- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:2498

Robosense (SEHK:2498) Gross Margin Jumps to 25.9%, Reinforcing Bulls’ Margin Expansion Narrative

Reviewed by Simply Wall St

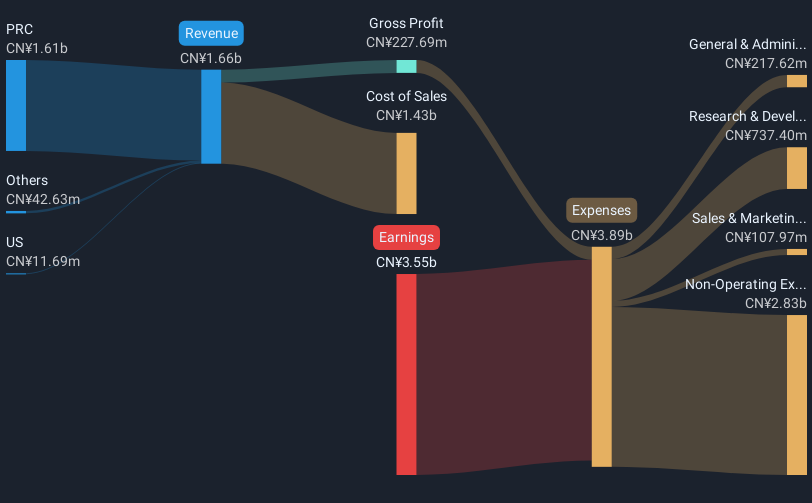

Robosense Technology (SEHK:2498) has just released its Q3 2025 results, posting revenue of 407.1 million CNY and basic EPS of -0.22 CNY. Over the last three quarters, revenue moved from 327.8 million CNY to 455.4 million CNY before settling at 407.1 million CNY, while EPS remained consistently negative. Despite ongoing losses, investors are closely watching for signs of margin recovery amid shifting top-line trends and significant market expectations.

See our full analysis for Robosense Technology.Next, the focus will turn to how these headline results compare with the market’s major narratives and whether the numbers support or challenge the prevailing stories.

See what the community is saying about Robosense Technology

Gross Margin Leaps to 25.9%, Halving Losses

- Overall gross margin improved from 13.6% to 25.9% year-over-year, with net income losses narrowing by 44.5% compared to the same period last year (from -130.5 million CNY in Q4 2024 to -101.0 million CNY in Q3 2025).

- Analysts' consensus narrative highlights the company's push into higher-value robotics and non-automotive LiDAR solutions as the key growth driver, with robotics-related revenue up 185% and segment gross margin rising from 26.1% to 45%.

- Consensus notes that operational scale and internal development of SOC chips have helped achieve this margin boost. This approach is setting a path to sustainable earnings even while net profit is still negative.

- Notably, despite elevated R&D costs at 36.3% of revenue, prudent cost management allowed for these gains and supports the view that margin expansion could continue.

- To see why analysts still see room for upside despite ongoing losses, check out the full Robosense consensus narrative. 📊 Read the full Robosense Technology Consensus Narrative.

Price-To-Sales Soars to 7.7x Despite Discount to DCF Value

- Robosense’s Price-To-Sales Ratio currently sits at 7.7x, far above peers (1x) and the Hong Kong Electronic industry average (0.5x), even though its HK$30.70 share price is trading 58.4% below its DCF fair value of HK$73.86.

- Consensus narrative observes that while the company trades at what looks like a deep discount to modeled fair value, the premium valuation relative to revenue and peers indicates investors are pricing in very high growth. This raises the bar for continued revenue and margin execution.

- The narrative explicitly ties the current multiples to strong analyst price targets (HK$46.94), which is still 18.3% above today’s share price. This suggests the market expects substantial improvement in profitability and scale.

- The tension stems from whether projected annual revenue and earnings growth rates of 32.7% and 69.5%, respectively, can materialize quickly enough to justify the premium.

LiDAR ADAS Sales Slip, Robotics Segment Shines

- Revenue and unit sales of LiDAR for ADAS applications fell 17.9% as both major automotive OEM customers cut or paused installations. In contrast, robotics and non-automotive LiDAR sales surged in both volume (more than 5x year-over-year) and revenue (up 185%).

- Consensus narrative warns that this high customer concentration and price pressure in the ADAS category pose a structural risk, potentially depressing future earnings if new automotive partners or verticals are not secured.

- On the other hand, the 43.5% jump in solutions revenue and nearly 4x average project size in robotics has cushioned the impact. This illustrates the growing importance of diversification and segment mix.

- The balance between automotive headwinds and robotics outperformance is shaping Robosense’s near-term revenue trajectory and long-term addressable market.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Robosense Technology on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on these figures? You can shape your own perspective in just a few minutes and make your narrative heard. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Robosense Technology.

See What Else Is Out There

Robosense’s premium revenue multiple and highly optimistic growth expectations create risk if its rapid revenue and margin expansion does not materialize.

If you want to focus instead on companies actually trading at compelling prices relative to their fundamentals, check out these 927 undervalued stocks based on cash flows that could fit your strategy right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2498

Robosense Technology

An investment holding company, provides LiDAR and perception solutions in the People’s Republic of China and internationally.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success