- Hong Kong

- /

- Tech Hardware

- /

- SEHK:3396

Does Joyvio’s Q3 Struggles Reveal Hidden Complexities in Legend Holdings’ (SEHK:3396) Group Structure?

Reviewed by Sasha Jovanovic

- Joyvio Food Co., Ltd., a subsidiary of Legend Holdings Corporation, recently announced that its Q3 2025 revenue fell by 71.47%, resulting in a substantial net loss for the quarter.

- Management emphasized that Joyvio Food’s weak quarterly performance may not fully represent Legend Holdings’ overall financial condition, highlighting the complexities within the group’s operations.

- We’ll explore how Joyvio’s steep revenue decline adds new dimensions to Legend Holdings’ investment narrative and group earnings outlook.

These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Legend Holdings' Investment Narrative?

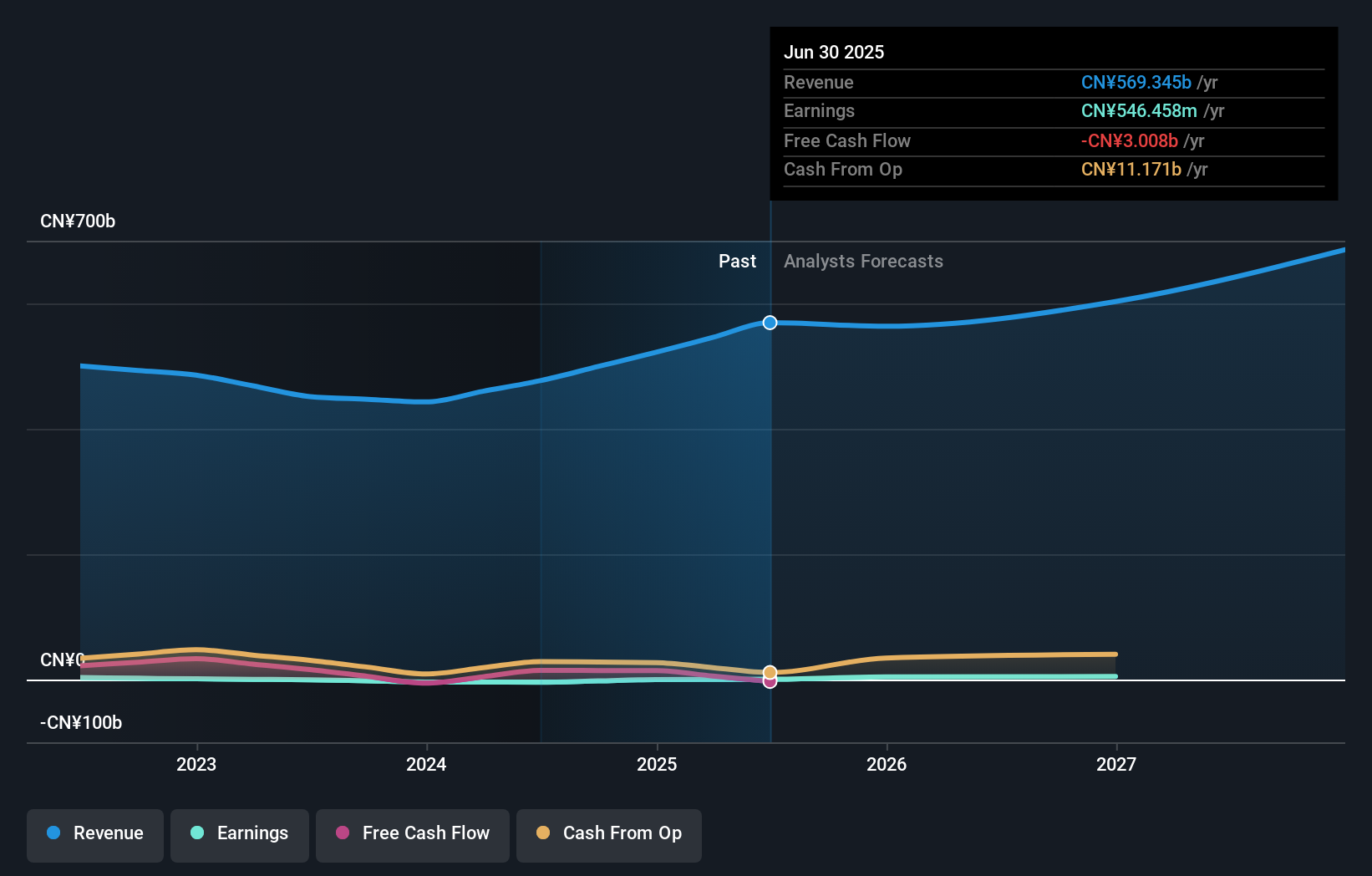

Being a shareholder in Legend Holdings means believing in the strength of a diversified conglomerate, with several businesses spanning technology, finance, and food. The recent sharp revenue drop and net loss at Joyvio Food, a key subsidiary, brings renewed attention to the group’s segment risks. While management maintains that Joyvio’s quarterly setback may not reflect Legend Holdings’ broader earnings power, such a dramatic decline could add pressure to short-term sentiment, especially with previous analyst outlooks not factoring in this event. This development may influence near-term catalysts like expectations for continued earnings recovery or the impact of potential asset sales (including the Banque Internationale stake), as well as highlight risks in group earnings volatility and interest coverage. Investors are left re-assessing how resilient group profits really are as Joyvio’s results ripple through future reports.

On the flip side, the group’s ability to absorb shocks from a single business unit remains a risk investors should be aware of.

Exploring Other Perspectives

Explore another fair value estimate on Legend Holdings - why the stock might be worth less than half the current price!

Build Your Own Legend Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Legend Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Legend Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Legend Holdings' overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3396

Legend Holdings

Legend Holdings Corporation, along with its subsidiaries, operates in the industrial operations and industrial incubations and investments sectors in the People’s Republic of China and internationally.

Moderate growth potential with questionable track record.

Market Insights

Community Narratives