Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, Kinergy Corporation Ltd. (HKG:3302) does carry debt. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for Kinergy

How Much Debt Does Kinergy Carry?

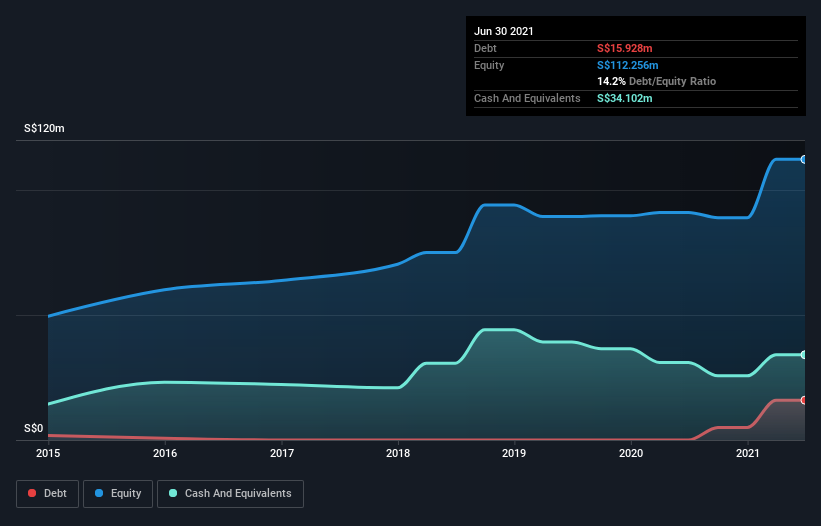

As you can see below, at the end of June 2021, Kinergy had S$15.9m of debt, up from none a year ago. Click the image for more detail. However, it does have S$34.1m in cash offsetting this, leading to net cash of S$18.2m.

How Strong Is Kinergy's Balance Sheet?

According to the last reported balance sheet, Kinergy had liabilities of S$53.7m due within 12 months, and liabilities of S$8.69m due beyond 12 months. Offsetting this, it had S$34.1m in cash and S$34.5m in receivables that were due within 12 months. So it can boast S$6.17m more liquid assets than total liabilities.

This surplus suggests that Kinergy has a conservative balance sheet, and could probably eliminate its debt without much difficulty. Succinctly put, Kinergy boasts net cash, so it's fair to say it does not have a heavy debt load!

Although Kinergy made a loss at the EBIT level, last year, it was also good to see that it generated S$1.7m in EBIT over the last twelve months. When analysing debt levels, the balance sheet is the obvious place to start. But it is Kinergy's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. Kinergy may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. During the last year, Kinergy burned a lot of cash. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Summing up

While it is always sensible to investigate a company's debt, in this case Kinergy has S$18.2m in net cash and a decent-looking balance sheet. So we don't have any problem with Kinergy's use of debt. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 5 warning signs for Kinergy (2 make us uncomfortable) you should be aware of.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Kinergy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:3302

Kinergy

Provides contract manufacturing, design, engineering, and assembly services for the electronics industry in Singapore, the Philippines, the United States, the Mainland China, Japan, and internationally.

Slight risk with mediocre balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)