- Hong Kong

- /

- Tech Hardware

- /

- SEHK:1810

Xiaomi (SEHK:1810): Evaluating Valuation After Notable Share Price Volatility

Reviewed by Simply Wall St

See our latest analysis for Xiaomi.

After such a sharp rally over the past year, Xiaomi’s recent 1-month share price decline has caught attention, yet the company’s stellar 56.96% total shareholder return over 12 months shows that momentum has not disappeared; it has just shifted pace. While there is clear volatility in the short term, Xiaomi’s longer-term returns and profit growth suggest some investors are still betting on its story.

If you’re looking for the next wave of stand-out tech names, now is a great time to discover See the full list for free..

With Xiaomi’s strong annual gains and recent correction, the question is whether today’s prices reflect lingering value or if the market has already factored in expectations for future growth. Is there still a buying opportunity here?

Most Popular Narrative: 33.2% Undervalued

Xiaomi's consensus fair value sits significantly above the last close, suggesting notable upside from current levels. This perspective is based on robust growth expectations for both the company’s revenue and margins.

"Accelerated R&D investments in core areas like AI, chips, smart EVs, and connected hardware enable differentiated offerings and ecosystem lock-in. This allows Xiaomi to ride the trend of AI-hardware-software convergence. Over time, these capabilities should expand higher-margin services and recurring revenue, boosting earnings resilience."

Curious which bold moves underpin this valuation? One forecast stands out: future growth and profitability expectations that rival some of the industry’s biggest names. Want to see the full analyst playbook and uncover the surprising assumptions driving Xiaomi’s potential? Find out what could really send shares higher.

Result: Fair Value of $64.87 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, stalled smartphone demand or a tougher international landscape could undermine Xiaomi’s growth story and put pressure on long-term margins and profitability.

Find out about the key risks to this Xiaomi narrative.

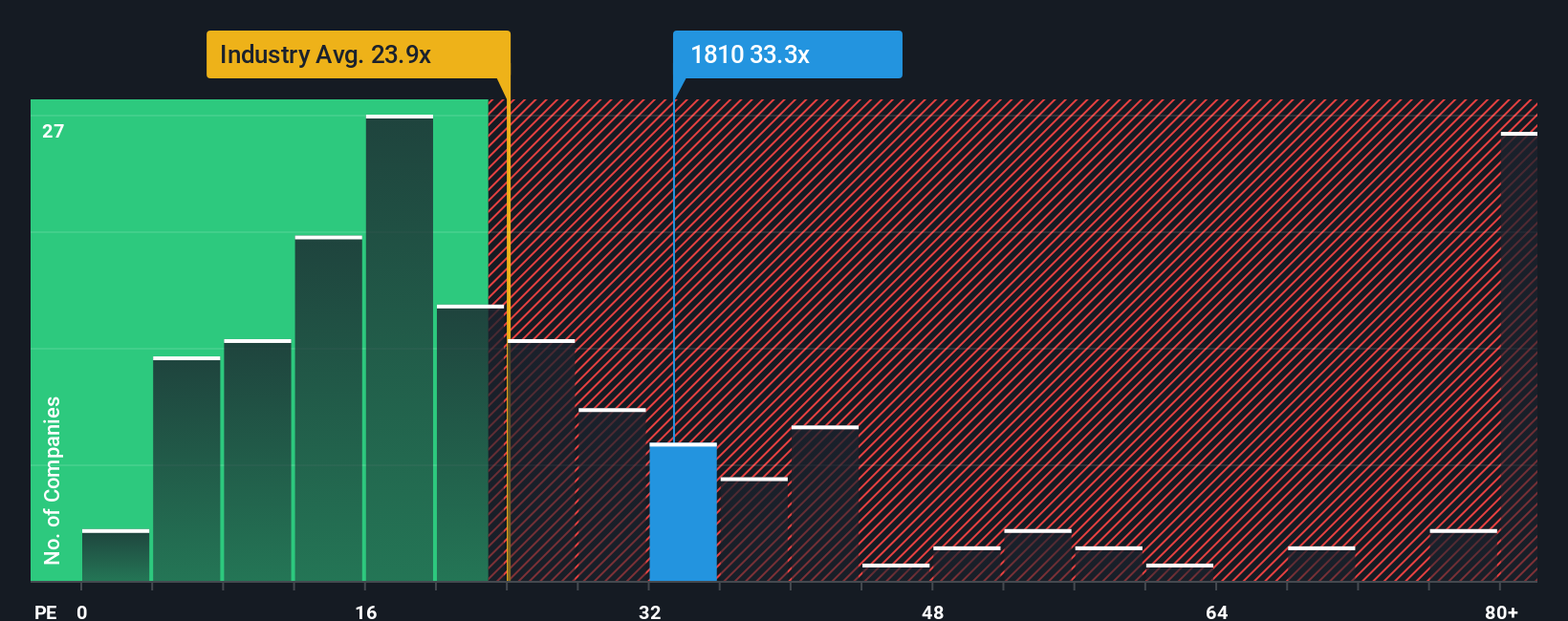

Another View: Multiples Show a Different Story

Looking at valuation through earnings ratios, Xiaomi trades at 27.8 times earnings, making it pricier than both its Asian Tech industry average of 23.3x and its peers’ 19.6x. The fair ratio is 23.9x, which suggests the market could become more cautious if expectations change. Is the recent optimism a bit too much?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Xiaomi Narrative

If you have a different perspective or want to dig into the numbers yourself, shaping your own Xiaomi outlook takes just a few minutes. Go ahead and Do it your way.

A great starting point for your Xiaomi research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never settle for just one opportunity. Give yourself an edge by checking out these top investment themes and make sure you’re ahead of the next big move.

- Uncover high-yield potential and steady income streams by reviewing these 20 dividend stocks with yields > 3%, which boasts yields above the norm for income-focused portfolios.

- Capture powerful growth trends by evaluating these 26 AI penny stocks, leading innovation in artificial intelligence and transforming entire industries.

- Seize undervalued opportunities before the crowd by tapping into these 843 undervalued stocks based on cash flows, based on solid cash flow metrics and expert analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1810

Xiaomi

An investment holding company, engages in the development and sales of smartphones in Mainland China and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives