- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:6088

How Stronger Results and Governance Changes at FIT Hon Teng (SEHK:6088) Have Changed Its Investment Story

Reviewed by Sasha Jovanovic

- FIT Hon Teng Limited has released its unaudited financial results for the nine months ending September 30, 2025, reporting increases in both current and non-current assets as well as higher revenue and net profit from continuing operations.

- A newly announced board and committee structure aims to further strengthen governance and support long-term corporate growth initiatives.

- We’ll explore how FIT Hon Teng’s recent financial improvements and corporate governance changes may influence its evolving investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is FIT Hon Teng's Investment Narrative?

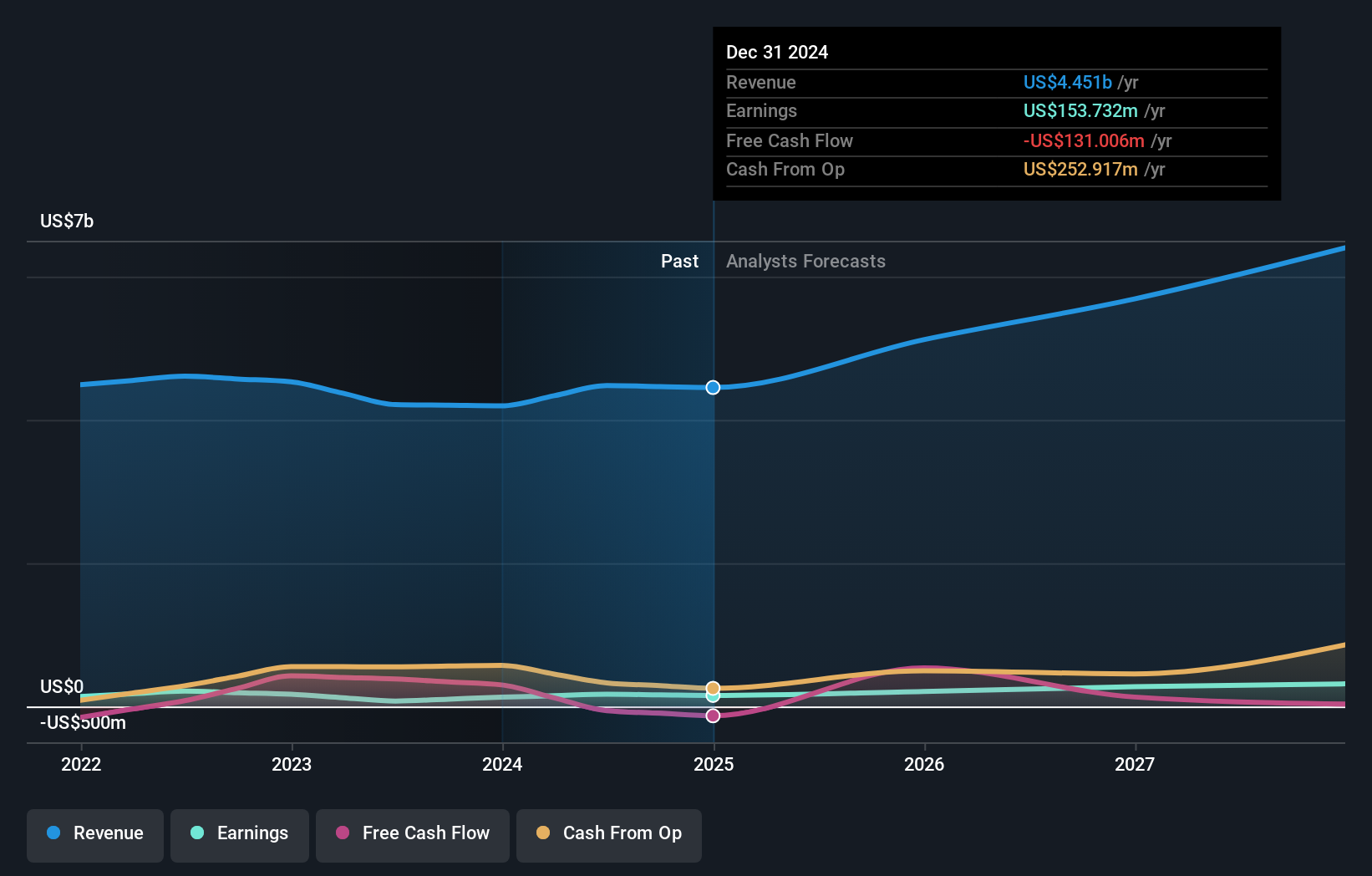

For me, the big picture behind FIT Hon Teng is grounded in confidence that its core technology and product roadmap will continue driving revenue and profit growth, particularly as AI-related infrastructure needs accelerate. The company's latest unaudited results, showing increases in current and non-current assets along with higher revenue and net profit, suggest that recent business execution has been effective. The newly refreshed board and committee structure is also a meaningful shift, given that board independence and governance quality were highlighted as weaknesses in earlier analysis. These governance steps could build credibility and smooth the way for future strategic execution, which might have more immediate impact on stakeholder confidence than on day-to-day operations. However, risks such as recent share price volatility, significant insider sales, and the outsized effect of one-off items on earnings remain pressing considerations for anyone watching short term catalysts. All in, while financial improvement and stronger governance are welcome, material risks around sustainable profit margins and true earnings quality deserve close attention. On the flip side, insider activity and non-recurring income could signal shifts investors need to track.

FIT Hon Teng's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 3 other fair value estimates on FIT Hon Teng - why the stock might be worth over 2x more than the current price!

Build Your Own FIT Hon Teng Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your FIT Hon Teng research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free FIT Hon Teng research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate FIT Hon Teng's overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6088

FIT Hon Teng

Manufactures and sells mobile and wireless devices and connectors in Taiwan and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives