- Hong Kong

- /

- Communications

- /

- SEHK:1720

Would Shareholders Who Purchased Putian Communication Group's (HKG:1720) Stock Year Be Happy With The Share price Today?

It is doubtless a positive to see that the Putian Communication Group Limited (HKG:1720) share price has gained some 33% in the last three months. But that isn't much consolation to those who have suffered through the declines of the last year. Specifically, the stock price slipped by 51% in that time. It's not that amazing to see a bounce after a drop like that. You could argue that the sell-off was too severe.

View our latest analysis for Putian Communication Group

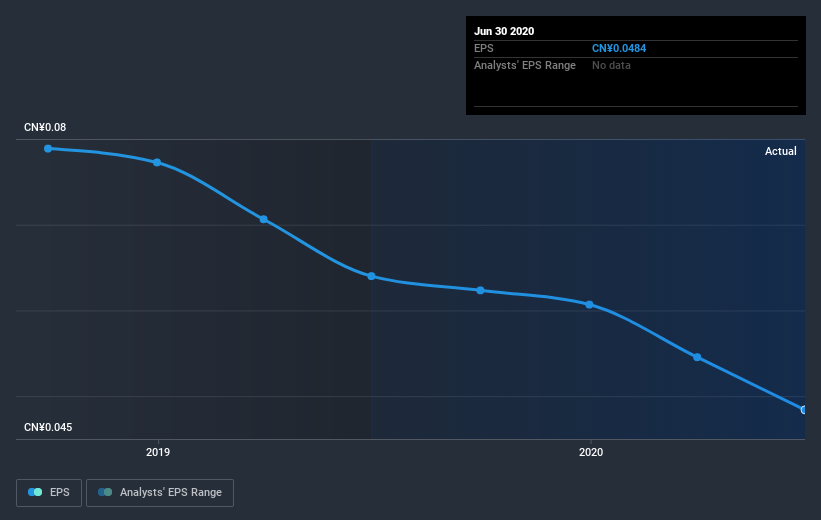

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Unfortunately Putian Communication Group reported an EPS drop of 24% for the last year. The share price decline of 51% is actually more than the EPS drop. This suggests the EPS fall has made some shareholders are more nervous about the business.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

Dive deeper into Putian Communication Group's key metrics by checking this interactive graph of Putian Communication Group's earnings, revenue and cash flow.

A Different Perspective

Putian Communication Group shareholders are down 51% for the year, but the broader market is up 7.6%. Of course the long term matters more than the short term, and even great stocks will sometimes have a poor year. Shareholders have lost 12% per year over the last three years, so the share price drop has become steeper, over the last year; a potential symptom of as yet unsolved challenges. Although Baron Rothschild famously said to "buy when there's blood in the streets, even if the blood is your own", he also focusses on high quality stocks with solid prospects. It's always interesting to track share price performance over the longer term. But to understand Putian Communication Group better, we need to consider many other factors. Case in point: We've spotted 2 warning signs for Putian Communication Group you should be aware of, and 1 of them is a bit concerning.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

When trading Putian Communication Group or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:1720

Putian Communication Group

An investment holding company, produces and sells optical fiber cables, communication copper cables, and structured cabling system products under the Hanphy brand name in the People's Republic of China, Hong Kong, and internationally.

Proven track record with slight risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion