- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:1912

Here's Why Shareholders Should Examine Contel Technology Company Limited's (HKG:1912) CEO Compensation Package More Closely

Key Insights

- Contel Technology will host its Annual General Meeting on 23rd of September

- CEO Keung Lam's total compensation includes salary of US$229.0k

- The total compensation is similar to the average for the industry

- Contel Technology's EPS declined by 69% over the past three years while total shareholder loss over the past three years was 30%

The results at Contel Technology Company Limited (HKG:1912) have been quite disappointing recently and CEO Keung Lam bears some responsibility for this. At the upcoming AGM on 23rd of September, shareholders can hear from the board including their plans for turning around performance. They will also get a chance to influence managerial decision-making through voting on resolutions such as executive remuneration, which may impact firm value in the future. We present the case why we think CEO compensation is out of sync with company performance.

See our latest analysis for Contel Technology

Comparing Contel Technology Company Limited's CEO Compensation With The Industry

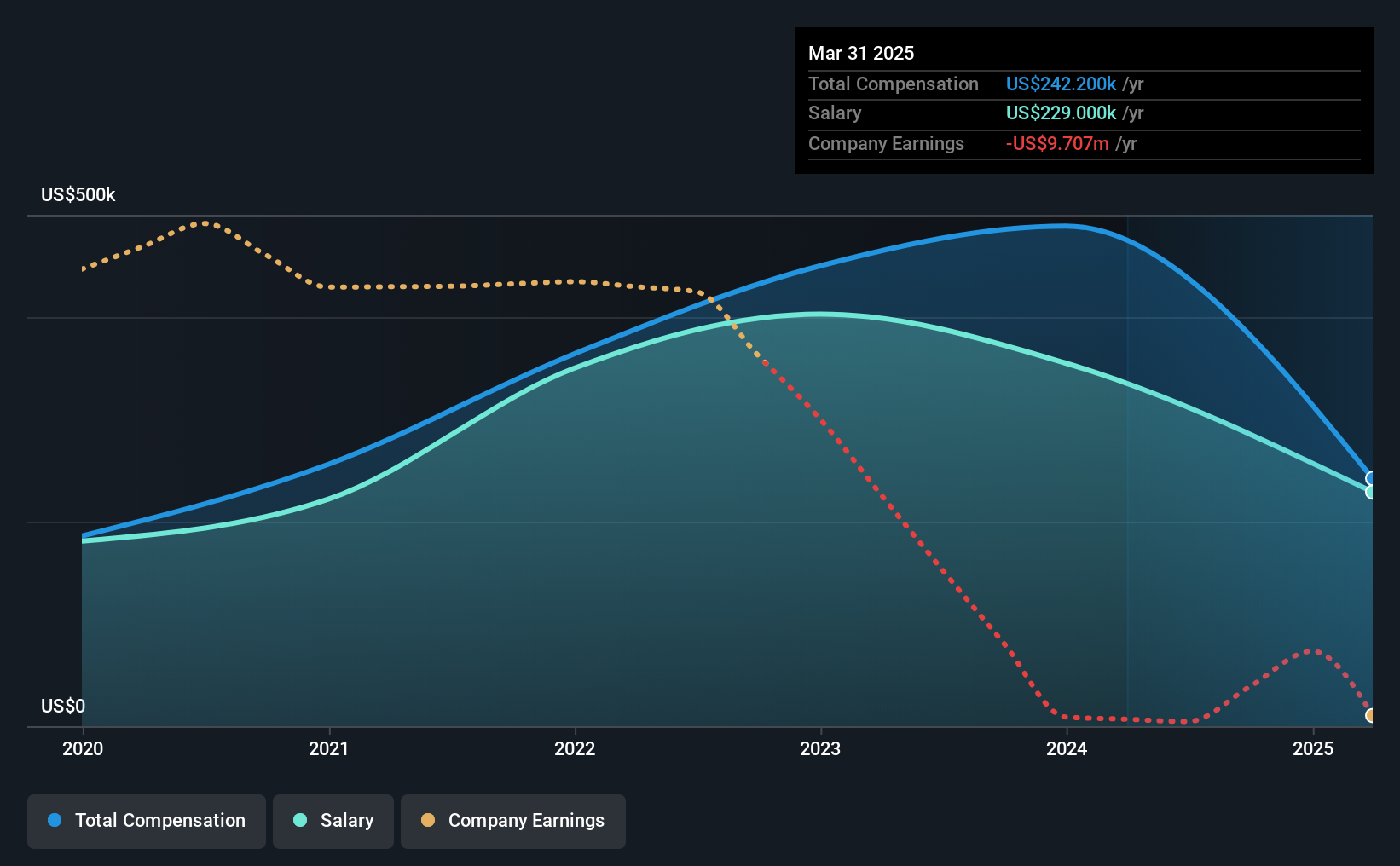

At the time of writing, our data shows that Contel Technology Company Limited has a market capitalization of HK$90m, and reported total annual CEO compensation of US$242k for the year to March 2025. We note that's a decrease of 50% compared to last year. In particular, the salary of US$229.0k, makes up a huge portion of the total compensation being paid to the CEO.

For comparison, other companies in the Hong Kong Electronic industry with market capitalizations below HK$1.6b, reported a median total CEO compensation of US$295k. This suggests that Contel Technology remunerates its CEO largely in line with the industry average. What's more, Keung Lam holds HK$54m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2025 | 2023 | Proportion (2025) |

| Salary | US$229k | US$355k | 95% |

| Other | US$13k | US$134k | 5% |

| Total Compensation | US$242k | US$489k | 100% |

Talking in terms of the industry, salary represented approximately 78% of total compensation out of all the companies we analyzed, while other remuneration made up 22% of the pie. According to our research, Contel Technology has allocated a higher percentage of pay to salary in comparison to the wider industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Contel Technology Company Limited's Growth Numbers

Over the last three years, Contel Technology Company Limited has shrunk its earnings per share by 69% per year. In the last year, its revenue is down 5.5%.

Overall this is not a very positive result for shareholders. And the impression is worse when you consider revenue is down year-on-year. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Contel Technology Company Limited Been A Good Investment?

With a total shareholder return of -30% over three years, Contel Technology Company Limited shareholders would by and large be disappointed. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

Along with the business performing poorly, shareholders have suffered with poor share price returns on their investments, suggesting that there's little to no chance of them being in favor of a CEO pay raise. At the upcoming AGM, management will get a chance to explain how they plan to get the business back on track and address the concerns from investors.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. We did our research and identified 2 warning signs (and 1 which is potentially serious) in Contel Technology we think you should know about.

Switching gears from Contel Technology, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1912

Contel Technology

An investment holding company, operates as a fabless semiconductor application solutions provider in Hong Kong and the People’s Republic of China.

Good value with adequate balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success