- Hong Kong

- /

- Tech Hardware

- /

- SEHK:1810

Xiaomi (SEHK:1810) Is Down 11.2% After Doubling Net Income on Strong Q3 Results Has the Bull Case Changed?

Reviewed by Sasha Jovanovic

- Xiaomi Corporation recently reported its third quarter and nine-month earnings for 2025, with quarterly sales reaching CNY 113.12 billion and net income at CNY 12.27 billion, both increasing compared to the previous year.

- Net income more than doubled year-on-year, reflecting significant gains in both sales and earnings per share, highlighting strong operational execution.

- We'll explore how Xiaomi's substantial sales and net income growth add new context to its investment narrative and future growth prospects.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Xiaomi Investment Narrative Recap

Owning Xiaomi stock means believing in the company's ability to expand its AIoT ecosystem, move upmarket in smartphones and appliances, and profitably break into new product segments such as electric vehicles. The latest quarterly results, with net income more than doubling year-on-year, are impressive, but do not erase the short-term risk of margin pressure as competition intensifies and premiumization remains a work in progress in key markets.

One recent announcement closely tied to these results is Xiaomi's new strategic alliance with BASF Coatings, which aims to co-develop innovative automotive paint colors over three years. This development is directly relevant to Xiaomi's ambitions in smart mobility and electric vehicles, aligning with one of the company's major growth catalysts as it seeks to diversify beyond core consumer electronics.

By contrast, investors should be aware that even with strong earnings growth, there is still lingering uncertainty around...

Read the full narrative on Xiaomi (it's free!)

Xiaomi's narrative projects CN¥765.2 billion revenue and CN¥69.6 billion earnings by 2028. This requires 21.3% yearly revenue growth and a CN¥32.4 billion increase in earnings from CN¥37.2 billion today.

Uncover how Xiaomi's forecasts yield a HK$62.94 fair value, a 62% upside to its current price.

Exploring Other Perspectives

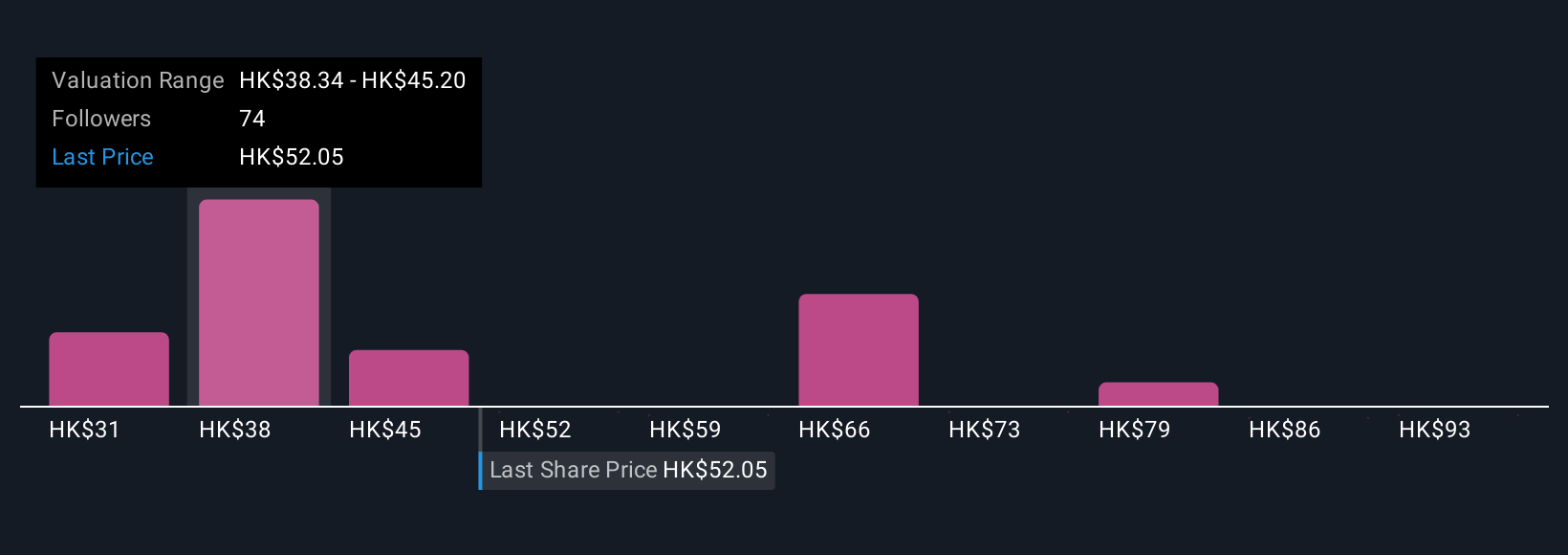

Seventeen Simply Wall St Community members estimate Xiaomi’s fair value from HK$31.49 to HK$80.25, offering a wide set of expectations. This diversity highlights how ongoing price competition remains a top concern among many market participants.

Explore 17 other fair value estimates on Xiaomi - why the stock might be worth over 2x more than the current price!

Build Your Own Xiaomi Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Xiaomi research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Xiaomi research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Xiaomi's overall financial health at a glance.

Interested In Other Possibilities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1810

Xiaomi

An investment holding company, engages in the development and sales of smartphones in Mainland China and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives