- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:2323

Does Renco Holdings Group (HKG:2323) Have A Healthy Balance Sheet?

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies Renco Holdings Group Limited (HKG:2323) makes use of debt. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Renco Holdings Group

What Is Renco Holdings Group's Net Debt?

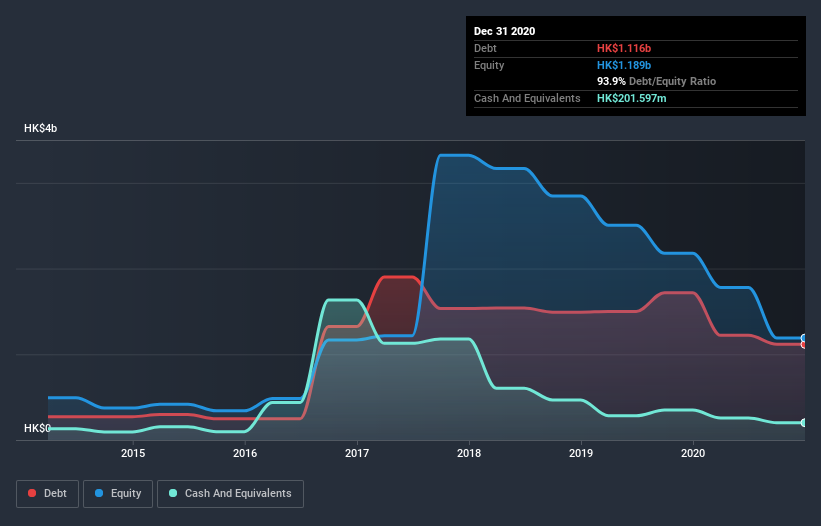

The image below, which you can click on for greater detail, shows that Renco Holdings Group had debt of HK$1.12b at the end of December 2020, a reduction from HK$1.72b over a year. However, it does have HK$201.6m in cash offsetting this, leading to net debt of about HK$914.6m.

How Strong Is Renco Holdings Group's Balance Sheet?

The latest balance sheet data shows that Renco Holdings Group had liabilities of HK$1.09b due within a year, and liabilities of HK$669.4m falling due after that. Offsetting this, it had HK$201.6m in cash and HK$1.58b in receivables that were due within 12 months. So its total liabilities are just about perfectly matched by its shorter-term, liquid assets.

This surplus suggests that Renco Holdings Group has a conservative balance sheet, and could probably eliminate its debt without much difficulty. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Renco Holdings Group's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

In the last year Renco Holdings Group wasn't profitable at an EBIT level, but managed to grow its revenue by 33%, to HK$278m. Shareholders probably have their fingers crossed that it can grow its way to profits.

Caveat Emptor

Even though Renco Holdings Group managed to grow its top line quite deftly, the cold hard truth is that it is losing money on the EBIT line. Indeed, it lost a very considerable HK$508m at the EBIT level. On a more positive note, the company does have liquid assets, so it has a bit of time to improve its operations before the debt becomes an acute problem. Still, we'd be more encouraged to study the business in depth if it already had some free cash flow. So it seems too risky for our taste. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. To that end, you should learn about the 3 warning signs we've spotted with Renco Holdings Group (including 1 which shouldn't be ignored) .

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you decide to trade Renco Holdings Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:2323

Renco Holdings Group

An investment holding company, manufactures and sells printed circuit boards.

Good value slight.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.