- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:3638

Here's Why Huabang Financial Holdings (HKG:3638) Can Manage Its Debt Responsibly

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, Huabang Financial Holdings Limited (HKG:3638) does carry debt. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Huabang Financial Holdings

How Much Debt Does Huabang Financial Holdings Carry?

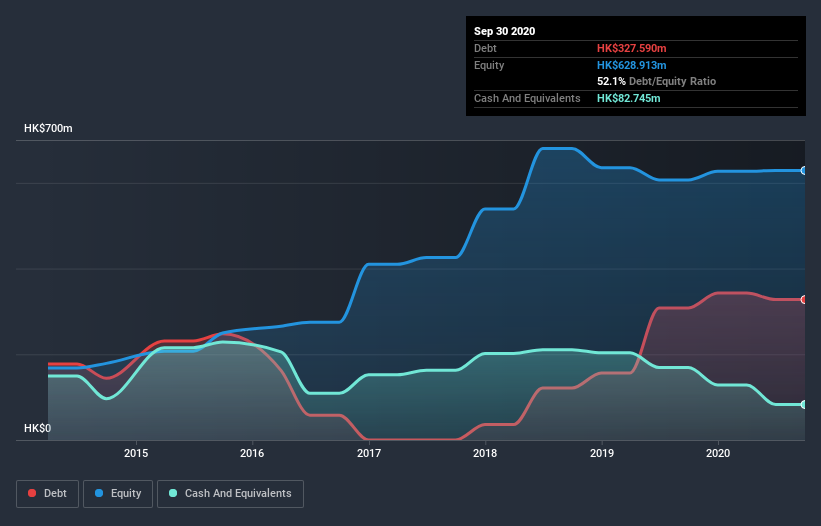

You can click the graphic below for the historical numbers, but it shows that as of September 2020 Huabang Financial Holdings had HK$327.6m of debt, an increase on HK$308.0m, over one year. However, because it has a cash reserve of HK$82.7m, its net debt is less, at about HK$244.8m.

How Strong Is Huabang Financial Holdings' Balance Sheet?

We can see from the most recent balance sheet that Huabang Financial Holdings had liabilities of HK$365.0m falling due within a year, and liabilities of HK$627.0k due beyond that. Offsetting this, it had HK$82.7m in cash and HK$500.8m in receivables that were due within 12 months. So it can boast HK$217.9m more liquid assets than total liabilities.

It's good to see that Huabang Financial Holdings has plenty of liquidity on its balance sheet, suggesting conservative management of liabilities. Due to its strong net asset position, it is not likely to face issues with its lenders.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

As it happens Huabang Financial Holdings has a fairly concerning net debt to EBITDA ratio of 5.3 but very strong interest coverage of 40.2. So either it has access to very cheap long term debt or that interest expense is going to grow! We also note that Huabang Financial Holdings improved its EBIT from a last year's loss to a positive HK$33m. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Huabang Financial Holdings will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it's worth checking how much of the earnings before interest and tax (EBIT) is backed by free cash flow. During the last year, Huabang Financial Holdings burned a lot of cash. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Our View

We weren't impressed with Huabang Financial Holdings's net debt to EBITDA, and its conversion of EBIT to free cash flow made us cautious. But like a ballerina ending on a perfect pirouette, it has not trouble covering its interest expense with its EBIT. When we consider all the factors mentioned above, we do feel a bit cautious about Huabang Financial Holdings's use of debt. While we appreciate debt can enhance returns on equity, we'd suggest that shareholders keep close watch on its debt levels, lest they increase. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. Like risks, for instance. Every company has them, and we've spotted 3 warning signs for Huabang Financial Holdings (of which 2 make us uncomfortable!) you should know about.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you’re looking to trade Huabang Financial Holdings, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Hunlicar Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:3638

Hunlicar Group

An investment holding company, engages in the computer and electronic products trading business in Hong Kong and the People's Republic of China.

Flawless balance sheet with weak fundamentals.

Market Insights

Community Narratives