In a week marked by volatility, global markets have been influenced by competitive tensions in the AI sector and mixed corporate earnings, with indices like the Nasdaq Composite experiencing significant fluctuations. Amidst these broader market dynamics, small-cap stocks often present unique opportunities for those willing to explore beyond the well-trodden paths of large-cap investments. Identifying promising stocks requires a keen eye for companies with solid fundamentals and potential resilience in an unpredictable economic landscape.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Cresco | 6.62% | 8.15% | 9.94% | ★★★★★★ |

| DoshishaLtd | NA | 2.43% | 2.36% | ★★★★★★ |

| NOROO PAINT & COATINGS | 12.38% | 4.96% | 8.97% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| ITOCHU-SHOKUHIN | NA | 0.74% | 13.97% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Wan Hwa Enterprise | NA | -7.43% | -7.24% | ★★★★★★ |

| First Copper Technology | 17.03% | 3.07% | 19.66% | ★★★★★★ |

| New Asia Construction & Development | 65.89% | 5.34% | 12.05% | ★★★★★☆ |

| Nippon Sharyo | 59.09% | -1.22% | -12.92% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Vtech Holdings (SEHK:303)

Simply Wall St Value Rating: ★★★★★★

Overview: Vtech Holdings Limited is a company that designs, manufactures, and distributes electronic products globally, with a market capitalization of approximately HK$13.28 billion.

Operations: Vtech Holdings generates revenue primarily from the design, manufacture, and distribution of consumer electronic products, amounting to $2.09 billion.

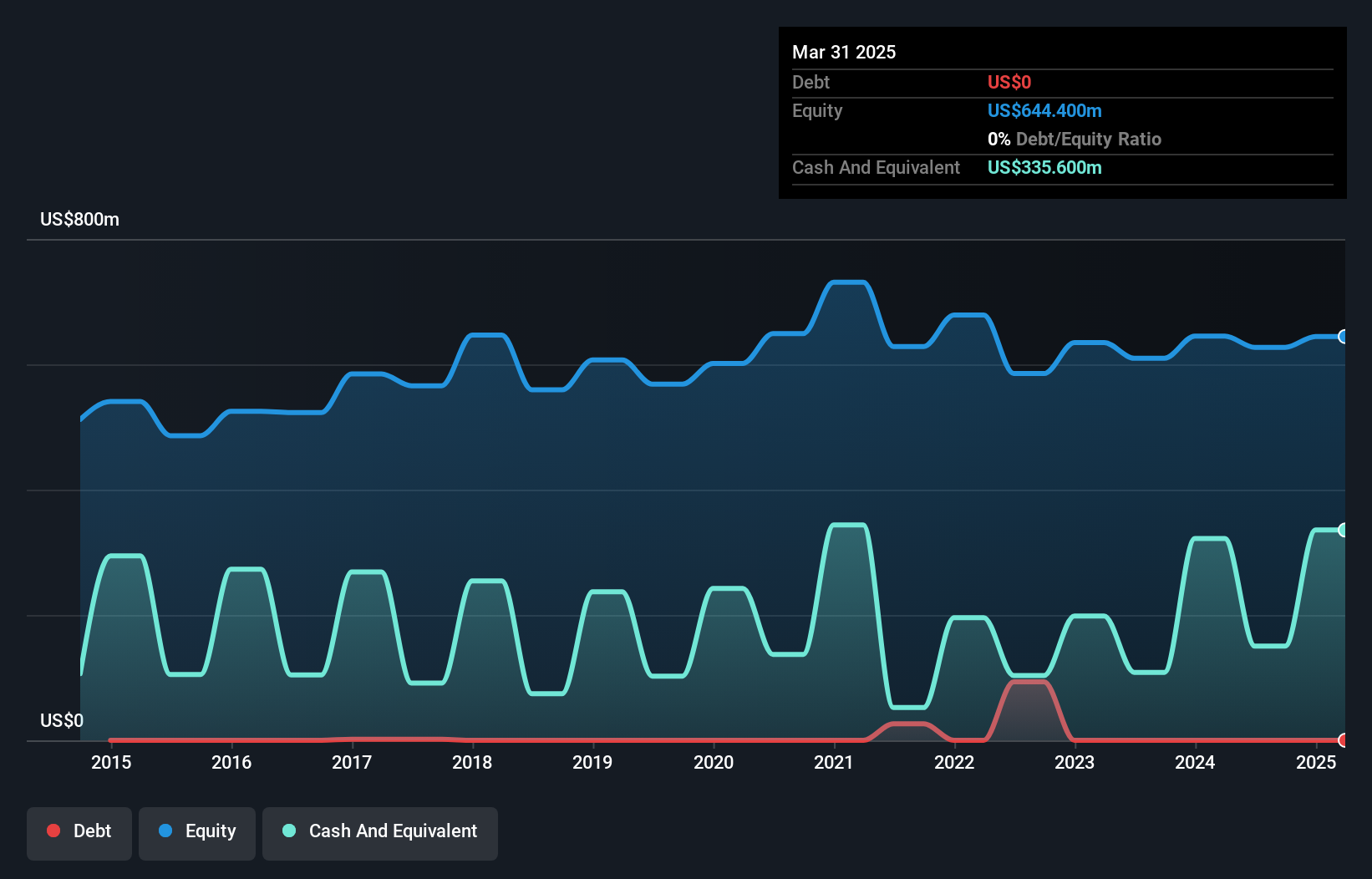

Vtech Holdings, a smaller player in the tech industry, has managed to keep its debt at bay, remaining debt-free over the past five years. Despite earnings declining by 5.9% annually over this period, Vtech is trading at 57.8% below its estimated fair value, suggesting potential undervaluation. Recent figures show net income of US$87 million for H1 2025 compared to US$94 million a year earlier. The company anticipates improved profitability for the full year due to reduced material costs and a favorable product mix shift. An interim dividend of US$0.17 per share was also declared recently.

- Click here and access our complete health analysis report to understand the dynamics of Vtech Holdings.

Gain insights into Vtech Holdings' past trends and performance with our Past report.

CMST DevelopmentLtd (SHSE:600787)

Simply Wall St Value Rating: ★★★★★☆

Overview: CMST Development Co., Ltd. offers warehouse logistics services across China, the rest of Asia, Europe, and the United States with a market capitalization of approximately CN¥13.14 billion.

Operations: CMST Development Co., Ltd. generates revenue primarily through its warehouse logistics services. The company has a market capitalization of approximately CN¥13.14 billion.

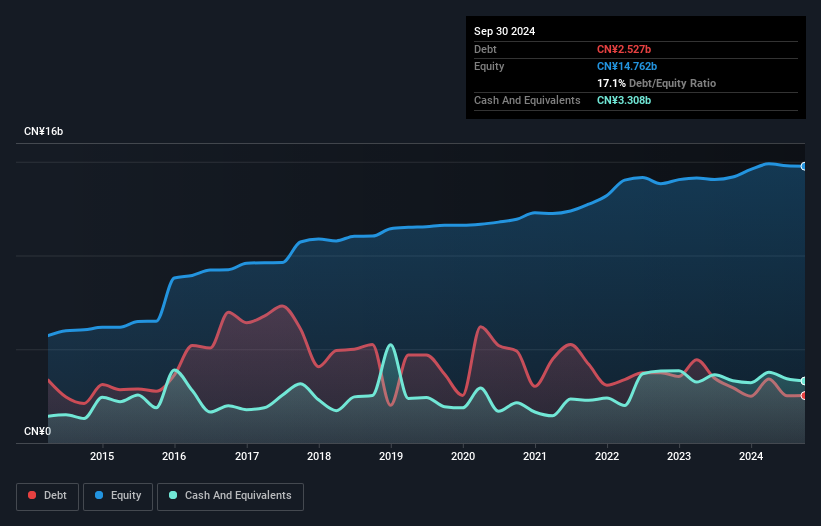

CMST Development, a nimble player in the logistics sector, has been on an impressive trajectory with earnings growth of 59.9% over the past year, outpacing the industry average of 4.9%. Its debt-to-equity ratio improved significantly from 31.7% to 17.1% over five years, indicating prudent financial management. The company enjoys a favorable position with more cash than total debt and maintains a price-to-earnings ratio of 15.8x, which is notably below the CN market average of 34.9x. Despite high volatility in its share price recently, CMST's profitability and strategic financial decisions suggest robust potential for continued success in its field.

- Click to explore a detailed breakdown of our findings in CMST DevelopmentLtd's health report.

Explore historical data to track CMST DevelopmentLtd's performance over time in our Past section.

Fujian South Highway Machinery (SHSE:603280)

Simply Wall St Value Rating: ★★★★★★

Overview: Fujian South Highway Machinery Co., Ltd. is a Chinese company that manufactures and sells equipment for the engineering mixing field, with a market capitalization of CN¥2.64 billion.

Operations: The company generates revenue through the sale of equipment in the engineering mixing field. Its gross profit margin has shown variability, reflecting changes in production costs and pricing strategies.

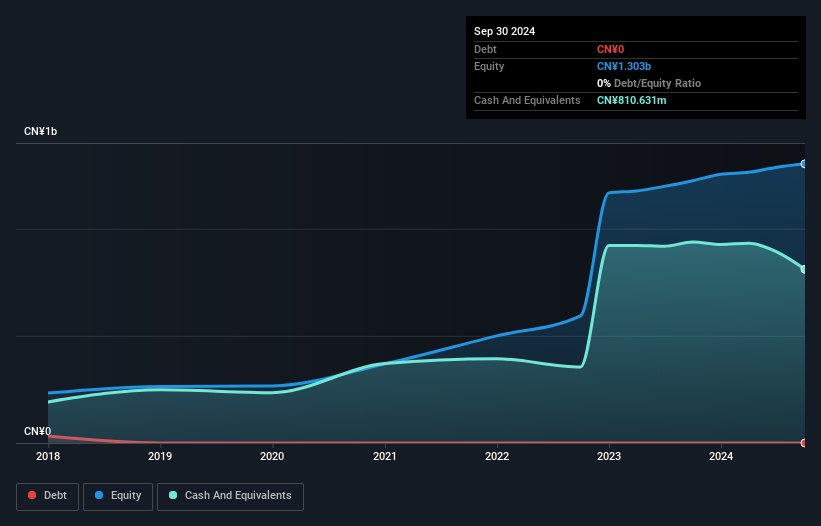

Fujian South Highway Machinery stands out with its debt-free status, a rarity in the industry. The company’s earnings growth of 1.4% over the past year surpasses the machinery sector's -0.4%, hinting at resilience amidst broader challenges. With a Price-To-Earnings ratio of 23x, it appears undervalued compared to China's market average of 35x, suggesting potential upside for investors seeking value plays. While free cash flow is currently negative, high levels of non-cash earnings indicate strong underlying operations. Future projections show an optimistic growth forecast at nearly 19% annually, positioning it as an intriguing prospect within its niche market segment.

Next Steps

- Explore the 4724 names from our Undiscovered Gems With Strong Fundamentals screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600787

CMST DevelopmentLtd

Provides warehouse logistics services in China, Hong Kong, and internationally.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives