- Hong Kong

- /

- Communications

- /

- SEHK:303

Why Vtech Holdings (SEHK:303) Is Down 8.2% After Forecasting a Full-Year Revenue Decline

Reviewed by Sasha Jovanovic

- Vtech Holdings recently reported its earnings for the half year ended September 30, 2025, recording sales of US$991.1 million and net income of US$74.7 million, both down from the previous year, while reaffirming an interim dividend of 17.0 US cents per ordinary share.

- Despite anticipating improved sales in the second half of the financial year, Vtech guided that full-year revenue for 2026 is still expected to decline, signaling ongoing business challenges beyond near-term fluctuations.

- We'll explore how Vtech’s forecasted full-year revenue decline could alter the company’s previously optimistic investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Vtech Holdings Investment Narrative Recap

To remain a shareholder in Vtech Holdings, you need to believe that the company’s ongoing moves to diversify manufacturing and invest in new product categories, especially in electronic learning and connected devices, will offset pressure from a softening global market and evolving consumer preferences. The recent earnings report, which reaffirmed a revenue decline for the full year 2026 despite a projected second-half sales lift, puts extra focus on the risk of long-term demand weakness in legacy product lines; however, this news does not materially change the most important short-term catalyst, which remains the ramp-up of international sales and new product launches. The largest near-term risk is still exposure to slowing markets for traditional telecom and educational toys, but no sudden operational shock was disclosed in these results.

Of the recent company announcements, Vtech’s decision to maintain its interim dividend at US$0.17 per share, despite lower earnings and revenue, is particularly relevant. While this may provide reassurance to income-focused shareholders, it also signals the company’s commitment to capital returns even amid ongoing market challenges and shifts in segment performance. Nevertheless, the sustainability of this approach could soon be tested by weakening sales trends and possible margin erosion if core segments continue to slow...

Read the full narrative on Vtech Holdings (it's free!)

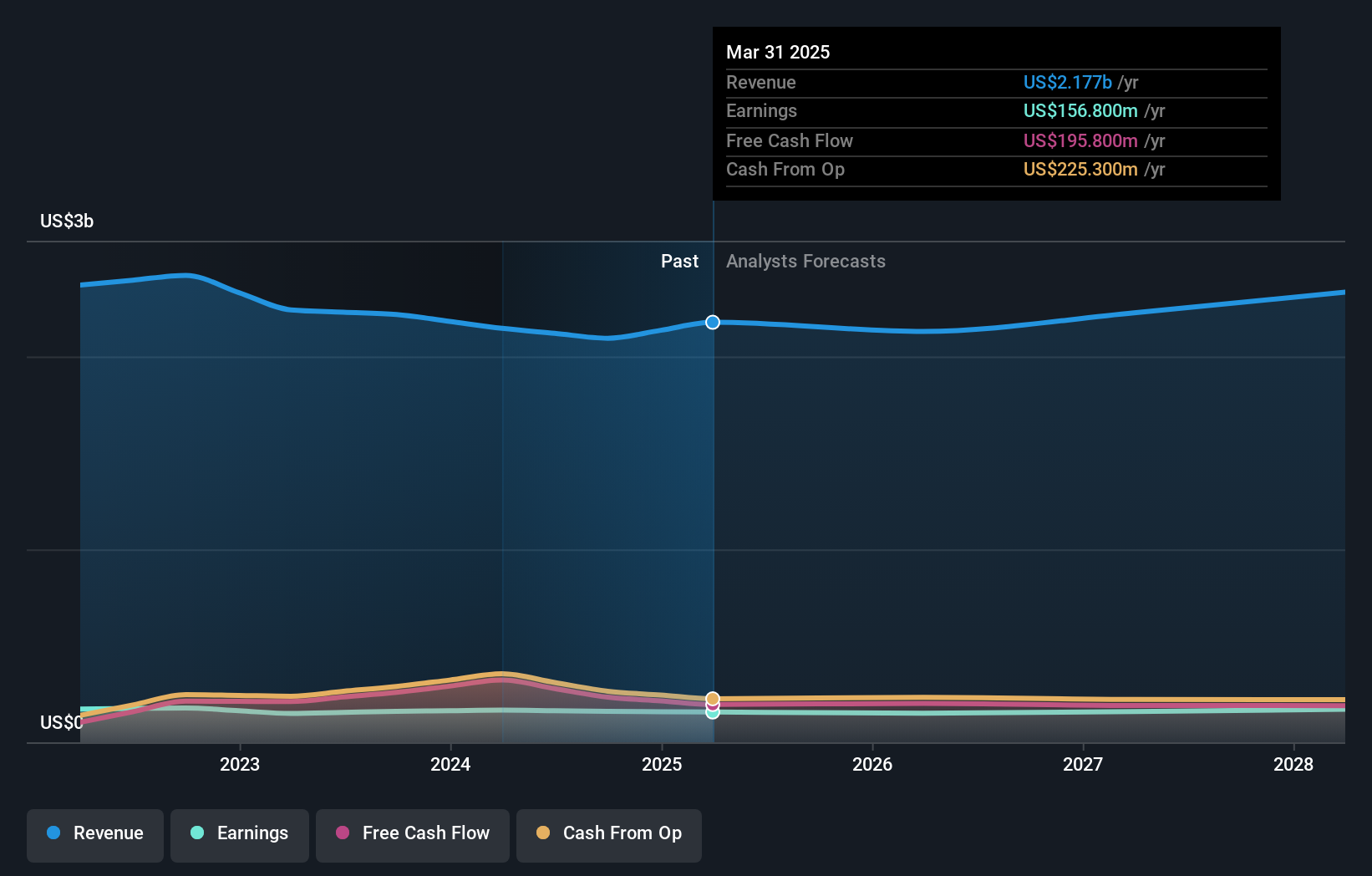

Vtech Holdings' narrative projects $2.3 billion revenue and $171.0 million earnings by 2028. This requires 2.3% yearly revenue growth and a $14.2 million earnings increase from $156.8 million.

Uncover how Vtech Holdings' forecasts yield a HK$69.88 fair value, a 14% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members assigned fair values from US$25.56 to US$93.46 in three analyses, showing opinions are highly varied. With ongoing concerns about secular threats in Vtech’s Electronic Learning Products segment, it pays to examine several viewpoints.

Explore 3 other fair value estimates on Vtech Holdings - why the stock might be worth less than half the current price!

Build Your Own Vtech Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Vtech Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Vtech Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Vtech Holdings' overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 38 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:303

Vtech Holdings

Designs, manufactures, and distributes electronic products in Hong Kong, North America, Europe, the Asia Pacific, and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives