- Taiwan

- /

- Tech Hardware

- /

- TWSE:3017

High Growth Tech Stocks In Asia To Watch July 2025

Reviewed by Simply Wall St

As global markets experience a mix of record highs in U.S. indices and varied performances across Europe and Asia, attention turns to the dynamic tech sector in Asia, where growth potential remains a focal point for investors. In this environment, identifying strong tech stocks involves evaluating companies with robust innovation capabilities and adaptability to economic shifts, making them well-positioned to capitalize on emerging opportunities within the region's evolving market landscape.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 30.19% | 29.63% | ★★★★★★ |

| Shengyi Electronics | 22.99% | 35.16% | ★★★★★★ |

| Fositek | 28.51% | 35.31% | ★★★★★★ |

| Shanghai Huace Navigation Technology | 24.44% | 23.48% | ★★★★★★ |

| PharmaResearch | 26.50% | 29.34% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| Global Security Experts | 20.56% | 28.04% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 81.53% | 96.08% | ★★★★★★ |

| Marketingforce Management | 26.39% | 112.30% | ★★★★★★ |

| JNTC | 55.45% | 94.52% | ★★★★★★ |

Here we highlight a subset of our preferred stocks from the screener.

BYD Electronic (International) (SEHK:285)

Simply Wall St Growth Rating: ★★★★☆☆

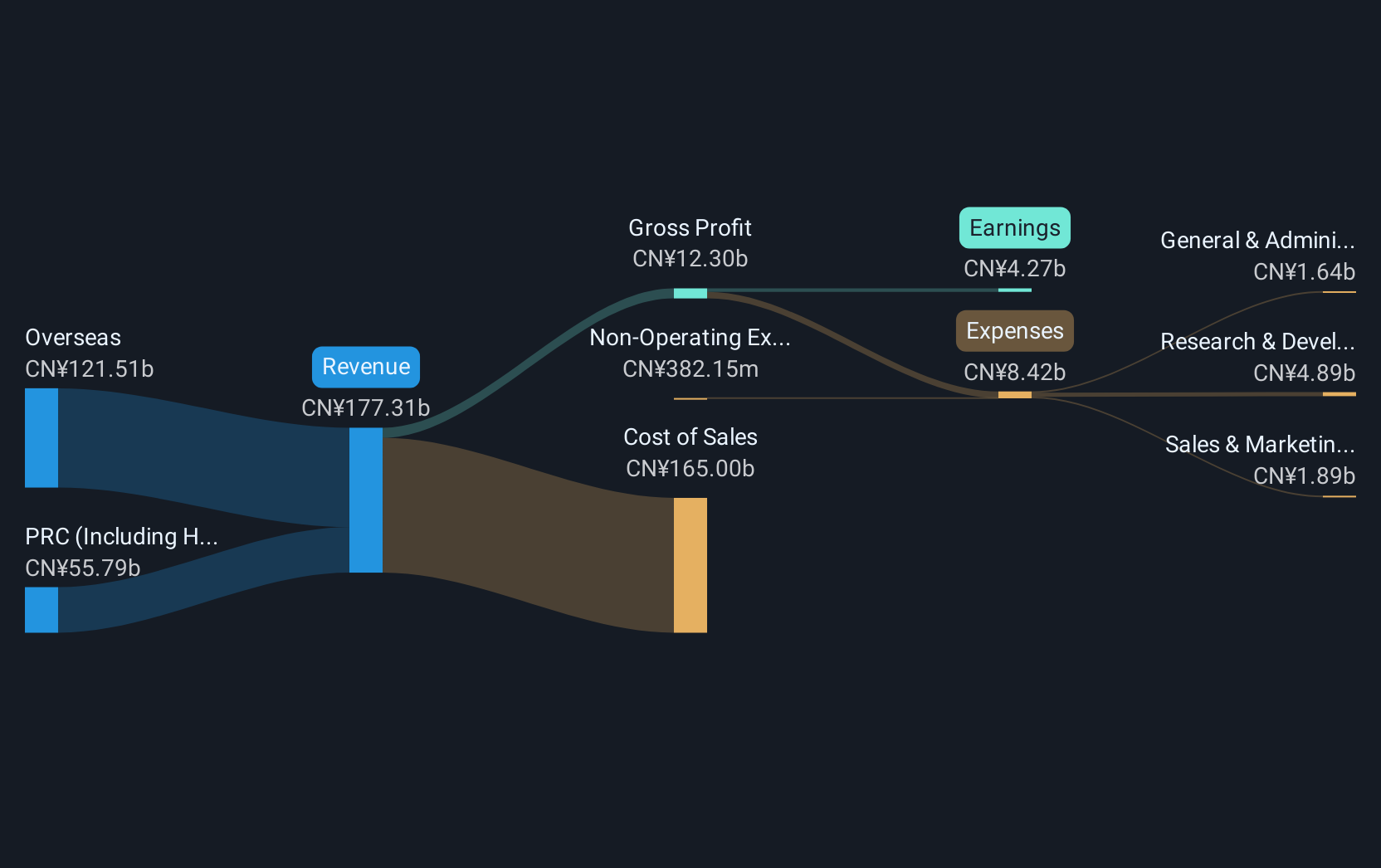

Overview: BYD Electronic (International) Company Limited is an investment holding company focused on designing, manufacturing, assembling, and selling mobile handset components and modules both in China and globally, with a market cap of approximately HK$76.50 billion.

Operations: The company primarily generates revenue through the manufacture, assembly, and sale of mobile handset components and modules, with reported sales amounting to CN¥177.31 billion.

BYD Electronic (International) has demonstrated robust financial health, with earnings growth outpacing the Communications industry by 5.5% over the past year, significantly above the industry's -0.2%. This performance is set against a backdrop of strategic R&D investments which have fortified its market position in high-growth tech sectors in Asia. Notably, its revenue is projected to rise by 10.2% annually, surpassing Hong Kong's market average of 8.1%. The company's commitment to innovation is further underscored by an expected annual earnings increase of 23.1%, highlighting its potential amid a competitive landscape. Recent corporate activities, including a dividend payout and key presentations at significant conferences like the Macquarie Asia Conference, reflect BYD Electronic’s proactive engagement with stakeholders and dedication to transparency in operations and future growth strategies.

Eoptolink Technology (SZSE:300502)

Simply Wall St Growth Rating: ★★★★★★

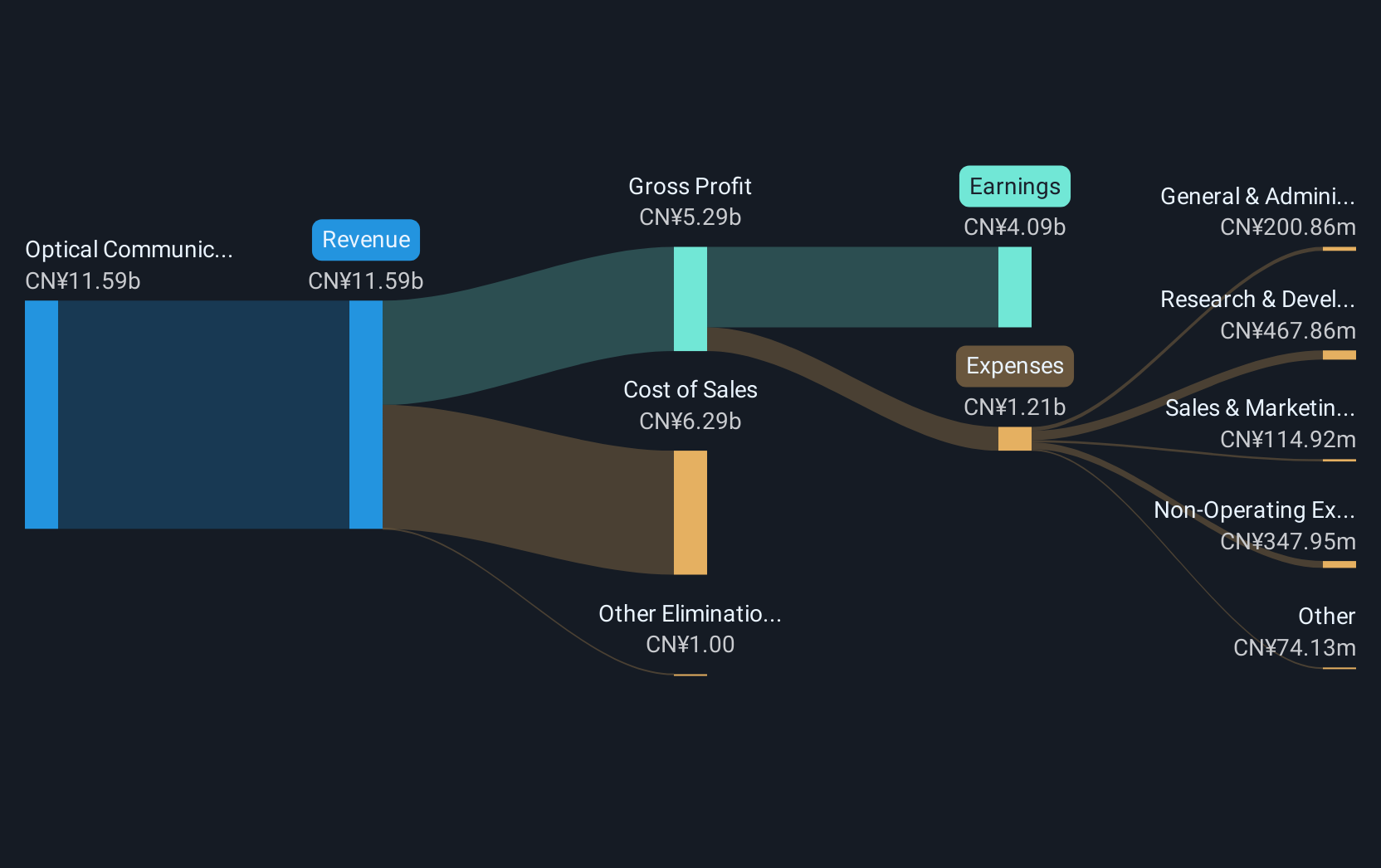

Overview: Eoptolink Technology Inc., Ltd. specializes in the research, development, production, and sales of optical modules both in China and internationally, with a market capitalization of CN¥132.03 billion.

Operations: Eoptolink Technology Inc., Ltd. focuses on the production and sales of optical communication equipment, generating revenue of CN¥11.59 billion.

Eoptolink Technology has shown remarkable financial agility, with a 351.4% earnings growth over the past year, significantly outstripping its industry's average of 2.9%. This surge is supported by strategic amendments in corporate governance and an aggressive dividend policy, reflecting a robust profit distribution plan. With R&D expenses aligning closely with revenue increases—revenue itself having grown by 31.5% annually—the company is evidently prioritizing innovation while expanding its market footprint aggressively in the competitive tech landscape of Asia. These factors combined suggest Eoptolink is not only enhancing shareholder value but also cementing its stature in high-growth technology sectors through focused investments and operational excellence.

Asia Vital Components (TWSE:3017)

Simply Wall St Growth Rating: ★★★★★★

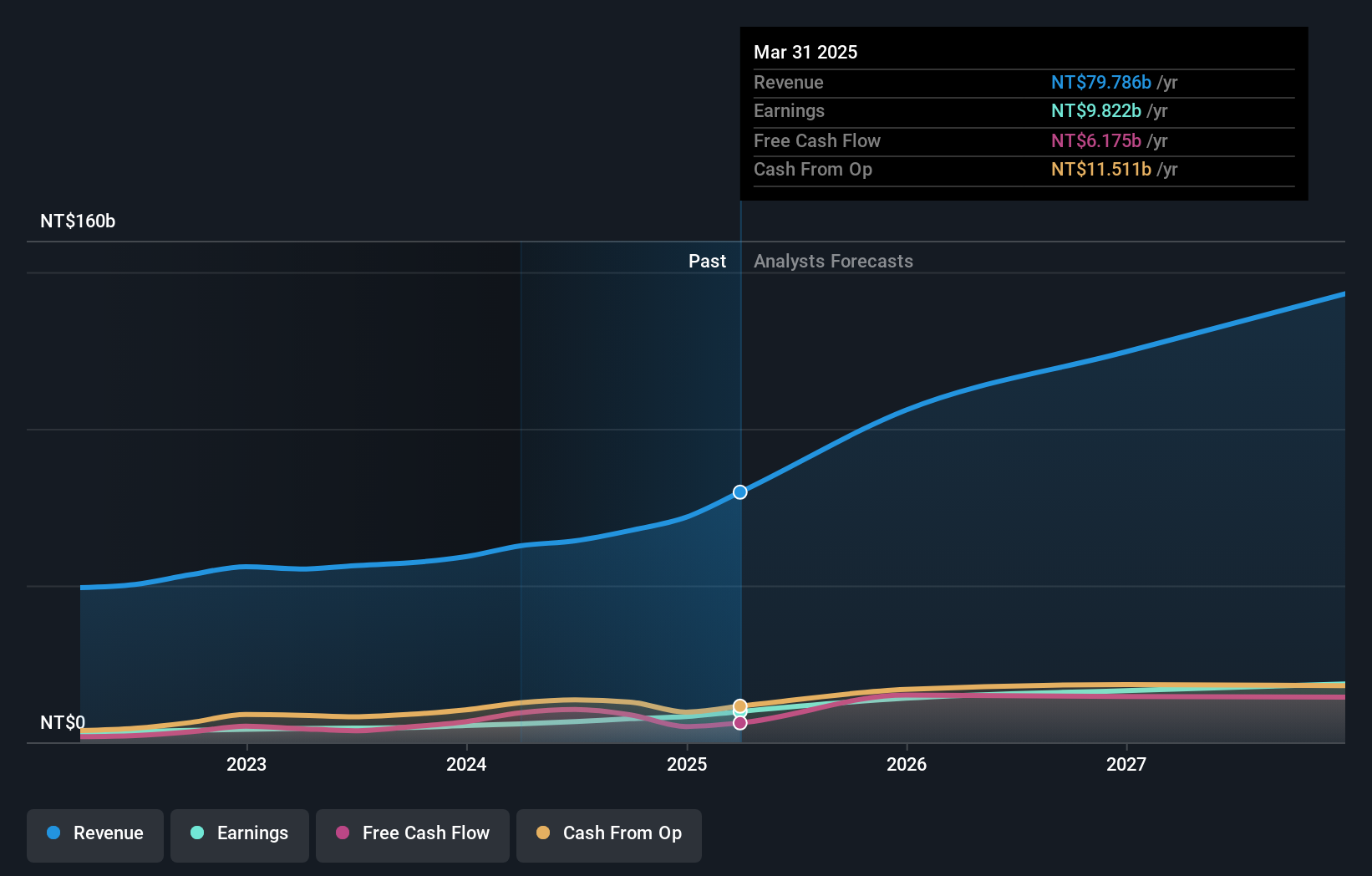

Overview: Asia Vital Components Co., Ltd. specializes in providing thermal solutions globally and has a market capitalization of approximately NT$328 billion.

Operations: The company generates revenue primarily through its Overseas Operating Department, contributing NT$93.10 billion, followed by the Integrated Management Division with NT$62.02 billion.

Asia Vital Components has demonstrated a robust trajectory in the high-growth tech sector in Asia, with a notable 22.1% annual revenue growth outpacing the TW market's 10%. This growth is underpinned by strategic expansions, such as the recent establishment of AVC Development Co., Ltd. in Vietnam, aimed at bolstering its regional presence and capabilities. Furthermore, its commitment to innovation is evident from its R&D expenditure trends which align closely with revenue increases, ensuring the company remains at the forefront of technological advancements. The firm's proactive approach in hosting and participating in numerous industry forums highlights its active role in shaping tech discussions regionally.

- Delve into the full analysis health report here for a deeper understanding of Asia Vital Components.

Make It Happen

- Navigate through the entire inventory of 478 Asian High Growth Tech and AI Stocks here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3017

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives