- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:8070

Here's Why Keen Ocean International Holding (HKG:8070) Has Caught The Eye Of Investors

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Keen Ocean International Holding (HKG:8070). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out our latest analysis for Keen Ocean International Holding

Keen Ocean International Holding's Improving Profits

In the last three years Keen Ocean International Holding's earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. So it would be better to isolate the growth rate over the last year for our analysis. To the delight of shareholders, Keen Ocean International Holding's EPS soared from HK$0.048 to HK$0.064, over the last year. That's a fantastic gain of 33%.

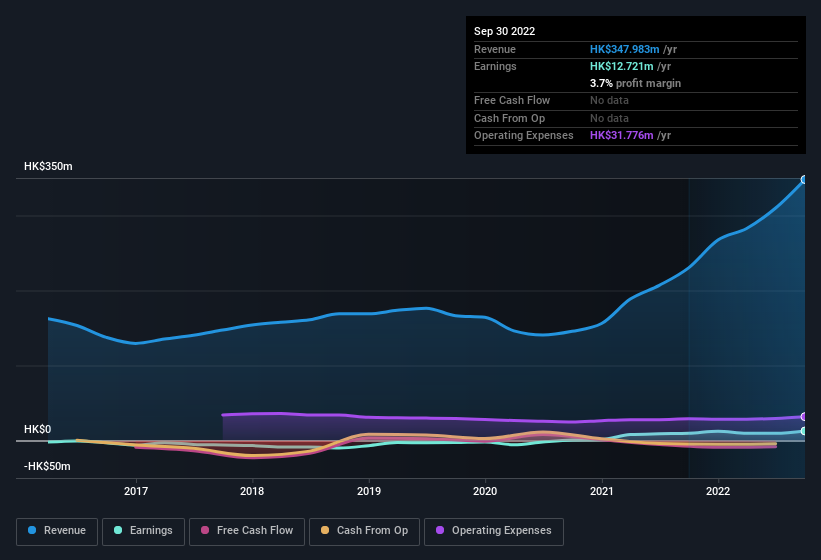

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. EBIT margins for Keen Ocean International Holding remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 51% to HK$348m. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Keen Ocean International Holding isn't a huge company, given its market capitalisation of HK$40m. That makes it extra important to check on its balance sheet strength.

Are Keen Ocean International Holding Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So as you can imagine, the fact that Keen Ocean International Holding insiders own a significant number of shares certainly is appealing. Indeed, with a collective holding of 70%, company insiders are in control and have plenty of capital behind the venture. Intuition will tell you this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. Of course, Keen Ocean International Holding is a very small company, with a market cap of only HK$40m. That means insiders only have HK$28m worth of shares, despite the large proportional holding. That's not a huge stake in absolute terms, but it should help keep insiders aligned with other shareholders.

It means a lot to see insiders invested in the business, but shareholders may be wondering if remuneration policies are in their best interest. A brief analysis of the CEO compensation suggests they are. Our analysis has discovered that the median total compensation for the CEOs of companies like Keen Ocean International Holding with market caps under HK$1.6b is about HK$1.9m.

The CEO of Keen Ocean International Holding only received HK$538k in total compensation for the year ending December 2021. That's clearly well below average, so at a glance that arrangement seems generous to shareholders and points to a modest remuneration culture. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of a culture of integrity, in a broader sense.

Should You Add Keen Ocean International Holding To Your Watchlist?

For growth investors, Keen Ocean International Holding's raw rate of earnings growth is a beacon in the night. If you need more convincing beyond that EPS growth rate, don't forget about the reasonable remuneration and the high insider ownership. This may only be a fast rundown, but the key takeaway is that Keen Ocean International Holding is worth keeping an eye on. It is worth noting though that we have found 2 warning signs for Keen Ocean International Holding that you need to take into consideration.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Keen Ocean International Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8070

Keen Ocean International Holding

An investment holding company, designs, develops, manufactures, and sells transformers, switching mode power supplies, electronic parts and components, and electric healthcare products in Hong Kong and internationally.

Flawless balance sheet and fair value.

Market Insights

Community Narratives