- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:2018

AAC Technologies Holdings (SEHK:2018): Is the Stock Still Undervalued After Recent Gains?

Reviewed by Kshitija Bhandaru

AAC Technologies Holdings (SEHK:2018) shares have shown steady gains over the past month, rising nearly 10% as investors weigh the company's recent track record along with strong revenue and net income growth.

See our latest analysis for AAC Technologies Holdings.

While AAC Technologies Holdings' share price has climbed nearly 10% over the past month, this momentum marks a turning point after a slower start to the year. With a latest share price of HK$46.12 and a strong recent run, investors might note that the 1-year total shareholder return sits at an impressive 44%, signaling growing confidence and renewed growth expectations for the company.

If you’re keeping an eye on upward trends, now is the perfect time to expand your search and see what fast-moving companies await in our fast growing stocks with high insider ownership.

With shares recently reaching HK$46.12, investors may be wondering whether AAC Technologies Holdings remains undervalued given its robust growth, or if the market has already priced in the company’s next chapter of expansion.

Most Popular Narrative: 20.3% Undervalued

AAC Technologies Holdings' fair value, according to the most widely followed narrative, is estimated at HK$57.86, materially higher than its recent close at HK$46.12. This sets the bar for debate about what is really driving these expectations and creates a narrative with ambitious targets grounded in evolving sector opportunities.

"Rapid expansion in demand for advanced miniaturized components (motors, lenses, MEMS microphones, acoustic modules) is being driven by increasing adoption of AI-enabled devices, wearables, AR/VR devices, smart home, and autonomous vehicles, significantly enlarging AAC's addressable market and supporting sustained revenue and earnings growth."

Curious how this valuation gets its boost? Hint: it all comes down to bold growth forecasts and a sector shift that could reshape AAC’s future. Ready to discover which major financial assumption is changing the game? See the full narrative for the details the market is debating in private.

Result: Fair Value of $57.86 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent margin pressure or sluggish adoption of new optical technologies could present key hurdles that challenge the bullish outlook for AAC Technologies Holdings.

Find out about the key risks to this AAC Technologies Holdings narrative.

Another View: Is the Market Price Fair?

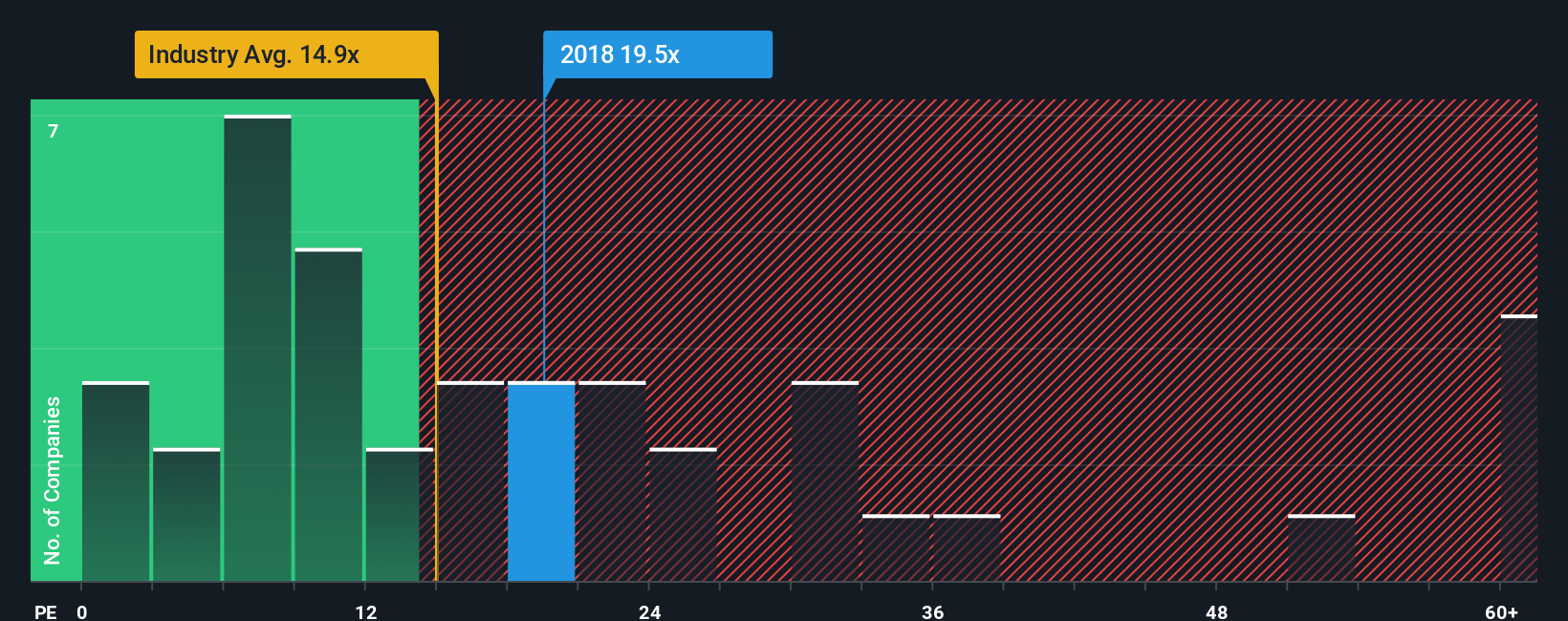

Taking a different angle, investors may look to the company's price-to-earnings ratio to gauge value. AAC Technologies Holdings trades at 23.2x earnings, which is steeper than the Hong Kong Electronic industry average of 14.6x. Compared to similar peers, however, its ratio looks moderate, but it is above the fair ratio of 19.8x indicated by market models. This gap signals that the market may be pricing in higher future growth or simply overvaluing the stock. Does this premium represent an opportunity or extra risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own AAC Technologies Holdings Narrative

If you have a different perspective or want to dive into the numbers yourself, you can analyze the data and shape your own narrative in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding AAC Technologies Holdings.

Ready for More Smart Investing?

Don’t sit on the sidelines. Broaden your portfolio with handpicked opportunities powered by data and real insights from Simply Wall Street’s advanced Stock Screener.

- Tap into growth potential by checking out these 906 undervalued stocks based on cash flows that the market may be overlooking, giving you the chance to move ahead of the crowd.

- Maximize your income by reviewing these 19 dividend stocks with yields > 3% with strong yields above 3%, ideal for building stable, rewarding returns.

- Ride the next tech wave by exploring these 24 AI penny stocks engineered for breakthroughs in artificial intelligence and future-ready innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2018

AAC Technologies Holdings

An investment holding company, provides sensory experience solutions in Greater China, the United States, Europe, Other Asian countries, and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives