- Hong Kong

- /

- Tech Hardware

- /

- SEHK:1810

Is Now the Right Time to Consider Xiaomi After Its Electric Vehicle Launch?

Reviewed by Bailey Pemberton

- Ever wondered if Xiaomi is actually undervalued, or if the buzz around its stock is just noise? You are certainly not alone if you are considering whether now is a smart entry point.

- The stock is up 19.7% year-to-date and 39.9% over the past 12 months, though it dipped slightly with a -5.8% move in the last month.

- Much of the recent momentum is linked to Xiaomi's entry into the electric vehicle market and its push into premium tech products, which has caught both consumer and investor attention. News about significant pre-orders for its debut SU7 EV and expanding international smartphone share has added renewed interest, drawing extra eyes to the ticker.

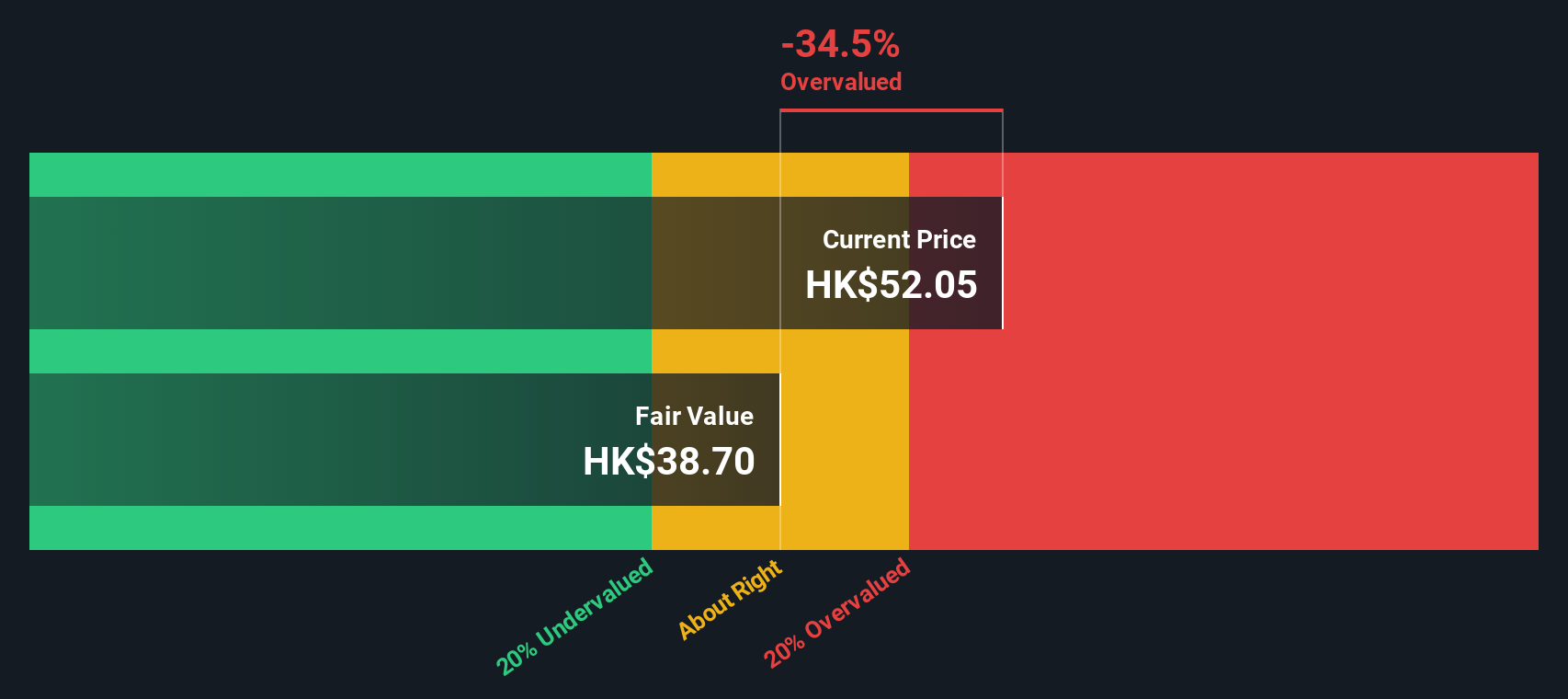

- Currently, Xiaomi has a valuation score of 2 out of 6 based on standard undervaluation checks. We will break down what goes into that number and cover the usual valuation considerations, but keep reading for a more comprehensive way to assess value later in the article.

Xiaomi scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Xiaomi Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to their present value using an appropriate rate. This approach helps investors understand what the company is fundamentally worth based on its likely ability to generate cash in the coming years.

For Xiaomi, the most recent Free Cash Flow (FCF) reported is CN¥43.5 billion. Analyst estimates see this figure growing steadily, with projections that by 2029 Xiaomi's annual FCF could reach as high as CN¥71.6 billion. Since analysts typically only provide five-year forecasts, numbers beyond that are extrapolated based on reasonable growth assumptions.

The model used here produces an estimated intrinsic value for Xiaomi shares of HK$45.71. With the current stock price sitting about 11.0% below this level, the DCF suggests that Xiaomi is trading at an attractive discount and may offer upside if those cash flow projections are realized.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Xiaomi is undervalued by 11.0%. Track this in your watchlist or portfolio, or discover 927 more undervalued stocks based on cash flows.

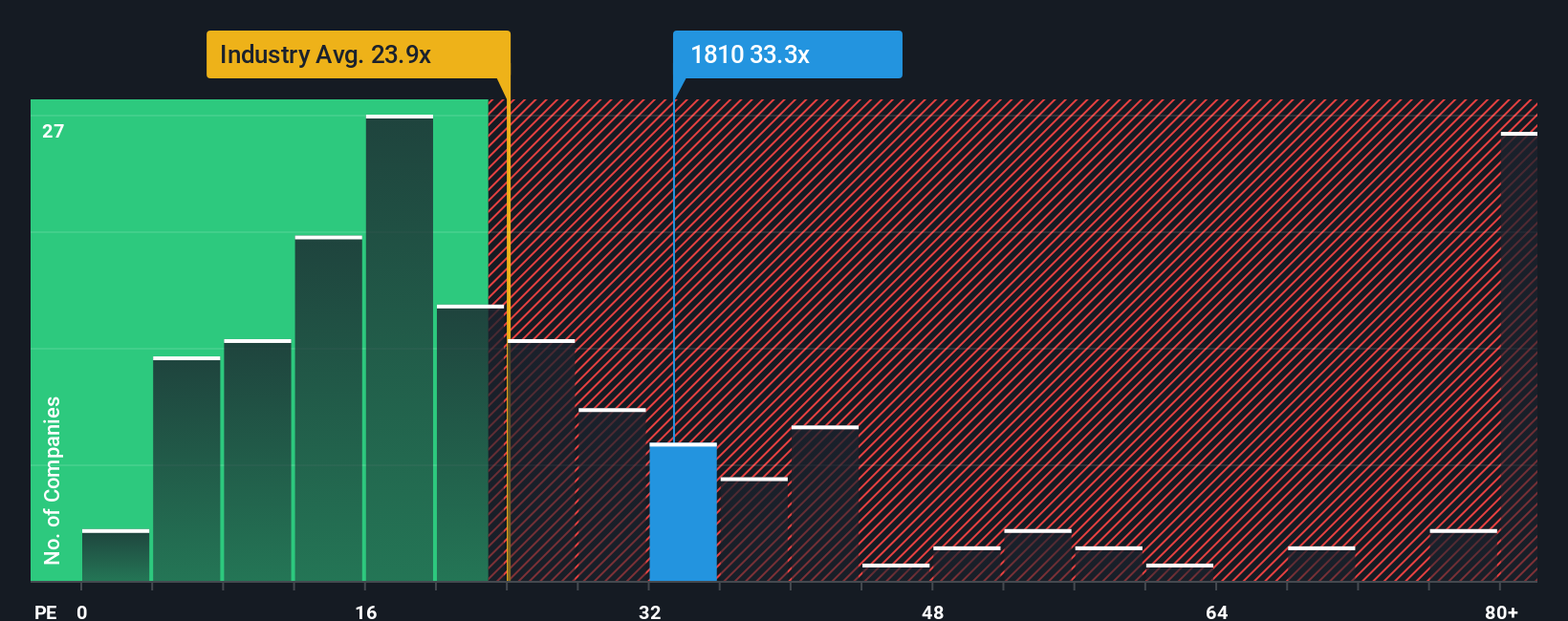

Approach 2: Xiaomi Price vs Earnings

The Price-to-Earnings (PE) ratio is a preferred valuation metric for profitable companies like Xiaomi because it puts the company’s share price in context with its per-share earnings. A higher PE ratio can reflect strong future growth expectations, while a lower PE may point to more modest growth or higher risks.

Growth outlook, risk profile, and market environment all influence what is considered a fair PE ratio for a company. Faster-growing or less risky businesses generally deserve a higher PE. In contrast, companies with uncertain earnings or sector headwinds tend to trade at lower multiples.

Xiaomi currently trades at a PE of 21.8x. This figure is just below the average for the wider tech industry at 22.5x and above its direct peer group, which averages 17.7x. The Simply Wall St “Fair Ratio” for Xiaomi, calculated using unique factors like the company’s earnings growth, industry characteristics, profit margins, market cap, and risk profile, stands at 20.4x.

Unlike simple industry or peer averages, the Fair Ratio gives a clearer representation of what Xiaomi’s PE deserves to be, reflecting both its strengths and risks in the current landscape.

Comparing the Fair Ratio (20.4x) to Xiaomi’s actual PE (21.8x), the difference is within the typical range, suggesting the market valuation is reasonable.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1442 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Xiaomi Narrative

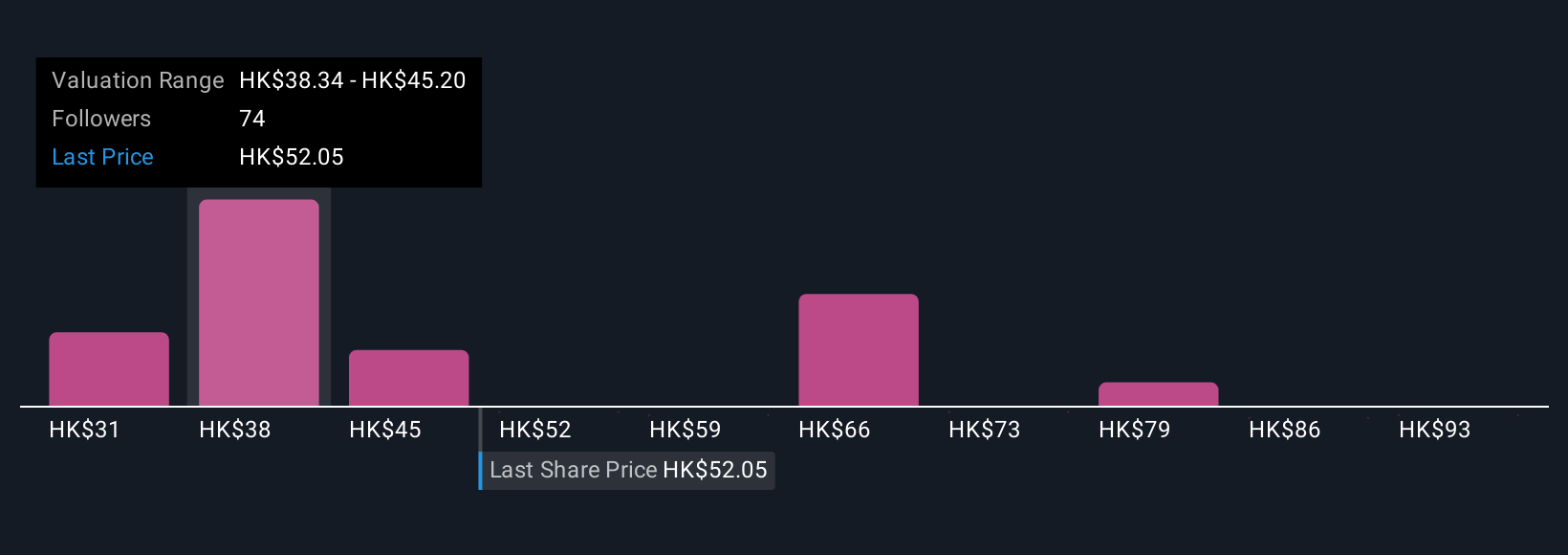

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a way to tie your view of Xiaomi's future, such as where you believe revenue, earnings, or profit margins are heading, directly to a financial forecast and a fair value estimate for the business.

Instead of just relying on historical ratios or analyst consensus, Narratives allow you to tell the story behind the numbers you believe in, clearly laying out your own assumptions about growth, innovation, risks, and pivotal moments for Xiaomi. By connecting the company’s journey to concrete estimates and valuation, you get a personalized, actionable viewpoint that goes beyond simple ratios.

This approach is easy to access and used by millions on Simply Wall St’s Community page. Narratives help you make sharper buy or sell decisions by directly comparing your Fair Value to the current market Price and are updated automatically as new news or earnings reports roll in, so your view always stays relevant.

For example, one Xiaomi Narrative sees the company led by EV success and premium segment growth, forecasting a fair value of HK$80.38. A more cautious Narrative, factoring in global competition and margin pressure, suggests a fair value closer to HK$36.17.

Do you think there's more to the story for Xiaomi? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1810

Xiaomi

An investment holding company, engages in the development and sales of smartphones in Mainland China and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026