- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:2708

How Is IBO Technology's (HKG:2708) CEO Paid Relative To Peers?

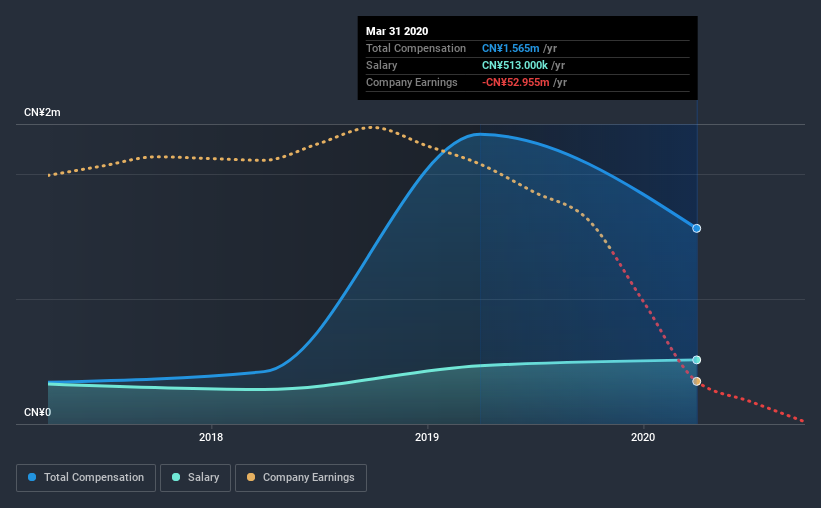

Weilong Gao is the CEO of IBO Technology Company Limited (HKG:2708), and in this article, we analyze the executive's compensation package with respect to the overall performance of the company. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

Check out our latest analysis for IBO Technology

Comparing IBO Technology Company Limited's CEO Compensation With the industry

According to our data, IBO Technology Company Limited has a market capitalization of HK$949m, and paid its CEO total annual compensation worth CN¥1.6m over the year to March 2020. We note that's a decrease of 32% compared to last year. While we always look at total compensation first, our analysis shows that the salary component is less, at CN¥513k.

For comparison, other companies in the industry with market capitalizations below HK$1.6b, reported a median total CEO compensation of CN¥1.6m. So it looks like IBO Technology compensates Weilong Gao in line with the median for the industry.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | CN¥513k | CN¥466k | 33% |

| Other | CN¥1.1m | CN¥1.9m | 67% |

| Total Compensation | CN¥1.6m | CN¥2.3m | 100% |

Talking in terms of the industry, salary represented approximately 76% of total compensation out of all the companies we analyzed, while other remuneration made up 24% of the pie. It's interesting to note that IBO Technology allocates a smaller portion of compensation to salary in comparison to the broader industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

IBO Technology Company Limited's Growth

IBO Technology Company Limited has reduced its earnings per share by 100% a year over the last three years. It achieved revenue growth of 17% over the last year.

The reduction in EPS, over three years, is arguably concerning. But in contrast the revenue growth is strong, suggesting future potential for EPS growth. These two metrics are moving in different directions, so while it's hard to be confident judging performance, we think the stock is worth watching. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has IBO Technology Company Limited Been A Good Investment?

IBO Technology Company Limited has generated a total shareholder return of 29% over three years, so most shareholders would be reasonably content. But they would probably prefer not to see CEO compensation far in excess of the median.

In Summary...

As previously discussed, Weilong is compensated close to the median for companies of its size, and which belong to the same industry. But revenues have been growing at a healthy pace, more recently. Shareholder returns, in comparison, have not been as impressive during the same period. EPS growth is a further sore spot — the metric is negative over the last three years. There's certainly room for improvement, but CEO compensation seems reasonable, considering the company's steady performance.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. We identified 4 warning signs for IBO Technology (2 are a bit unpleasant!) that you should be aware of before investing here.

Switching gears from IBO Technology, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

When trading IBO Technology or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:2708

IBO Technology

An investment holding company, sells radio frequency identification (RFID) equipment and electronic products in the People's Republic of China.

Slight and slightly overvalued.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026