PAX Global Technology's (HKG:327) Shareholders Have More To Worry About Than Only Soft Earnings

The subdued market reaction suggests that PAX Global Technology Limited's (HKG:327) recent earnings didn't contain any surprises. We think that investors are worried about some weaknesses underlying the earnings.

View our latest analysis for PAX Global Technology

A Closer Look At PAX Global Technology's Earnings

As finance nerds would already know, the accrual ratio from cashflow is a key measure for assessing how well a company's free cash flow (FCF) matches its profit. In plain english, this ratio subtracts FCF from net profit, and divides that number by the company's average operating assets over that period. You could think of the accrual ratio from cashflow as the 'non-FCF profit ratio'.

As a result, a negative accrual ratio is a positive for the company, and a positive accrual ratio is a negative. While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. That's because some academic studies have suggested that high accruals ratios tend to lead to lower profit or less profit growth.

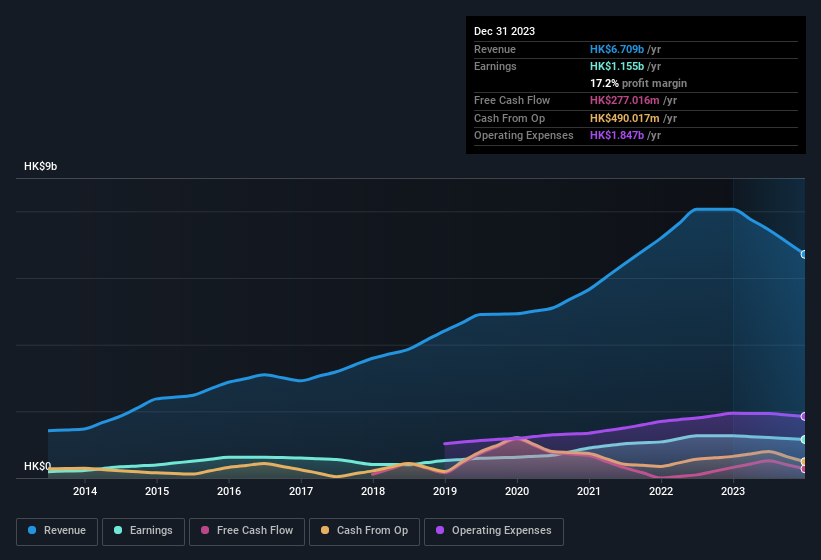

Over the twelve months to December 2023, PAX Global Technology recorded an accrual ratio of 0.21. We can therefore deduce that its free cash flow fell well short of covering its statutory profit. To wit, it produced free cash flow of HK$277m during the period, falling well short of its reported profit of HK$1.16b. PAX Global Technology's free cash flow actually declined over the last year, but it may bounce back next year, since free cash flow is often more volatile than accounting profits.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Our Take On PAX Global Technology's Profit Performance

PAX Global Technology didn't convert much of its profit to free cash flow in the last year, which some investors may consider rather suboptimal. Therefore, it seems possible to us that PAX Global Technology's true underlying earnings power is actually less than its statutory profit. But at least holders can take some solace from the 30% per annum growth in EPS for the last three. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. With this in mind, we wouldn't consider investing in a stock unless we had a thorough understanding of the risks. To help with this, we've discovered 2 warning signs (1 is a bit unpleasant!) that you ought to be aware of before buying any shares in PAX Global Technology.

This note has only looked at a single factor that sheds light on the nature of PAX Global Technology's profit. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:327

PAX Global Technology

An investment holding company, develops and sells electronic funds transfer point-of-sale products in Hong Kong, the People’s Republic of China, the United States, and Italy.

Flawless balance sheet 6 star dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion