- China

- /

- Electronic Equipment and Components

- /

- SZSE:300184

Undiscovered Gems in Asia to Explore This August 2025

Reviewed by Simply Wall St

As global markets react to economic data and rate cut speculations, small-cap stocks have been gaining attention, particularly in regions like Asia where trade tensions are easing and economic indicators show mixed signals. In this dynamic environment, identifying stocks with strong fundamentals and growth potential can be crucial for investors looking to navigate the evolving landscape of opportunities in Asia.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| VICOM | NA | 5.01% | 2.30% | ★★★★★★ |

| Camelot Electronics TechnologyLtd | 8.74% | 3.20% | -7.84% | ★★★★★★ |

| Xuchang Yuandong Drive ShaftLtd | 0.03% | -13.23% | -30.14% | ★★★★★★ |

| Anhui Guqi Down & Feather Textile | 30.32% | 21.48% | 23.11% | ★★★★★★ |

| Pan Asian Microvent Tech (Jiangsu) | 25.44% | 15.19% | 13.48% | ★★★★★★ |

| Sing Investments & Finance | 0.21% | 8.60% | 11.10% | ★★★★★☆ |

| Guangdong Goworld | 27.20% | 1.38% | -9.57% | ★★★★★☆ |

| Kondotec | 12.90% | 6.97% | 11.26% | ★★★★★☆ |

| SBS Philippines | 29.71% | 3.10% | -49.78% | ★★★★★☆ |

| JinXianDai Information IndustryLtd | 16.46% | -0.60% | -32.74% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

FIH Mobile (SEHK:2038)

Simply Wall St Value Rating: ★★★★★★

Overview: FIH Mobile Limited is an investment holding company that offers integrated manufacturing services for the global handset industry, with a market capitalization of HK$12.48 billion.

Operations: FIH Mobile generates revenue primarily from Asia, Europe, and America, with contributions of $2.38 billion, $1.50 billion, and $1.99 billion respectively.

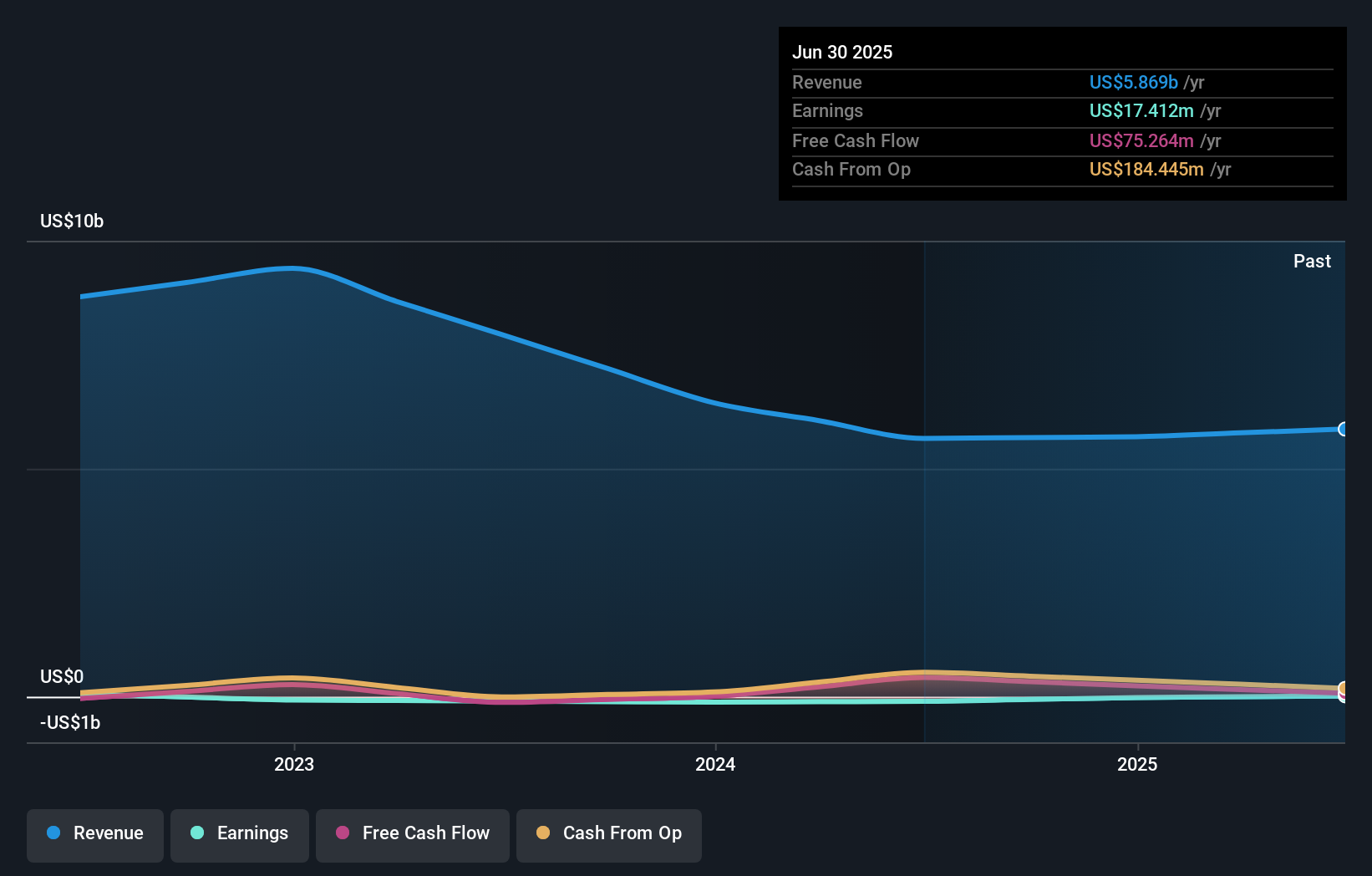

FIH Mobile, a notable player in the electronics sector with a market presence that might surprise some, has recently turned profitable, reporting net income of US$6.17 million for the half-year ending June 2025. This is a significant improvement from the previous year's net loss of US$31.58 million. The company trades at 70.6% below its estimated fair value and has seen its debt-to-equity ratio shrink from 44.3% to just 8.7% over five years, indicating prudent financial management. A share repurchase program commenced in May 2025 could enhance earnings per share further as it progresses through its authorized buyback of up to 787 million shares.

Wuhan P&S Information Technology (SZSE:300184)

Simply Wall St Value Rating: ★★★★★☆

Overview: Wuhan P&S Information Technology Co., Ltd. operates in the technology sector and has a market capitalization of CN¥13.33 billion.

Operations: Wuhan P&S Information Technology generates revenue primarily from its technology-related services. The company has a market capitalization of CN¥13.33 billion, reflecting its position in the sector.

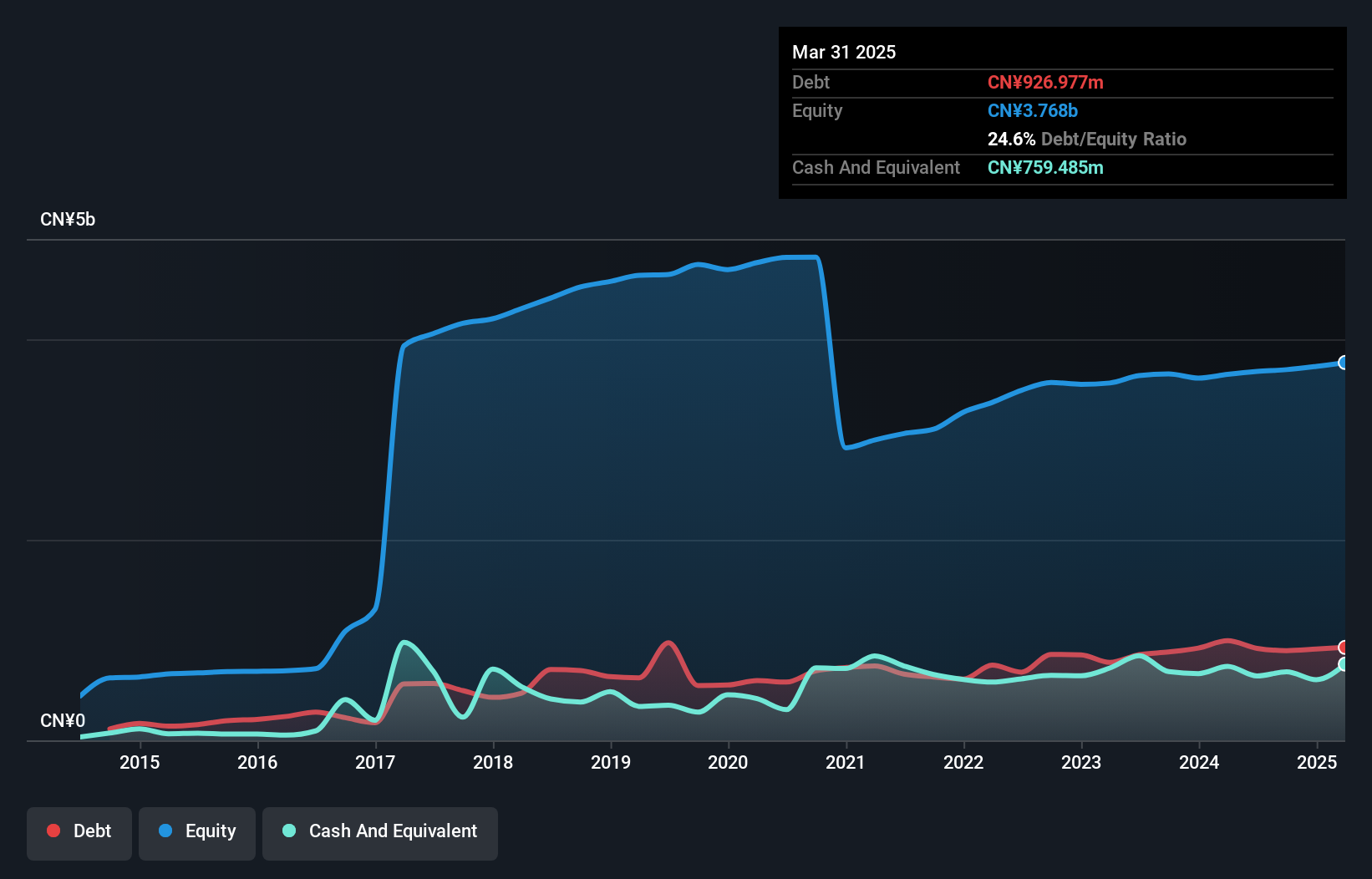

Wuhan P&S Information Technology has shown robust growth, with earnings surging 89.9% over the past year, outpacing the electronic industry average of 2.9%. The company's revenue for the first half of 2025 reached CNY 4.03 billion, up from CNY 3.43 billion a year prior, while net income climbed to CNY 96.13 million from CNY 57.98 million last year. Despite an increase in its debt to equity ratio from 12% to 26% over five years, its net debt to equity remains satisfactory at just 3%. With high-quality earnings and well-covered interest payments (7x EBIT), Wuhan P&S seems positioned for continued stability in its sector.

Dynapack International Technology (TPEX:3211)

Simply Wall St Value Rating: ★★★★★★

Overview: Dynapack International Technology Corporation is a company that manufactures and sells lithium-ion battery packs across Taiwan, the United States, and various international markets, with a market cap of NT$46.68 billion.

Operations: The primary revenue stream for Dynapack International Technology comes from the production and sales of hammer battery packs, generating NT$12.15 billion.

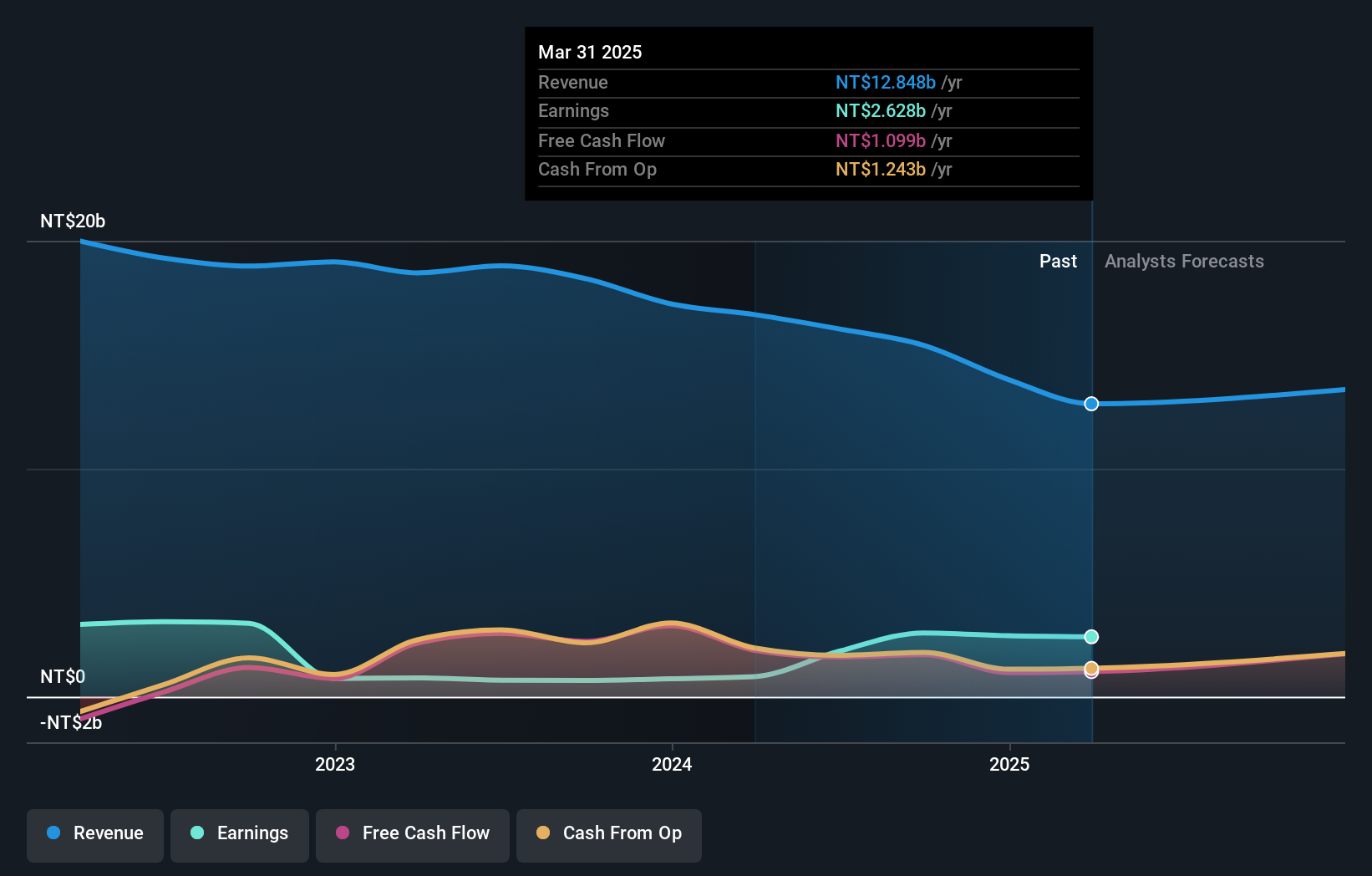

Dynapack International Technology, a small player in the electronics sector, experienced a challenging year with earnings growth at -6.1%, underperforming the industry average of -0.5%. Despite this, it trades at 5.8% below its estimated fair value, suggesting potential upside for investors seeking undervalued opportunities. The company’s debt-to-equity ratio improved significantly from 68.8% to 12.7% over five years, indicating better financial health and reduced leverage risk. Recent results showed net income of NT$593 million for Q2 2025 compared to NT$1,356 million last year, reflecting ongoing pressures but also highlighting areas for potential recovery and growth.

Summing It All Up

- Unlock our comprehensive list of 2443 Asian Undiscovered Gems With Strong Fundamentals by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wuhan P&S Information Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300184

Wuhan P&S Information Technology

Wuhan P&S Information Technology Co., Ltd.

Solid track record with adequate balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.