Ju Teng International Holdings And Two Other Penny Stocks Worth Watching

Reviewed by Simply Wall St

Global markets have experienced a turbulent week, with U.S. stocks ending lower amid tariff uncertainties and mixed economic signals, such as a cooling labor market and fluctuating manufacturing activity. In light of these conditions, investors are often drawn to opportunities that offer both affordability and growth potential, which is where penny stocks come into play. Despite their somewhat outdated moniker, penny stocks represent smaller or newer companies that can provide significant value when backed by strong financials.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.55 | MYR2.73B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.945 | £481.5M | ★★★★★★ |

| Warpaint London (AIM:W7L) | £3.99 | £329.19M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.345 | MYR959.84M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.90 | HK$44.77B | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.934 | £146.94M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.855 | MYR283.81M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.70 | MYR414.16M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$1.13 | HK$717.31M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.79 | A$144.95M | ★★★★☆☆ |

Click here to see the full list of 5,707 stocks from our Penny Stocks screener.

We'll examine a selection from our screener results.

Ju Teng International Holdings (SEHK:3336)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Ju Teng International Holdings Limited is an investment holding company that manufactures and sells casings for notebook computers and handheld devices in China and internationally, with a market cap of HK$845.66 million.

Operations: The company generates revenue of HK$6.47 billion from its operations in manufacturing and selling casings for notebook computers and handheld devices.

Market Cap: HK$845.66M

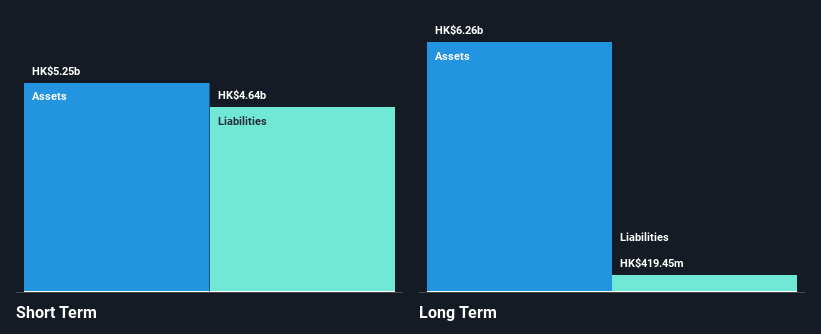

Ju Teng International Holdings, with a market cap of HK$845.66 million and revenue of HK$6.47 billion, faces challenges typical for stocks in its category. The company is currently unprofitable, with earnings declining by 48.5% annually over the past five years. However, its debt management is prudent; operating cash flow covers 30.3% of its debt, and both short-term (HK$5.2B) and long-term liabilities (HK$419.4M) are well-covered by assets. The management team and board are experienced, averaging tenures of 6.1 and 12.3 years respectively, which could provide stability amidst financial volatility.

- Take a closer look at Ju Teng International Holdings' potential here in our financial health report.

- Explore historical data to track Ju Teng International Holdings' performance over time in our past results report.

Jenscare Scientific (SEHK:9877)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Jenscare Scientific Co., Ltd. is a medical device company focused on developing interventional products for treating structural heart diseases in China, with a market cap of approximately HK$1.75 billion.

Operations: Jenscare Scientific Co., Ltd. has not reported any specific revenue segments.

Market Cap: HK$1.75B

Jenscare Scientific, with a market cap of HK$1.75 billion, is pre-revenue and currently unprofitable. The company has more cash than its total debt and short-term assets (CN¥883.1M) exceed both short-term (CN¥51.7M) and long-term liabilities (CN¥54.3M), indicating solid financial health despite the lack of revenue. Recent executive changes saw Mr. Pan Fei appointed as CEO to advance internationalization efforts, bringing over 15 years of experience in healthcare management and investment banking to the role. The company's board and management team are experienced, averaging tenures of 3.9 and 3.8 years respectively.

- Unlock comprehensive insights into our analysis of Jenscare Scientific stock in this financial health report.

- Assess Jenscare Scientific's future earnings estimates with our detailed growth reports.

Zhejiang Hailide New MaterialLtd (SZSE:002206)

Simply Wall St Financial Health Rating: ★★★★★☆

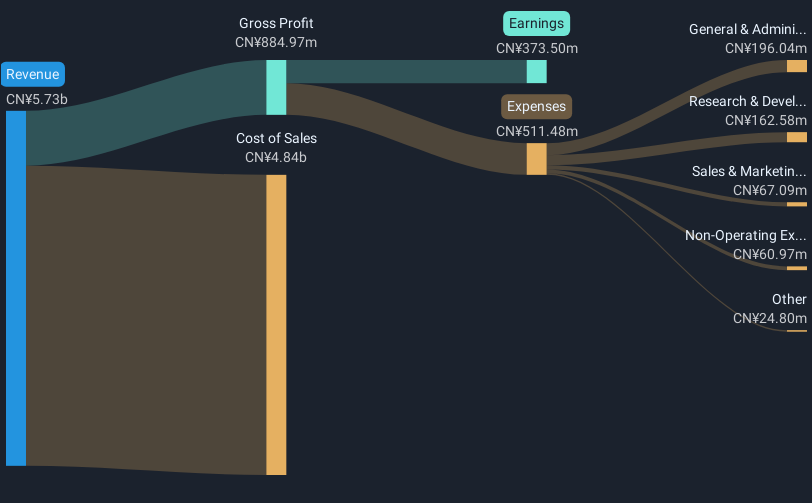

Overview: Zhejiang Hailide New Material Co., Ltd operates in the research, development, production, and sales of chemical fibers, textile materials, and rubber and plastic products both in China and internationally with a market cap of CN¥5.14 billion.

Operations: No specific revenue segments are reported for Zhejiang Hailide New Material Co., Ltd.

Market Cap: CN¥5.14B

Zhejiang Hailide New Material Co., Ltd, with a market cap of CN¥5.14 billion, demonstrates financial stability as its short-term assets (CN¥3.4 billion) exceed both short-term and long-term liabilities. The company has shown consistent earnings growth, recording a 15.5% increase over the past year, surpassing the industry average decline of -5.4%. Its debt is well managed with operating cash flow covering 29.2% of its debt and interest payments covered 13.6 times by EBIT. Trading at a price-to-earnings ratio of 13.8x below the market average suggests it offers good relative value among peers in the chemicals sector.

- Click here and access our complete financial health analysis report to understand the dynamics of Zhejiang Hailide New MaterialLtd.

- Gain insights into Zhejiang Hailide New MaterialLtd's future direction by reviewing our growth report.

Key Takeaways

- Unlock our comprehensive list of 5,707 Penny Stocks by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Hailide New MaterialLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002206

Zhejiang Hailide New MaterialLtd

Engages in the research, develops, produces, and markets industrial polyester yarns, plastic materials, tire cord fabrics, and plastic floors in China and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives