- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:6088

FIT Hon Teng Limited's (HKG:6088) 41% Jump Shows Its Popularity With Investors

Those holding FIT Hon Teng Limited (HKG:6088) shares would be relieved that the share price has rebounded 41% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. The annual gain comes to 180% following the latest surge, making investors sit up and take notice.

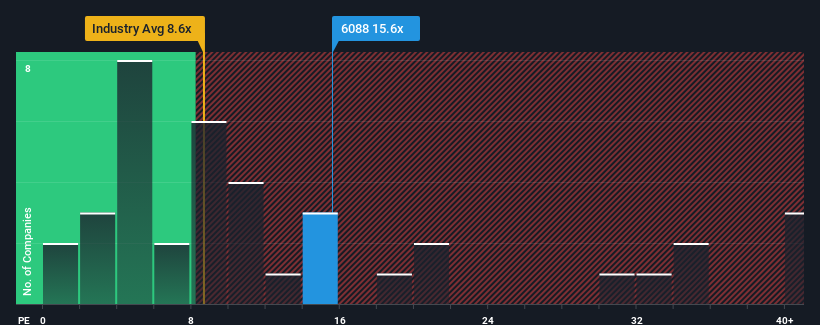

Since its price has surged higher, given close to half the companies in Hong Kong have price-to-earnings ratios (or "P/E's") below 10x, you may consider FIT Hon Teng as a stock to avoid entirely with its 15.6x P/E ratio. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

FIT Hon Teng certainly has been doing a good job lately as it's been growing earnings more than most other companies. The P/E is probably high because investors think this strong earnings performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price.

View our latest analysis for FIT Hon Teng

Does Growth Match The High P/E?

There's an inherent assumption that a company should far outperform the market for P/E ratios like FIT Hon Teng's to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 125%. The latest three year period has also seen an excellent 443% overall rise in EPS, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 29% per annum as estimated by the five analysts watching the company. Meanwhile, the rest of the market is forecast to only expand by 12% per year, which is noticeably less attractive.

In light of this, it's understandable that FIT Hon Teng's P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

Shares in FIT Hon Teng have built up some good momentum lately, which has really inflated its P/E. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of FIT Hon Teng's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

Plus, you should also learn about these 2 warning signs we've spotted with FIT Hon Teng.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:6088

FIT Hon Teng

Manufactures and sells mobile and wireless devices and connectors in Taiwan and internationally.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives