Shareholders May Be More Conservative With AV Concept Holdings Limited's (HKG:595) CEO Compensation For Now

Key Insights

- AV Concept Holdings will host its Annual General Meeting on 30th of August

- CEO Yuk Kwan So's total compensation includes salary of HK$9.65m

- Total compensation is 365% above industry average

- AV Concept Holdings' three-year loss to shareholders was 12% while its EPS was down 26% over the past three years

In the past three years, the share price of AV Concept Holdings Limited (HKG:595) has struggled to generate growth for its shareholders. Per share earnings growth is also poor, despite revenues growing. Shareholders will have a chance to take their concerns to the board at the next AGM on 30th of August and vote on resolutions including executive compensation, which studies show may have an impact on company performance. Here's why we think shareholders should hold off on a raise for the CEO at the moment.

View our latest analysis for AV Concept Holdings

Comparing AV Concept Holdings Limited's CEO Compensation With The Industry

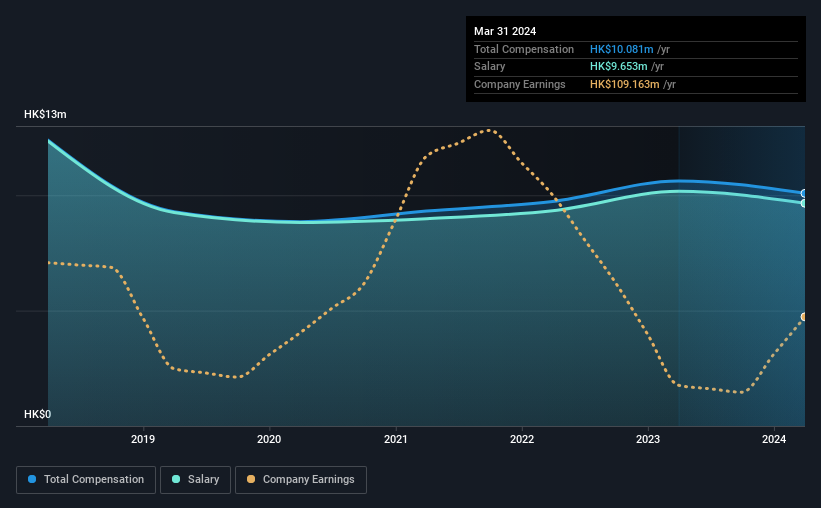

According to our data, AV Concept Holdings Limited has a market capitalization of HK$386m, and paid its CEO total annual compensation worth HK$10m over the year to March 2024. We note that's a small decrease of 5.1% on last year. In particular, the salary of HK$9.65m, makes up a huge portion of the total compensation being paid to the CEO.

On comparing similar-sized companies in the Hong Kong Electronic industry with market capitalizations below HK$1.6b, we found that the median total CEO compensation was HK$2.2m. This suggests that Yuk Kwan So is paid more than the median for the industry. What's more, Yuk Kwan So holds HK$247m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | HK$9.7m | HK$10m | 96% |

| Other | HK$428k | HK$450k | 4% |

| Total Compensation | HK$10m | HK$11m | 100% |

Speaking on an industry level, nearly 78% of total compensation represents salary, while the remainder of 22% is other remuneration. AV Concept Holdings pays a high salary, concentrating more on this aspect of compensation in comparison to non-salary pay. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

AV Concept Holdings Limited's Growth

AV Concept Holdings Limited has reduced its earnings per share by 26% a year over the last three years. It achieved revenue growth of 49% over the last year.

The reduction in EPS, over three years, is arguably concerning. On the other hand, the strong revenue growth suggests the business is growing. In conclusion we can't form a strong opinion about business performance yet; but it's one worth watching. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has AV Concept Holdings Limited Been A Good Investment?

Given the total shareholder loss of 12% over three years, many shareholders in AV Concept Holdings Limited are probably rather dissatisfied, to say the least. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude...

Yuk Kwan receives almost all of their compensation through a salary. The returns to shareholders is disappointing along with lack of earnings growth, which goes some way in explaining the poor returns. The upcoming AGM will provide shareholders the opportunity to revisit the company’s remuneration policies and evaluate if the board’s judgement and decision-making is aligned with that of the company’s shareholders.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. That's why we did our research, and identified 5 warning signs for AV Concept Holdings (of which 1 is significant!) that you should know about in order to have a holistic understanding of the stock.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:595

AV Concept Holdings

An investment holding company, engages in the marketing and distribution of electronic components in Hong Kong and Singapore.

Excellent balance sheet and good value.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.