Stock Analysis

- Hong Kong

- /

- Communications

- /

- SEHK:285

High Growth Tech Stocks To Watch In Hong Kong This September 2024

Reviewed by Simply Wall St

As global markets navigate a period of economic adjustments and shifting investor sentiment, the Hong Kong tech sector remains a focal point for growth opportunities. With technology stocks showing resilience and strong performance globally, identifying high-growth tech stocks in Hong Kong could be particularly rewarding this September 2024.

Top 10 High Growth Tech Companies In Hong Kong

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Wasion Holdings | 22.37% | 25.47% | ★★★★★☆ |

| MedSci Healthcare Holdings | 48.74% | 48.78% | ★★★★★☆ |

| Inspur Digital Enterprise Technology | 25.37% | 39.10% | ★★★★★☆ |

| Cowell e Holdings | 31.82% | 35.43% | ★★★★★★ |

| RemeGen | 26.30% | 52.19% | ★★★★★☆ |

| Akeso | 33.07% | 54.67% | ★★★★★★ |

| Innovent Biologics | 22.34% | 59.40% | ★★★★★☆ |

| Biocytogen Pharmaceuticals (Beijing) | 21.53% | 109.17% | ★★★★★☆ |

| Beijing Airdoc Technology | 37.47% | 93.35% | ★★★★★☆ |

| Sichuan Kelun-Biotech Biopharmaceutical | 24.70% | 8.53% | ★★★★★☆ |

Click here to see the full list of 45 stocks from our SEHK High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Cowell e Holdings (SEHK:1415)

Simply Wall St Growth Rating: ★★★★★★

Overview: Cowell e Holdings Inc., an investment holding company, designs, develops, manufactures, trades in, and sells optical modules and systems integration products for smartphones, multimedia tablets, smart driving, and other mobile devices in several countries including the People’s Republic of China and India; it has a market cap of approximately HK$17.64 billion.

Operations: Cowell e Holdings Inc. generates revenue primarily from its photographic equipment and supplies segment, amounting to $1.14 billion. The company operates in multiple countries including China, India, and South Korea, focusing on optical modules and systems integration products for various mobile devices.

Cowell e Holdings, a significant player in Hong Kong's tech sector, has demonstrated robust revenue growth of 31.8% annually, outpacing the market average of 7.3%. Despite a slight dip in net income to $16.04 million from $18.03 million last year, the company continues to invest heavily in R&D with expenses contributing substantially to innovation and future growth prospects. Earnings are forecasted to grow at an impressive rate of 35.4% per year over the next three years, reflecting strong potential for sustained advancement in their sector. The company's recent earnings report highlighted sales reaching $585.93 million for H1 2024 compared to $366.73 million a year ago, showcasing significant top-line expansion despite tighter profit margins (3.9% vs last year's 6.6%). Cowell e Holdings' focus on high-quality earnings and strategic investments positions it well within the competitive landscape of high-growth tech companies in Hong Kong, with promising future projections driven by continued innovation and market demand.

- Click here to discover the nuances of Cowell e Holdings with our detailed analytical health report.

Assess Cowell e Holdings' past performance with our detailed historical performance reports.

BYD Electronic (International) (SEHK:285)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: BYD Electronic (International) Company Limited, an investment holding company, primarily engages in the design, manufacture, assembly, and sale of mobile handset components, modules, and other products in the People’s Republic of China and internationally with a market cap of HK$57.57 billion.

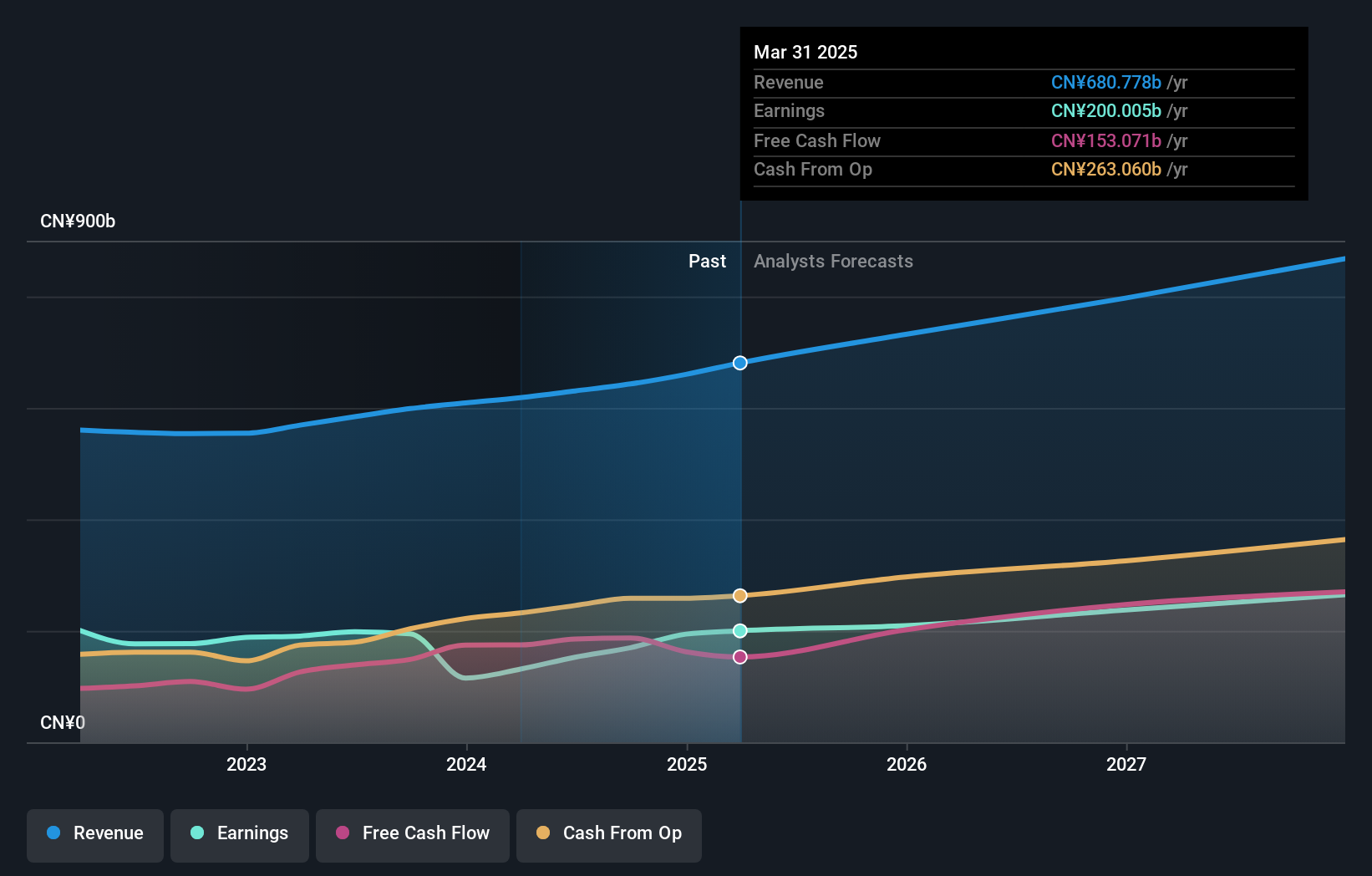

Operations: The company focuses on the design, manufacture, assembly, and sale of mobile handset components and modules. It generated CN¥152.36 billion in revenue from these activities.

BYD Electronic (International) reported a robust 40% increase in sales for H1 2024, reaching ¥78.58 billion from ¥56.18 billion last year, while net income remained stable at ¥1.52 billion. Despite tighter profit margins, the company continues to invest heavily in R&D, with expenses contributing to future innovation and growth prospects. Earnings are forecasted to grow at an impressive rate of 24.7% annually over the next three years, reflecting strong potential for sustained advancement in their sector.

Tencent Holdings (SEHK:700)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Tencent Holdings Limited, an investment holding company, provides a range of services including value-added services (VAS), online advertising, fintech, and business services both in China and internationally with a market cap of HK$3.48 trillion.

Operations: Tencent Holdings Limited generates revenue primarily from value-added services (CN¥302.28 billion), fintech and business services (CN¥209.17 billion), and online advertising (CN¥111.89 billion). The company operates extensively both within China and on an international scale.

Tencent Holdings showcases a robust performance with Q2 2024 revenue hitting ¥161.12 billion, up from ¥149.21 billion last year, and net income soaring to ¥47.63 billion from ¥26.17 billion. The company’s R&D expenses are substantial, contributing to future innovation and growth; in 2023 alone, Tencent spent approximately 8% of its revenue on R&D activities. Earnings are forecasted to grow at an annual rate of 12.82%, while revenue is expected to increase by 8.2% per year, surpassing the Hong Kong market's average growth rate of 7.3%.

- Click to explore a detailed breakdown of our findings in Tencent Holdings' health report.

Examine Tencent Holdings' past performance report to understand how it has performed in the past.

Make It Happen

- Discover the full array of 45 SEHK High Growth Tech and AI Stocks right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BYD Electronic (International) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:285

BYD Electronic (International)

An investment holding company, primarily engages in the design, manufacture, assembly, and sale of mobile handset components, modules, and other products in the People’s Republic of China and internationally.