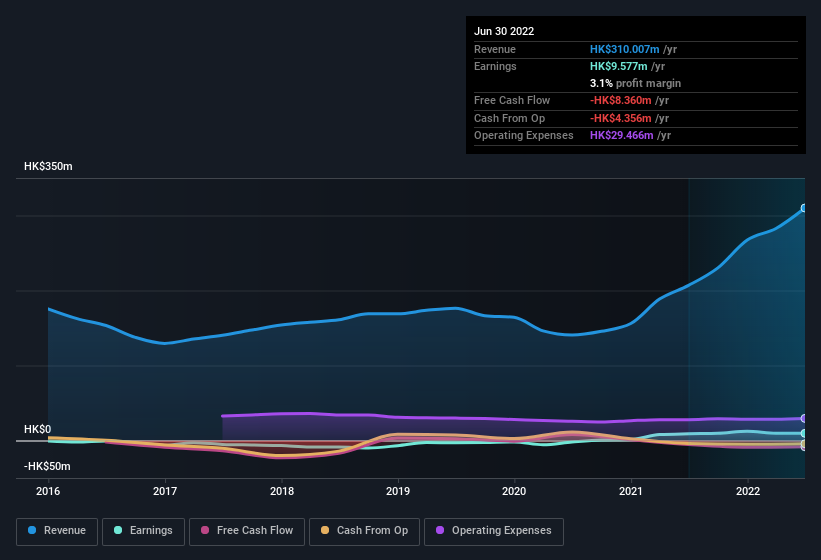

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. While we note Keen Ocean International Holding achieved similar EBIT margins to last year, revenue grew by a solid 50% to HK$310m. That's progress.

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

Keen Ocean International Holding isn't a huge company, given its market capitalisation of HK$54m. That makes it extra important to check on its balance sheet strength.

Are Keen Ocean International Holding Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So those who are interested in Keen Ocean International Holding will be delighted to know that insiders have shown their belief, holding a large proportion of the company's shares. In fact, they own 70% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. Intuition will tell you this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. Valued at only HK$54m Keen Ocean International Holding is really small for a listed company. That means insiders only have HK$38m worth of shares, despite the large proportional holding. That's not a huge stake in absolute terms, but it should help keep insiders aligned with other shareholders.

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? Well, based on the CEO pay, you'd argue that they are indeed. Our analysis has discovered that the median total compensation for the CEOs of companies like Keen Ocean International Holding with market caps under HK$1.6b is about HK$1.9m.

The Keen Ocean International Holding CEO received total compensation of just HK$538k in the year to December 2021. First impressions seem to indicate a compensation policy that is favourable to shareholders. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Is Keen Ocean International Holding Worth Keeping An Eye On?

One important encouraging feature of Keen Ocean International Holding is that it is growing profits. Earnings growth might be the main attraction for Keen Ocean International Holding, but the fun does not stop there. With a meaningful level of insider ownership, and reasonable CEO pay, a reasonable mind might conclude that this is one stock worth watching. We should say that we've discovered 2 warning signs for Keen Ocean International Holding that you should be aware of before investing here.

Although Keen Ocean International Holding certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see insider buying, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Keen Ocean International Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8070

Keen Ocean International Holding

An investment holding company, designs, develops, manufactures, and sells transformers, switching mode power supplies, electronic parts and components, and electric healthcare products in Hong Kong and internationally.

Flawless balance sheet and fair value.

Market Insights

Community Narratives