- China

- /

- Electronic Equipment and Components

- /

- SZSE:002384

High Growth Tech Stocks in Asia for July 2025

Reviewed by Simply Wall St

As global markets experience significant developments, with the U.S. and China finalizing a trade deal and major indices like the Nasdaq Composite reaching all-time highs, investor sentiment in Asia's tech sector remains buoyant. In such an environment, identifying high-growth tech stocks involves looking for companies that not only capitalize on technological advancements but also demonstrate resilience amid evolving trade dynamics and economic conditions.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 29.78% | 30.32% | ★★★★★★ |

| Shengyi Electronics | 22.99% | 35.16% | ★★★★★★ |

| Fositek | 28.54% | 35.14% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 27.31% | 28.63% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| PharmaResearch | 24.91% | 26.60% | ★★★★★★ |

| Global Security Experts | 20.56% | 28.04% | ★★★★★★ |

| Marketingforce Management | 26.39% | 112.30% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 81.05% | 87.21% | ★★★★★★ |

| JNTC | 55.45% | 94.52% | ★★★★★★ |

Underneath we present a selection of stocks filtered out by our screen.

ABL Bio (KOSDAQ:A298380)

Simply Wall St Growth Rating: ★★★★★☆

Overview: ABL Bio Inc. is a biotech research company specializing in the development of therapeutic drugs for immuno-oncology and neurodegenerative diseases, with a market cap of ₩3.31 trillion.

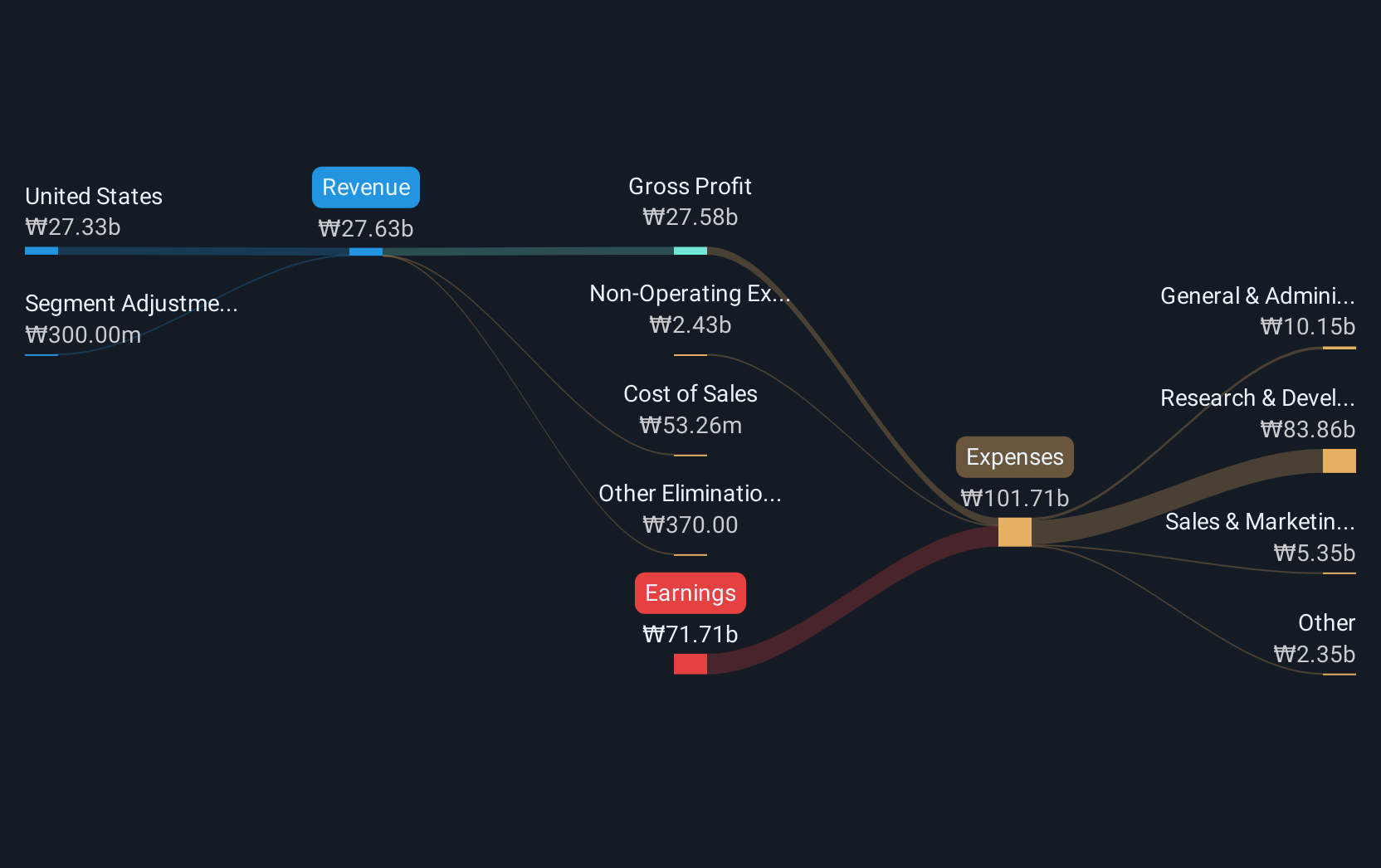

Operations: ABL Bio Inc. generates revenue primarily from its biotechnology segment, specifically focusing on startups, with reported earnings of ₩27.63 billion. The company is engaged in developing therapeutic drugs targeting immuno-oncology and neurodegenerative diseases.

ABL Bio's recent strategic moves, including a significant licensing agreement with GSK to develop treatments for neurodegenerative diseases using its innovative Grabody-B platform, underscore its potential in the high-growth biotech sector. This deal not only brings an immediate financial boost with up to £77.1 million in upfront and near-term payments but also positions ABL Bio at the forefront of overcoming the blood-brain barrier, a major challenge in neurological treatment. Despite being currently unprofitable and facing high share price volatility, ABL Bio's revenue is expected to grow by 23.1% annually, outpacing the South Korean market's 6.9% growth rate. The company's earnings are also projected to surge by 43.36% per year as it moves towards profitability within three years, highlighting its dynamic approach in a competitive industry landscape.

- Click here to discover the nuances of ABL Bio with our detailed analytical health report.

Evaluate ABL Bio's historical performance by accessing our past performance report.

Kingboard Laminates Holdings (SEHK:1888)

Simply Wall St Growth Rating: ★★★★☆☆

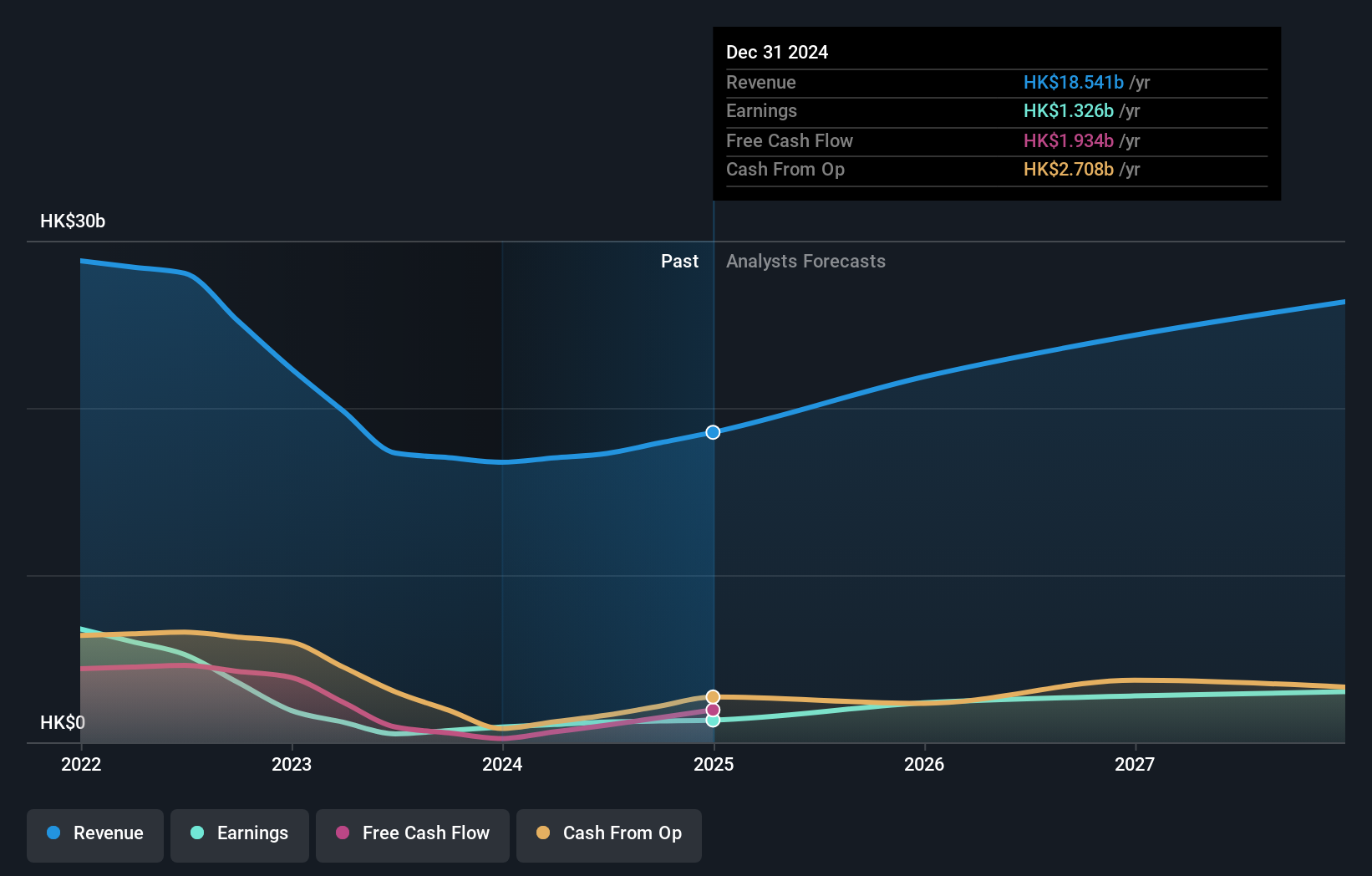

Overview: Kingboard Laminates Holdings Limited is an investment holding company that manufactures and sells laminates across the People's Republic of China, Europe, other Asian countries, and the United States with a market capitalization of HK$30.11 billion.

Operations: Kingboard Laminates Holdings generates most of its revenue from the laminates segment, which accounts for HK$18.30 billion, while its properties and investments segments contribute HK$126.67 million and HK$109.81 million respectively.

Kingboard Laminates Holdings, while not a top-tier high-growth tech firm in Asia, demonstrates robust financial health with a notable 23.2% projected annual earnings growth and an 11.4% revenue increase per year, outpacing the Hong Kong market's average of 8.2%. The company's strategic emphasis on R&D is evident from its substantial investment in innovation, aligning with industry demands for advanced materials used in electronics manufacturing. With earnings growth last year surpassing the electronic industry average by nearly double at 46.1%, Kingboard's focus on enhancing product capabilities could position it advantageously as technological demands evolve.

- Dive into the specifics of Kingboard Laminates Holdings here with our thorough health report.

Learn about Kingboard Laminates Holdings' historical performance.

Suzhou Dongshan Precision Manufacturing (SZSE:002384)

Simply Wall St Growth Rating: ★★★★☆☆

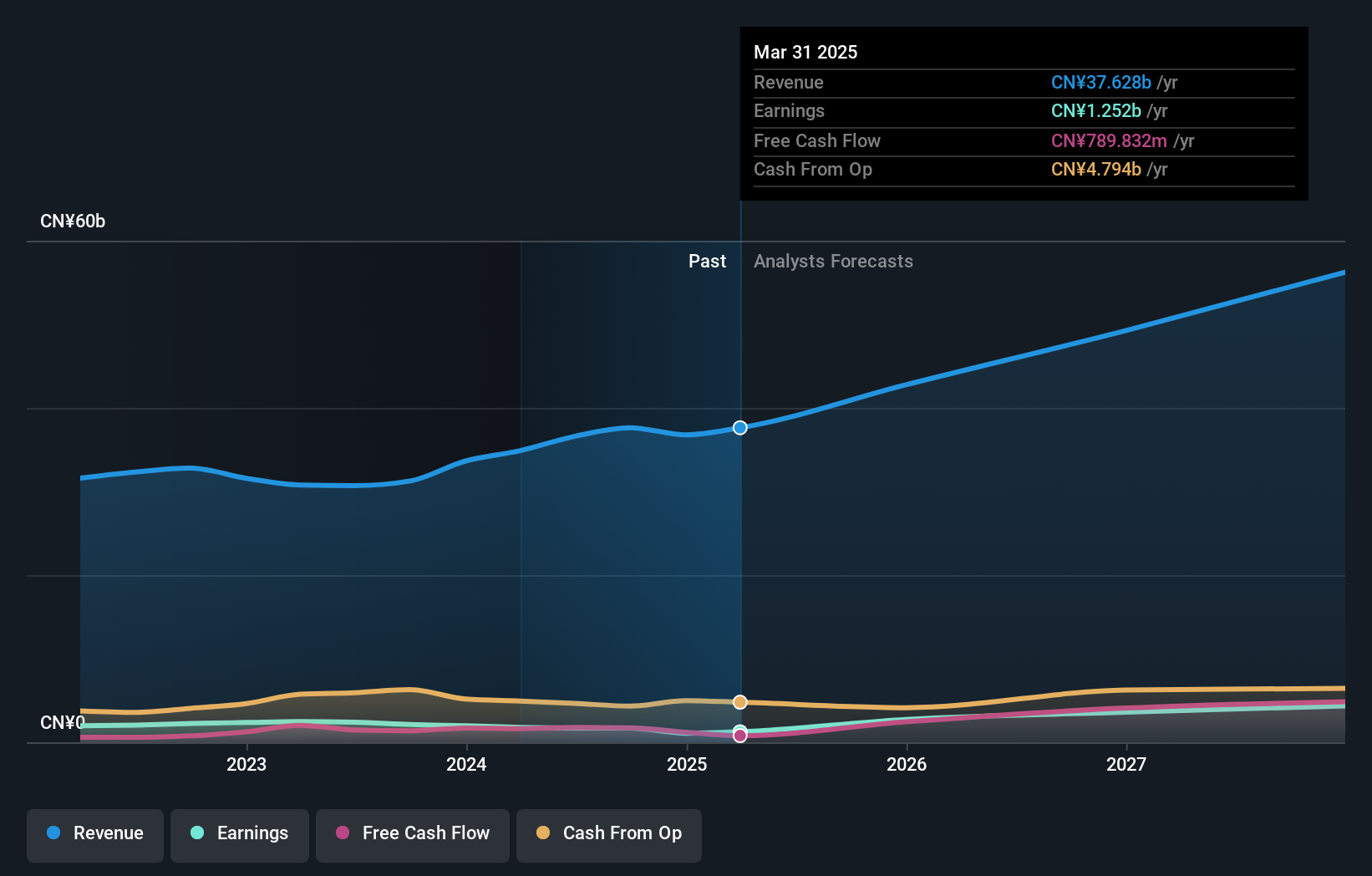

Overview: Suzhou Dongshan Precision Manufacturing Co., Ltd. operates in the precision manufacturing sector, focusing on producing electronic components and products, with a market cap of CN¥72.18 billion.

Operations: Dongshan Precision generates revenue primarily from the production and sale of electronic components. The company focuses on precision manufacturing within this sector, contributing to its substantial market presence.

Suzhou Dongshan Precision Manufacturing has demonstrated a robust trajectory in the tech sector, with a notable revenue increase of 11.1% to CNY 8.6 billion in Q1 2025 from the previous year, and an impressive surge in net income by 57.5% to CNY 455.86 million. This growth is underpinned by strategic share repurchases amounting to CNY 100.08 million, reflecting confidence in its operational capabilities and future prospects despite recent dividend cuts. The company's commitment to innovation is evident as it navigates through competitive markets, positioning itself strongly for sustained growth.

Where To Now?

- Unlock more gems! Our Asian High Growth Tech and AI Stocks screener has unearthed 483 more companies for you to explore.Click here to unveil our expertly curated list of 486 Asian High Growth Tech and AI Stocks.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002384

Suzhou Dongshan Precision Manufacturing

Suzhou Dongshan Precision Manufacturing Co., Ltd.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives