- Hong Kong

- /

- Interactive Media and Services

- /

- SEHK:1024

Kuaishou Technology And 2 Other High Growth Tech Stocks In Hong Kong

Reviewed by Simply Wall St

As global markets navigate the complexities of geopolitical tensions and economic fluctuations, Hong Kong's tech sector stands out with its dynamic growth potential, highlighted by a recent surge in the Hang Seng Index. In this environment, identifying high-growth stocks like Kuaishou Technology involves looking for companies that demonstrate strong adaptability and innovation amid changing market conditions.

Top 10 High Growth Tech Companies In Hong Kong

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Wasion Holdings | 22.37% | 25.47% | ★★★★★☆ |

| MedSci Healthcare Holdings | 48.74% | 48.78% | ★★★★★☆ |

| Inspur Digital Enterprise Technology | 25.31% | 39.04% | ★★★★★☆ |

| RemeGen | 26.30% | 52.19% | ★★★★★☆ |

| Cowell e Holdings | 31.82% | 35.43% | ★★★★★★ |

| Akeso | 32.41% | 54.21% | ★★★★★★ |

| Innovent Biologics | 22.24% | 59.39% | ★★★★★☆ |

| Beijing Airdoc Technology | 37.47% | 93.35% | ★★★★★☆ |

| Sichuan Kelun-Biotech Biopharmaceutical | 24.70% | 8.53% | ★★★★★☆ |

| Biocytogen Pharmaceuticals (Beijing) | 21.53% | 109.17% | ★★★★★☆ |

Click here to see the full list of 44 stocks from our SEHK High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

Kuaishou Technology (SEHK:1024)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kuaishou Technology is an investment holding company that offers live streaming, online marketing, and other services in the People’s Republic of China, with a market cap of HK$253.60 billion.

Operations: The company generates revenue primarily from domestic operations, totaling CN¥117.32 billion, with a smaller contribution from overseas markets at CN¥3.57 billion.

Kuaishou Technology, a player in Hong Kong's tech scene, has demonstrated substantial growth with a 9% annual increase in revenue, outpacing the local market's 7.4% expansion. The company recently reported a significant rise in net income to CNY 3.98 billion for Q2 2024 from CNY 1.48 billion the previous year, reflecting robust profitability and effective scaling of operations. Notably, Kuaishou is investing heavily in innovation; its R&D expenses have surged by 18.7%, underscoring its commitment to advancing its technological capabilities and enhancing product offerings like the Kling AI video generation model. This strategic focus on R&D not only fuels current performance but is also pivotal for sustaining long-term competitiveness in the fast-evolving tech landscape.

- Get an in-depth perspective on Kuaishou Technology's performance by reading our health report here.

Assess Kuaishou Technology's past performance with our detailed historical performance reports.

Tencent Holdings (SEHK:700)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Tencent Holdings Limited is an investment holding company that provides value-added services, online advertising, fintech, and business services in China and globally, with a market capitalization of HK$4.39 trillion.

Operations: The company generates revenue primarily from value-added services (CN¥302.28 billion), fintech and business services (CN¥209.17 billion), and online advertising (CN¥111.89 billion). Its diverse operations span across various sectors, contributing to its significant market presence both in China and internationally.

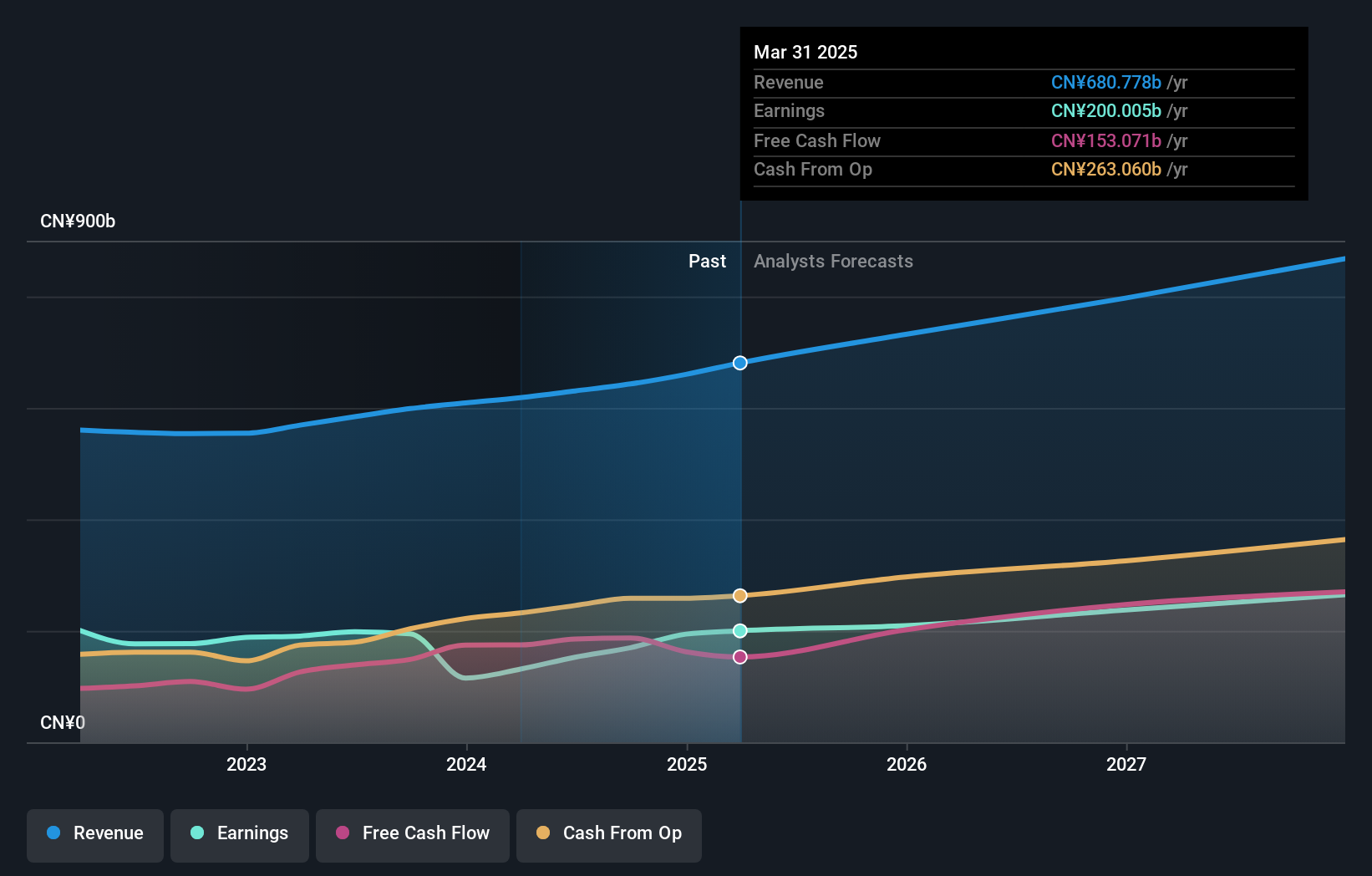

Tencent Holdings, navigating the volatile tech landscape, has been proactive in its strategic maneuvers. With a robust 12.8% forecasted annual earnings growth, the company outpaces Hong Kong's average market growth of 12.4%. This financial vigor is supported by a significant commitment to innovation, as evidenced by its R&D expenses rising to 8.1% of total revenue. Recently, Tencent's potential collaboration with Ubisoft signals an aggressive expansion strategy into global gaming markets, potentially revitalizing Ubisoft after recent setbacks and leveraging Tencent’s technological prowess for new opportunities in interactive media.

- Navigate through the intricacies of Tencent Holdings with our comprehensive health report here.

Explore historical data to track Tencent Holdings' performance over time in our Past section.

Digital China Holdings (SEHK:861)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Digital China Holdings Limited is an investment holding company that offers big data products and solutions to government and enterprise clients mainly in Mainland China, with a market capitalization of approximately HK$5.04 billion.

Operations: The company generates revenue through three primary segments: Big Data Products and Solutions (CN¥3.39 billion), Software and Operating Services (CN¥5.31 billion), and Traditional and Localization Services (CN¥10.03 billion). The focus on diverse technology offerings supports its operations in the Chinese market, catering to both government and enterprise clients.

Amidst a challenging landscape, Digital China Holdings has managed to post a modest revenue increase to CNY 7.01 billion, up from CNY 6.68 billion year-over-year, though its net income dipped significantly to CNY 10.81 million from CNY 40.36 million previously. This financial turbulence is reflected in the company's strategic adjustments and R&D focus, with expenses aimed at fostering innovation despite tough competition affecting profitability. The firm recently declared an interim dividend of HKD 0.01 per share, underscoring its commitment to shareholder returns even as it navigates these headwinds.

Taking Advantage

- Unlock more gems! Our SEHK High Growth Tech and AI Stocks screener has unearthed 41 more companies for you to explore.Click here to unveil our expertly curated list of 44 SEHK High Growth Tech and AI Stocks.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kuaishou Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1024

Kuaishou Technology

An investment holding company, provides live streaming, online marketing, and other services in the People’s Republic of China.

Outstanding track record with flawless balance sheet.