Computime Group (HKG:320) Has Announced That Its Dividend Will Be Reduced To HK$0.0475

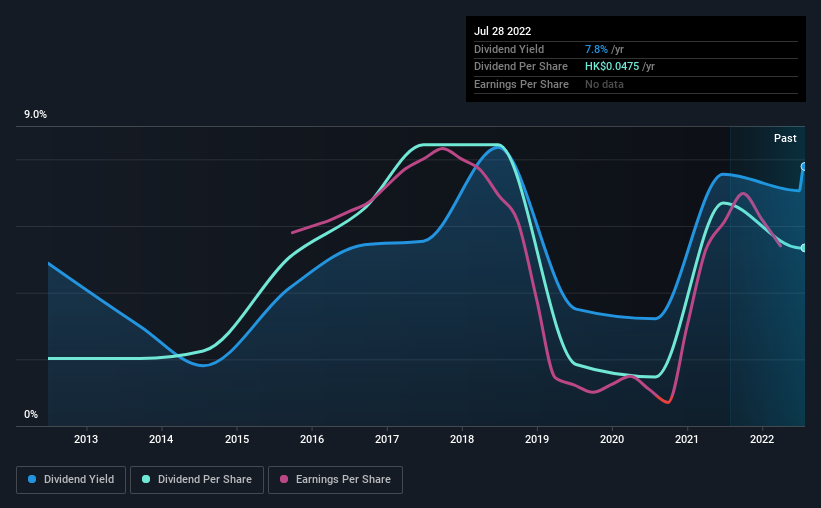

Computime Group Limited's ( HKG:320 ) dividend is being reduced from last year's payment covering the same period to HK$0.0475 on the 11th of October. However, the dividend yield of 7.8% is still a decent boost to shareholder returns.

Check out our latest analysis for Computime Group

Computime Group's Dividend Is Well Covered By Earnings

A big dividend yield for a few years doesn't mean much if it can't be sustained. Before making this announcement, Computime Group was earning enough to cover the dividend, but it wasn't generating any free cash flows. No cash flows could definitely make returning cash to shareholders difficult, or at least mean the balance sheet will come under pressure.

If the dividend continues along recent trends, we estimate the payout ratio could be 47%, which we consider to be quite comfortable, with most of the company's earnings left over to grow the business in the future.

Dividend Volatility

Although the company has a long dividend history, it has been cut at least once in the last 10 years. The dividend has gone from an annual total of HK$0.018 in 2012 to the most recent total annual payment of HK$0.0475. This means that it has been growing its distributions at 10% per annum over that time. Computime Group has grown distributions at a rapid rate despite cutting the dividend at least once in the past. Companies that cut once often cut again, so we would be cautious about buying this stock solely for the dividend income.

Dividend Growth Is Hopeful

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. While Computime Group has seen a decline in earnings compared to 5 years ago, the company's earnings recovered well during the pandemic downturn. Over last 3 years earnings per share has risen substantially, up 92.2%. While long term growth is uncertain, the earnings figures illustrate an impressive recovery from the pandemic downturn.

Given the volatile few years, dividend growth is by no means a certainty. If the company can buck the 5 year downward trend in earnings and continue the upwards trajectory of the last 3 years, things should be looking much more solid and dividend growth may be on the horizon. Until then, investors will want to keep an eye out on earnings performance.

The Dividend Could Prove To Be Unreliable

In summary, dividends being cut isn't ideal, however it can bring the payment into a more sustainable range. While the low payout ratio is redeeming feature, this is offset by the minimal cash to cover the payments. We don't think Computime Group is a great stock to add to your portfolio if income is your focus.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. To that end, Computime Group has 4 warning signs (and 2 which are potentially serious) we think you should know about. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:320

Computime Group

An investment holding company, engages in the research and development, design, manufacture, trading, and distribution of electronic control products in the Americas, Europe, Oceania, and Asia.

Established dividend payer and good value.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026