- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:3393

High Growth Tech Stocks in Hong Kong October 2024

Reviewed by Simply Wall St

As global markets experience fluctuations, with U.S. indices reaching record highs and Chinese equities facing declines amid stimulus concerns, the Hong Kong market has been navigating its own set of challenges and opportunities. In this dynamic environment, identifying high-growth tech stocks requires a keen understanding of innovation potential and resilience to economic shifts.

Top 10 High Growth Tech Companies In Hong Kong

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Wasion Holdings | 22.37% | 25.47% | ★★★★★☆ |

| MedSci Healthcare Holdings | 48.74% | 48.78% | ★★★★★☆ |

| Inspur Digital Enterprise Technology | 25.31% | 39.04% | ★★★★★☆ |

| RemeGen | 26.30% | 52.19% | ★★★★★☆ |

| Innovent Biologics | 21.80% | 59.60% | ★★★★★☆ |

| Akeso | 33.44% | 53.00% | ★★★★★★ |

| Cowell e Holdings | 31.68% | 35.44% | ★★★★★★ |

| Biocytogen Pharmaceuticals (Beijing) | 21.53% | 109.17% | ★★★★★☆ |

| Beijing Airdoc Technology | 37.47% | 93.35% | ★★★★★☆ |

| Sichuan Kelun-Biotech Biopharmaceutical | 24.70% | 8.53% | ★★★★★☆ |

Click here to see the full list of 43 stocks from our SEHK High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Plover Bay Technologies (SEHK:1523)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Plover Bay Technologies Limited is an investment holding company that designs, develops, and markets software-defined wide area network routers, with a market capitalization of HK$5.34 billion.

Operations: The company's revenue streams include sales of SD-WAN routers with fixed and mobile first connectivity, generating $15.19 million and $59.87 million respectively, alongside software licenses and warranty support services contributing $31.86 million.

Plover Bay Technologies, a Hong Kong-based tech firm, is demonstrating robust growth with its revenue projected to increase by 16.9% annually, outpacing the local market's 7.3% growth rate. This upward trajectory is complemented by an impressive forecast for earnings growth at 17.3% per year, significantly higher than the Hong Kong market average of 12.1%. The company's recent strategic board appointment and a hike in interim dividends signal strong governance and shareholder confidence. These factors collectively underscore Plover Bay’s potential in leveraging technological advancements to sustain its competitive edge in the communications sector.

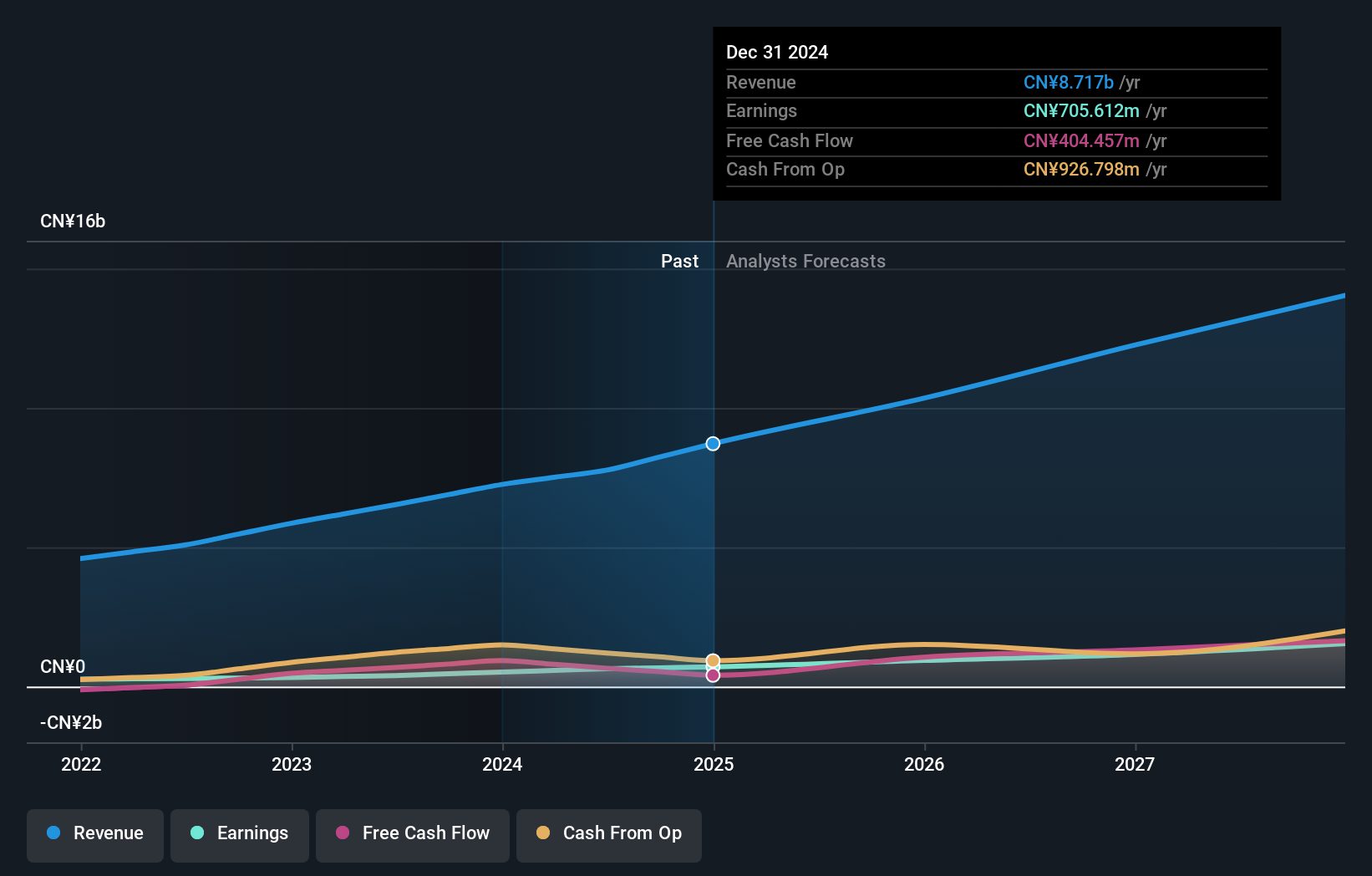

Wasion Holdings (SEHK:3393)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Wasion Holdings Limited is an investment holding company that focuses on the research, development, production, and sale of energy metering and energy efficiency management solutions across various regions including the People’s Republic of China, Africa, the United States, Europe, and other parts of Asia; it has a market capitalization of approximately HK$6.15 billion.

Operations: Wasion Holdings generates revenue primarily from three segments: Power Advanced Metering Infrastructure (CN¥2.99 billion), Advanced Distribution Operations (CN¥2.51 billion), and Communication and Fluid Advanced Metering Infrastructure (CN¥2.42 billion). The company serves energy supply industries across multiple regions, including China, Africa, the United States, Europe, and Asia.

Wasion Holdings is capturing attention with a 25.5% expected annual earnings growth, outpacing the Hong Kong market's average of 12.1%. This surge is backed by a substantial increase in sales revenue, as evidenced by their recent half-year report showing a jump from CNY 3.23 billion to CNY 3.74 billion, coupled with net income rising sharply to CNY 331 million from CNY 214 million year-over-year. Strategic expansions into international markets like Hungary and Southeast Asia through significant smart meter contracts further solidify Wasion's growth trajectory and its strengthening global footprint in the smart grid industry.

- Unlock comprehensive insights into our analysis of Wasion Holdings stock in this health report.

Evaluate Wasion Holdings' historical performance by accessing our past performance report.

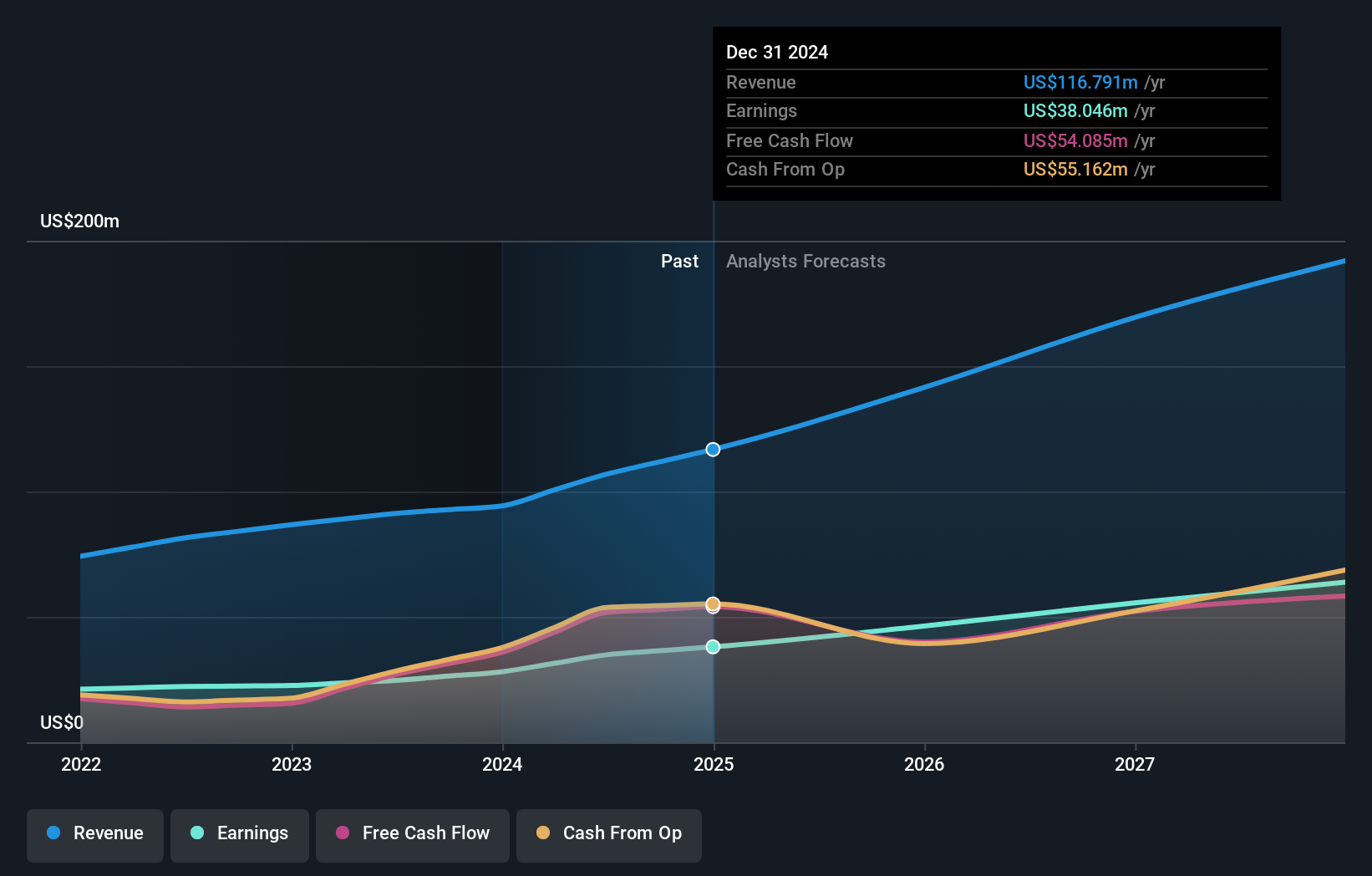

FIT Hon Teng (SEHK:6088)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: FIT Hon Teng Limited is a company engaged in the manufacturing and sale of mobile and wireless devices and connectors, operating both in Taiwan and internationally, with a market capitalization of HK$20.62 billion.

Operations: The company generates revenue primarily from two segments: Consumer Products and Intermediate Products, with the latter contributing significantly more at $3.94 billion compared to $690.95 million for Consumer Products.

FIT Hon Teng has shown a robust turnaround with its half-year sales soaring to USD 2.07 billion from USD 1.78 billion, reflecting an impressive growth trajectory in the tech sector of Hong Kong. This performance is underscored by a swing to a net income of USD 32.52 million, reversing from a net loss just a year prior, signaling effective operational adjustments and market adaptation. The company's commitment to innovation is evident in its R&D investments, aligning with industry demands for evolving tech solutions and potentially setting the stage for sustained growth; these efforts are crucial as they navigate through highly competitive markets where annual earnings are expected to burgeon by 32.2%. Moreover, anticipated revenue growth at an annual rate of 18.4% positions FIT Hon Teng favorably against the broader market's pace, highlighting their strategic initiatives' effectiveness in capturing and expanding market share amidst dynamic industry shifts.

- Click here to discover the nuances of FIT Hon Teng with our detailed analytical health report.

Assess FIT Hon Teng's past performance with our detailed historical performance reports.

Turning Ideas Into Actions

- Reveal the 43 hidden gems among our SEHK High Growth Tech and AI Stocks screener with a single click here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wasion Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3393

Wasion Holdings

An investment holding company, engages in the research and development, production, and sale of energy metering and energy efficiency management solutions for energy supply industries in the People’s Republic of China, Africa, the United States, Europe, and rest of Asia.

Solid track record with excellent balance sheet and pays a dividend.