- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:1888

Here's Why We Think Kingboard Laminates Holdings (HKG:1888) Might Deserve Your Attention Today

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Kingboard Laminates Holdings (HKG:1888). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

View our latest analysis for Kingboard Laminates Holdings

Kingboard Laminates Holdings' Earnings Per Share Are Growing

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Impressively, Kingboard Laminates Holdings has grown EPS by 27% per year, compound, in the last three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be beaming.

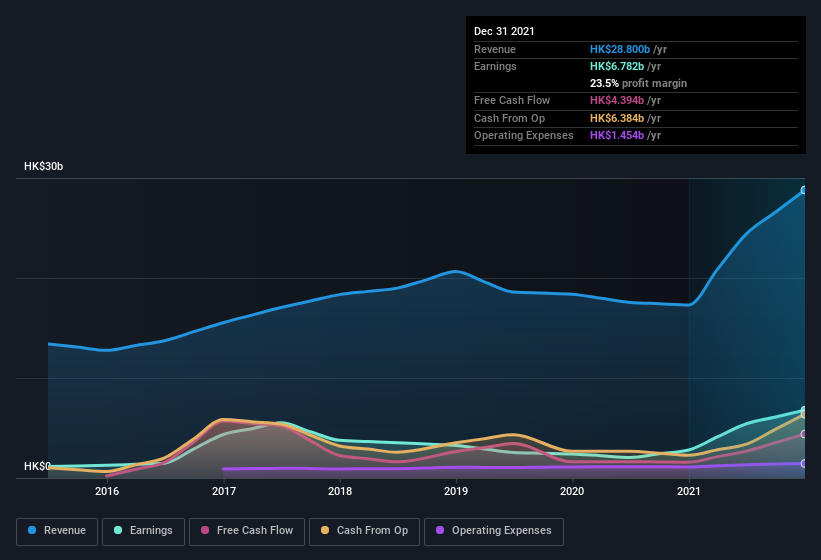

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Kingboard Laminates Holdings shareholders can take confidence from the fact that EBIT margins are up from 21% to 29%, and revenue is growing. That's great to see, on both counts.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Kingboard Laminates Holdings' future profits.

Are Kingboard Laminates Holdings Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Any way you look at it Kingboard Laminates Holdings shareholders can gain quiet confidence from the fact that insiders shelled out HK$3.5m to buy stock, over the last year. And when you consider that there was no insider selling, you can understand why shareholders might believe that there are brighter days ahead. We also note that it was the Executive Director, Ka Ho Cheung, who made the biggest single acquisition, paying HK$2.7m for shares at about HK$12.45 each.

The good news, alongside the insider buying, for Kingboard Laminates Holdings bulls is that insiders (collectively) have a meaningful investment in the stock. To be specific, they have HK$192m worth of shares. That shows significant buy-in, and may indicate conviction in the business strategy. Despite being just 0.6% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Should You Add Kingboard Laminates Holdings To Your Watchlist?

For growth investors, Kingboard Laminates Holdings' raw rate of earnings growth is a beacon in the night. On top of that, insiders own a significant stake in the company and have been buying more shares. So it's fair to say that this stock may well deserve a spot on your watchlist. However, before you get too excited we've discovered 2 warning signs for Kingboard Laminates Holdings that you should be aware of.

Keen growth investors love to see insider buying. Thankfully, Kingboard Laminates Holdings isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Kingboard Laminates Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1888

Kingboard Laminates Holdings

An investment holding company, manufactures and sells laminates in the People's Republic of China, Europe, other Asian countries, and the United States.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives