- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:2018

The total return for AAC Technologies Holdings (HKG:2018) investors has risen faster than earnings growth over the last year

AAC Technologies Holdings Inc. (HKG:2018) shareholders might be concerned after seeing the share price drop 10% in the last week. Despite this, the stock is a strong performer over the last year, no doubt about that. Indeed, the share price is up an impressive 124% in that time. So we think most shareholders won't be too upset about the recent fall. Only time will tell if there is still too much optimism currently reflected in the share price.

Since the long term performance has been good but there's been a recent pullback of 10%, let's check if the fundamentals match the share price.

Check out our latest analysis for AAC Technologies Holdings

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

AAC Technologies Holdings was able to grow EPS by 84% in the last twelve months. This EPS growth is significantly lower than the 124% increase in the share price. This indicates that the market is now more optimistic about the stock.

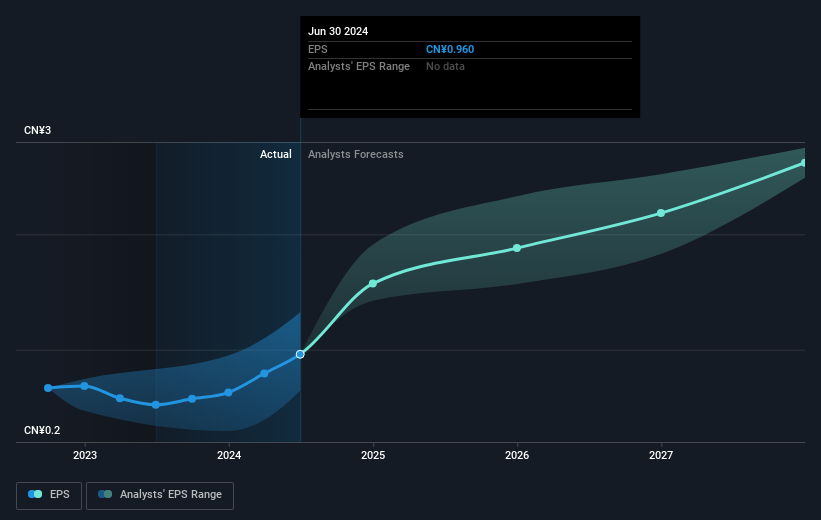

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

We know that AAC Technologies Holdings has improved its bottom line lately, but is it going to grow revenue? This free report showing analyst revenue forecasts should help you figure out if the EPS growth can be sustained.

A Different Perspective

It's good to see that AAC Technologies Holdings has rewarded shareholders with a total shareholder return of 125% in the last twelve months. Of course, that includes the dividend. That certainly beats the loss of about 2% per year over the last half decade. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. Before forming an opinion on AAC Technologies Holdings you might want to consider these 3 valuation metrics.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2018

AAC Technologies Holdings

An investment holding company, provides sensory experience solutions in Greater China, the United States, Europe, Other Asian countries, and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives