Hong Kong's Top Undervalued Small Caps With Insider Action For August 2024

Reviewed by Simply Wall St

As global markets react to anticipated interest rate cuts by the Federal Reserve, Hong Kong's small-cap stocks are drawing increased attention from investors. In this environment, identifying undervalued small caps with insider action can offer unique opportunities for those looking to capitalize on market inefficiencies.

Top 10 Undervalued Small Caps With Insider Buying In Hong Kong

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Ever Sunshine Services Group | 5.5x | 0.4x | 26.52% | ★★★★★☆ |

| Shenzhen International Holdings | 7.4x | 0.7x | 29.66% | ★★★★★☆ |

| Wasion Holdings | 10.7x | 0.8x | 43.19% | ★★★★☆☆ |

| Lion Rock Group | 6.0x | 0.4x | 45.56% | ★★★★☆☆ |

| EEKA Fashion Holdings | 8.0x | 0.8x | 21.86% | ★★★☆☆☆ |

| BOE Varitronix | 8.0x | 0.3x | -21.22% | ★★★☆☆☆ |

| Skyworth Group | 5.1x | 0.1x | -160.39% | ★★★☆☆☆ |

| China Leon Inspection Holding | 9.6x | 0.7x | 37.26% | ★★★☆☆☆ |

| Lee & Man Paper Manufacturing | 6.1x | 0.4x | -25.83% | ★★★☆☆☆ |

| Cathay Group Holdings | NA | 1.3x | 14.09% | ★★★☆☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Shanghai Chicmax Cosmetic (SEHK:2145)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Shanghai Chicmax Cosmetic is a company engaged in the manufacture and sale of cosmetic products with a market cap of CN¥8.56 billion.

Operations: The company generates revenue primarily from the manufacture and sale of cosmetic products, with a recent revenue figure of CN¥6.11 billion. The gross profit margin has shown an increasing trend, reaching 74.96% as of June 2024.

PE: 17.5x

Shanghai Chicmax Cosmetic, a small-cap stock in Hong Kong, has shown significant growth with half-year sales reaching CNY 3.5 billion, up from CNY 1.6 billion last year. Net income surged to CNY 401 million from CNY 101 million. The company proposed an interim dividend of RMB 0.75 per share for the six months ended June 2024, payable in November. Notably, insider confidence is evident with recent purchases by executives over the past six months, signaling potential undervaluation and future growth prospects.

Comba Telecom Systems Holdings (SEHK:2342)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Comba Telecom Systems Holdings specializes in providing wireless telecommunications network system equipment and services, as well as operator telecommunication services, with a market cap of HK$2.18 billion.

Operations: The company generates revenue primarily from Wireless Telecommunications Network System Equipment and Services, with a smaller portion from Operator Telecommunication Services. The gross profit margin peaked at 30.93% in Q4 2019 but has fluctuated over time, reaching 27.79% by Q4 2023.

PE: -11.9x

Comba Telecom Systems Holdings, a small-cap company in Hong Kong, has faced recent financial challenges, including a projected loss of up to HK$160 million for the first half of 2024 due to delayed network capital projects and decreased other income. Despite this, insider confidence remains evident as Tung Ling Fok purchased 1.83 million shares valued at approximately HK$930,371 between June and August 2024. Additionally, the company initiated a share repurchase program in June 2024 to enhance net assets per share and earnings per share.

BOE Varitronix (SEHK:710)

Simply Wall St Value Rating: ★★★☆☆☆

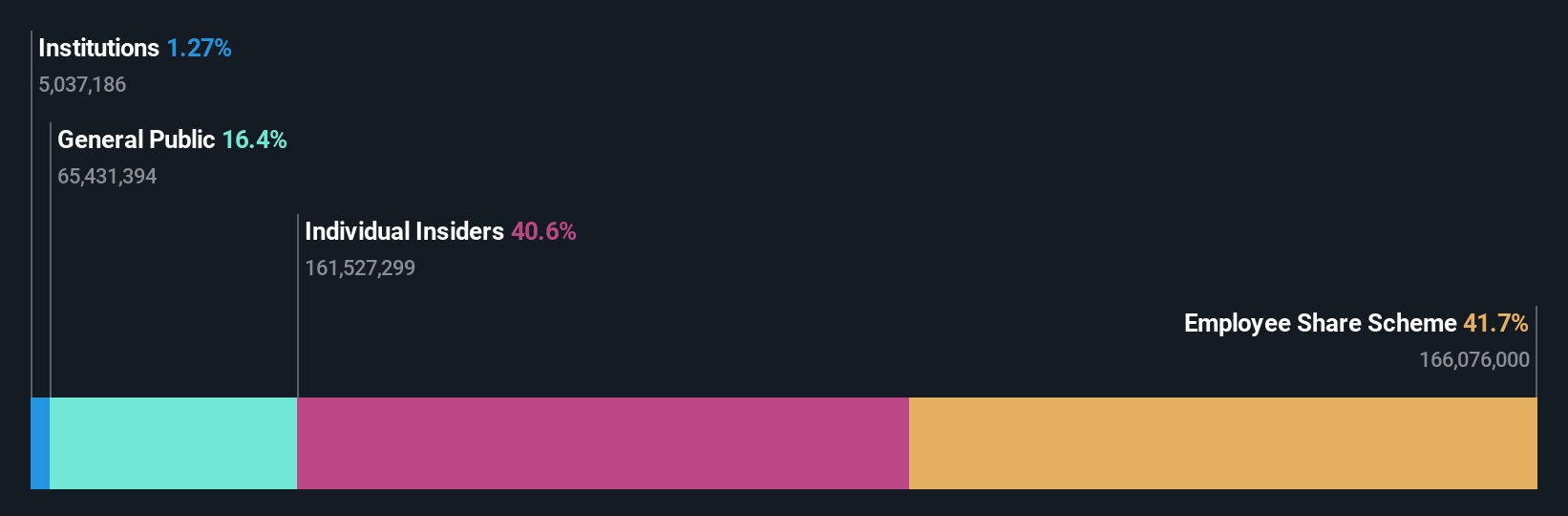

Overview: BOE Varitronix specializes in the design, manufacture, and sale of liquid crystal displays and related products, with a market cap of HK$5.68 billion.

Operations: The company generates revenue primarily from the design, manufacture, and sale of liquid crystal displays and related products. For the period ending June 30, 2024, it reported a gross profit margin of 18.46% on revenue of HK$11.68 billion. Operating expenses for this period were HK$1.78 billion with a net income margin of 3.81%.

PE: 8.0x

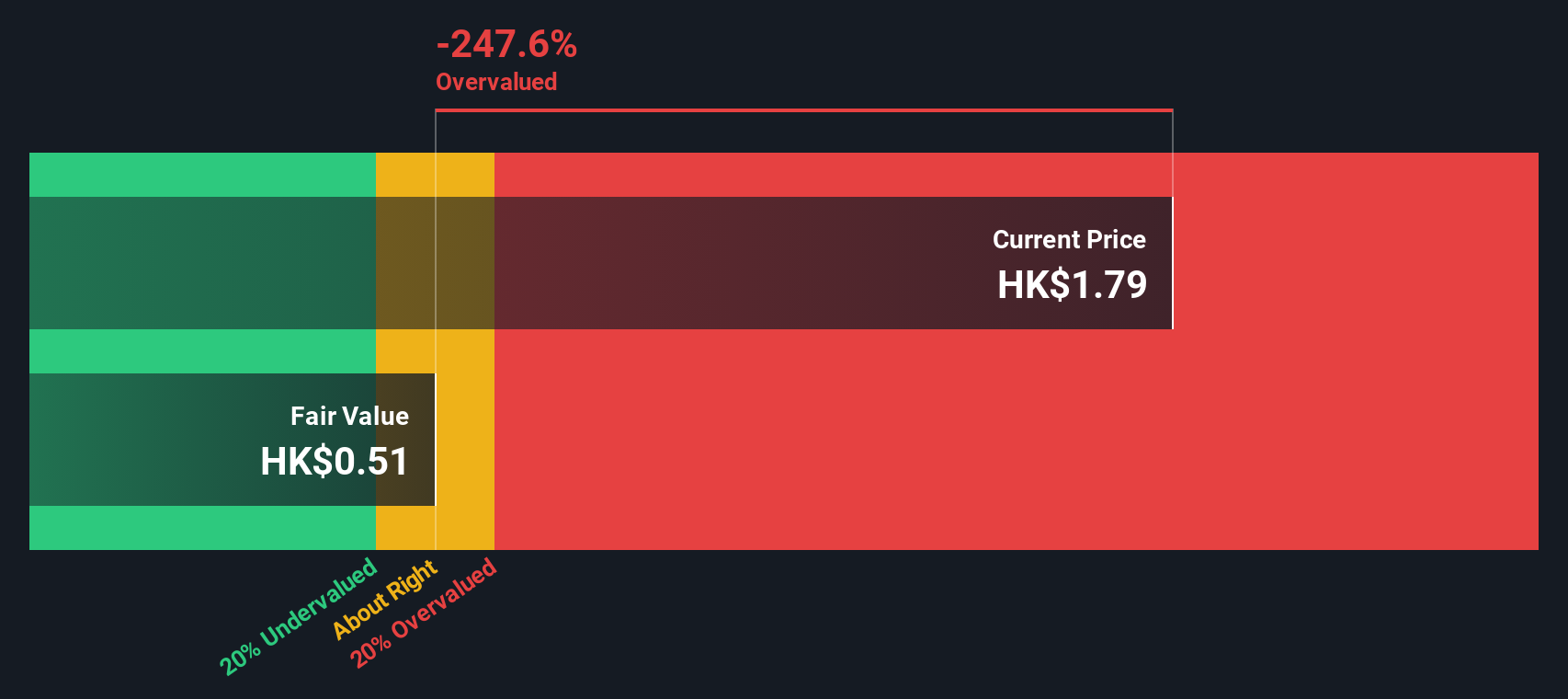

BOE Varitronix reported sales of HK$6.16 billion for the first half of 2024, up from HK$5.21 billion a year ago, though net income dipped to HK$172.1 million from HK$202.51 million. Basic earnings per share fell to HK$0.219 from HK$0.258 in the same period last year. Despite these mixed results, insider confidence is evident with recent share purchases by key figures within the company, signaling potential growth prospects amid its current undervaluation in Hong Kong's market.

- Dive into the specifics of BOE Varitronix here with our thorough valuation report.

Review our historical performance report to gain insights into BOE Varitronix's's past performance.

Where To Now?

- Click this link to deep-dive into the 19 companies within our Undervalued SEHK Small Caps With Insider Buying screener.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BOE Varitronix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:710

BOE Varitronix

An investment holding company, designs, manufactures, and sells liquid crystal display and related products in the People’s Republic of China, Europe, the United States, Korea, and internationally.

Excellent balance sheet and good value.