- Hong Kong

- /

- Communications

- /

- SEHK:1720

Putian Communication Group (HKG:1720) Might Be Having Difficulty Using Its Capital Effectively

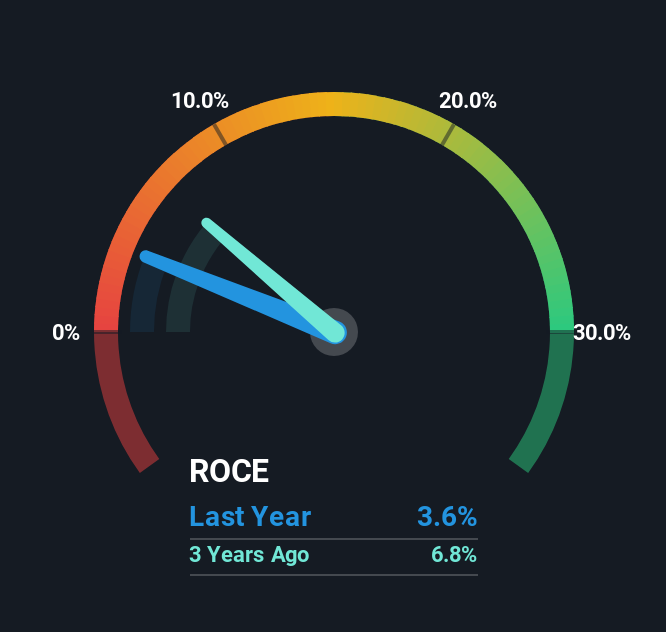

If you're looking for a multi-bagger, there's a few things to keep an eye out for. Firstly, we'll want to see a proven return on capital employed (ROCE) that is increasing, and secondly, an expanding base of capital employed. This shows us that it's a compounding machine, able to continually reinvest its earnings back into the business and generate higher returns. In light of that, when we looked at Putian Communication Group (HKG:1720) and its ROCE trend, we weren't exactly thrilled.

Return On Capital Employed (ROCE): What Is It?

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. To calculate this metric for Putian Communication Group, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.036 = CN¥26m ÷ (CN¥1.2b - CN¥452m) (Based on the trailing twelve months to June 2025).

Therefore, Putian Communication Group has an ROCE of 3.6%. Ultimately, that's a low return and it under-performs the Communications industry average of 6.7%.

See our latest analysis for Putian Communication Group

Historical performance is a great place to start when researching a stock so above you can see the gauge for Putian Communication Group's ROCE against it's prior returns. If you want to delve into the historical earnings , check out these free graphs detailing revenue and cash flow performance of Putian Communication Group.

The Trend Of ROCE

On the surface, the trend of ROCE at Putian Communication Group doesn't inspire confidence. To be more specific, ROCE has fallen from 13% over the last five years. Meanwhile, the business is utilizing more capital but this hasn't moved the needle much in terms of sales in the past 12 months, so this could reflect longer term investments. It's worth keeping an eye on the company's earnings from here on to see if these investments do end up contributing to the bottom line.

The Key Takeaway

In summary, Putian Communication Group is reinvesting funds back into the business for growth but unfortunately it looks like sales haven't increased much just yet. Moreover, since the stock has crumbled 86% over the last five years, it appears investors are expecting the worst. Therefore based on the analysis done in this article, we don't think Putian Communication Group has the makings of a multi-bagger.

One final note, you should learn about the 4 warning signs we've spotted with Putian Communication Group (including 2 which are concerning) .

If you want to search for solid companies with great earnings, check out this free list of companies with good balance sheets and impressive returns on equity.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1720

Putian Communication Group

An investment holding company, produces and sells optical fiber cables, communication copper cables, and structured cabling system products under the Hanphy brand name in the People's Republic of China, Hong Kong, and internationally.

Proven track record with slight risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion