- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:2498

Robosense Technology (SEHK:2498): Assessing Valuation After AC2 'Robot Manipulation Eye' Sensor Launch and Industry Buzz

Reviewed by Simply Wall St

Robosense Technology (SEHK:2498) made headlines at the International Conference on Intelligent Robots and Systems (IROS 2025) by unveiling its AC2 "Robot Manipulation Eye," a next-generation sensor with advanced perception capabilities and an industrial focus.

See our latest analysis for Robosense Technology.

Following the AC2 launch and industry buzz, Robosense Technology has seen notable momentum build in its stock. The company’s year-to-date share price return stands at 21.92%, while the one-year total shareholder return is a remarkable 110.65%. This surge suggests growing confidence in Robosense’s growth prospects and reflects the broader relevance of its technological breakthroughs.

If the wave of innovation in robotics has you thinking about what else the market has to offer, explore fresh opportunities with the See the full list for free.

With buzz building around breakthrough technology and strong recent returns, the key question now is whether Robosense shares are trading below their intrinsic value or if investors have already priced in future growth expectations.

Most Popular Narrative: 25% Undervalued

Robosense Technology's widely followed narrative sets a fair value of HK$47.45, a substantial premium to the last close of HK$35.6. The difference in these numbers is sparking interest across the robotics investment space.

The company's rapid increase in sales of LiDAR products for robotics and non-automotive applications (up 185% in revenue and more than 5x in units sold year-over-year), along with significant gross margin improvement in this segment (from 26.1% to 45%), points to successful expansion into new growth markets like robotics and smart cities. This positions Robosense to benefit from the wider adoption of intelligent infrastructure and automation, a trend likely to drive long-term revenue and margin growth.

Want to uncover the big assumptions fueling this bullish narrative? There is a bold growth outlook behind these numbers. Find out what forecasts and profit projections justify such conviction in Robosense’s future. The story goes deeper than initial headlines; only the full narrative reveals the drivers of this striking fair value.

Result: Fair Value of $47.45 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent net losses and high customer concentration could challenge Robosense’s bullish outlook if growth in core markets slows or if key partnerships falter.

Find out about the key risks to this Robosense Technology narrative.

Another View: Multiple-Based Valuation Raises Questions

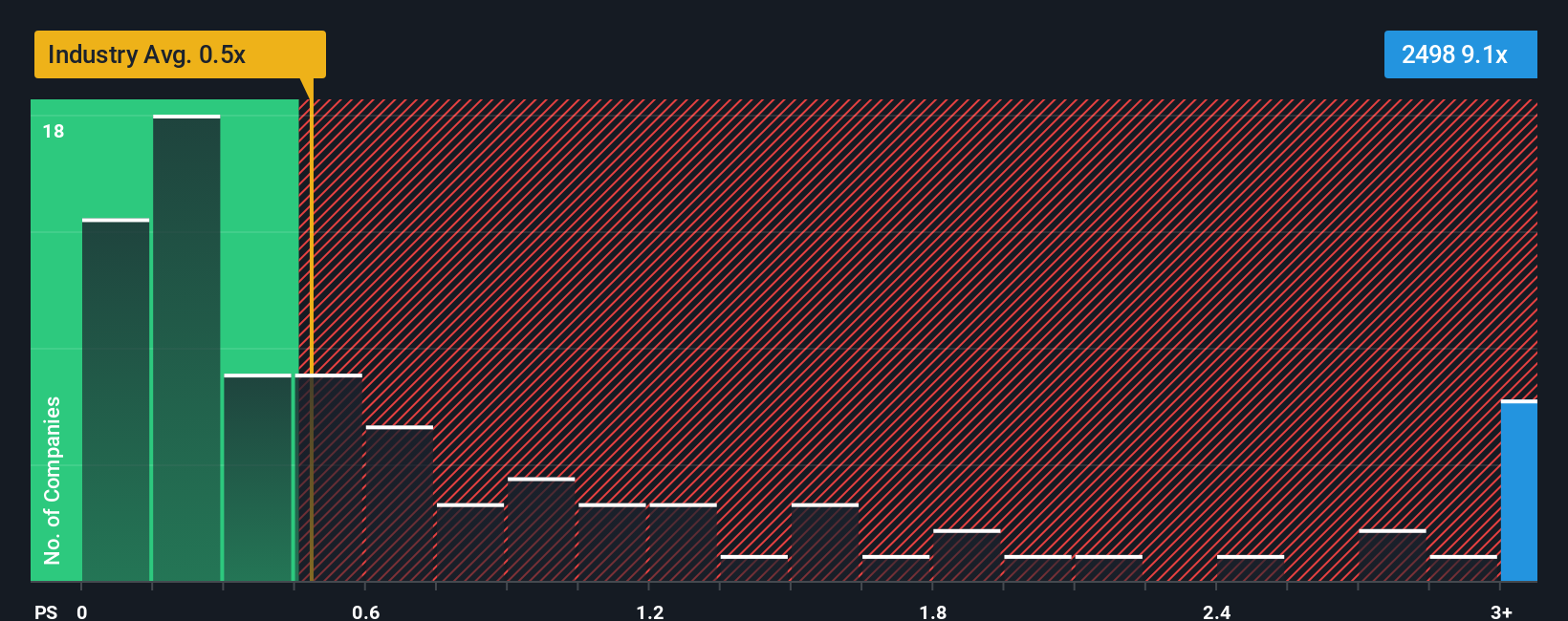

While the dominant narrative highlights Robosense’s upside, a look at price-to-sales tells a different story. Robosense trades at 9x sales, which is much higher than both its industry peers at 1.1x and the sector average of 0.5x. Even the fair ratio, at 1.9x, suggests the market could eventually reassess its enthusiasm. Could this premium signal valuation risk if growth falters?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Robosense Technology Narrative

If you’d rather put the story together yourself, our platform lets you dive into the data and build your own perspective in minutes, your conclusions, your approach: Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Robosense Technology.

Looking for More Smart Investment Ideas?

Ready to broaden your portfolio and uncover tomorrow’s market leaders? Don’t sit back while others make moves you could be capitalizing on.

- Spot untapped value by jumping into these 877 undervalued stocks based on cash flows, where you’ll see stocks trading below their true potential based on cash flows.

- Earn reliable income by checking out these 17 dividend stocks with yields > 3% for companies offering strong yields above 3% and robust fundamentals.

- Ride the next tech breakthrough by gaining an edge with these 27 AI penny stocks, designed for those eager to get ahead in the artificial intelligence race.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2498

Robosense Technology

An investment holding company, provides LiDAR and perception solutions in the People’s Republic of China and internationally.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives