- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:1888

I Ran A Stock Scan For Earnings Growth And Kingboard Laminates Holdings (HKG:1888) Passed With Ease

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Kingboard Laminates Holdings (HKG:1888). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

View our latest analysis for Kingboard Laminates Holdings

Kingboard Laminates Holdings's Earnings Per Share Are Growing.

As one of my mentors once told me, share price follows earnings per share (EPS). That means EPS growth is considered a real positive by most successful long-term investors. We can see that in the last three years Kingboard Laminates Holdings grew its EPS by 15% per year. That's a good rate of growth, if it can be sustained.

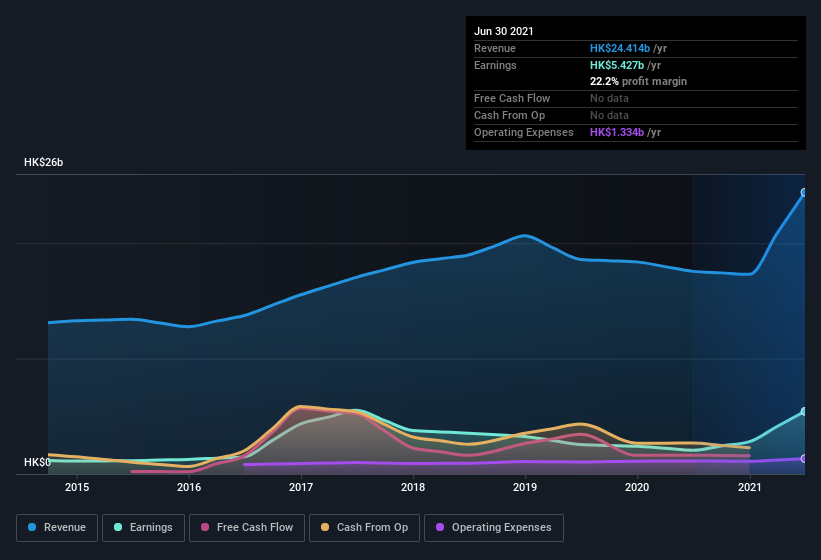

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The good news is that Kingboard Laminates Holdings is growing revenues, and EBIT margins improved by 9.1 percentage points to 26%, over the last year. Ticking those two boxes is a good sign of growth, in my book.

In the chart below, you can see how the company has grown earnings, and revenue, over time. To see the actual numbers, click on the chart.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Kingboard Laminates Holdings's future profits.

Are Kingboard Laminates Holdings Insiders Aligned With All Shareholders?

Since Kingboard Laminates Holdings has a market capitalization of HK$47b, we wouldn't expect insiders to hold a large percentage of shares. But we do take comfort from the fact that they are investors in the company. To be specific, they have HK$292m worth of shares. That's a lot of money, and no small incentive to work hard. Even though that's only about 0.6% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

Should You Add Kingboard Laminates Holdings To Your Watchlist?

One positive for Kingboard Laminates Holdings is that it is growing EPS. That's nice to see. If that's not enough on its own, there is also the rather notable levels of insider ownership. That combination appeals to me, for one. So yes, I do think the stock is worth keeping an eye on. You should always think about risks though. Case in point, we've spotted 1 warning sign for Kingboard Laminates Holdings you should be aware of.

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Kingboard Laminates Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1888

Kingboard Laminates Holdings

An investment holding company, manufactures and sells laminates in the People's Republic of China, Europe, other Asian countries, and the United States.

Excellent balance sheet with reasonable growth potential and pays a dividend.

Market Insights

Community Narratives