- Hong Kong

- /

- Communications

- /

- SEHK:1613

Need To Know: Synertone Communication Corporation (HKG:1613) Insiders Have Been Selling Shares

It is not uncommon to see companies perform well in the years after insiders buy shares. Unfortunately, there are also plenty of examples of share prices declining precipitously after insiders have sold shares. So shareholders might well want to know whether insiders have been buying or selling shares in Synertone Communication Corporation (HKG:1613).

Do Insider Transactions Matter?

It is perfectly legal for company insiders, including board members, to buy and sell stock in a company. However, rules govern insider transactions, and certain disclosures are required.

We don't think shareholders should simply follow insider transactions. But it is perfectly logical to keep tabs on what insiders are doing. For example, a Columbia University study found that 'insiders are more likely to engage in open market purchases of their own company’s stock when the firm is about to reveal new agreements with customers and suppliers'.

View our latest analysis for Synertone Communication

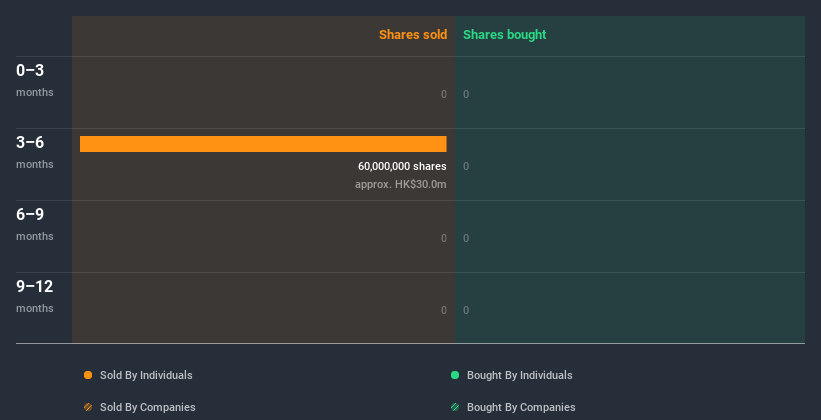

The Last 12 Months Of Insider Transactions At Synertone Communication

The insider, Jian Wang, made the biggest insider sale in the last 12 months. That single transaction was for HK$30m worth of shares at a price of HK$0.50 each. We generally don't like to see insider selling, but the lower the sale price, the more it concerns us. The silver lining is that this sell-down took place above the latest price (HK$0.28). So it is hard to draw any strong conclusion from it. The only individual insider seller over the last year was Jian Wang.

You can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, below. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Insider Ownership of Synertone Communication

Many investors like to check how much of a company is owned by insiders. Usually, the higher the insider ownership, the more likely it is that insiders will be incentivised to build the company for the long term. Synertone Communication insiders own 50% of the company, currently worth about HK$148m based on the recent share price. This kind of significant ownership by insiders does generally increase the chance that the company is run in the interest of all shareholders.

What Might The Insider Transactions At Synertone Communication Tell Us?

The fact that there have been no Synertone Communication insider transactions recently certainly doesn't bother us. While we feel good about high insider ownership of Synertone Communication, we can't say the same about the selling of shares. In addition to knowing about insider transactions going on, it's beneficial to identify the risks facing Synertone Communication. While conducting our analysis, we found that Synertone Communication has 3 warning signs and it would be unwise to ignore them.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

When trading Synertone Communication or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:1613

Synertone Communication

Designs, researches, develops, produces, and sells automation control and intelligent building systems in the People’s Republic of China, Hong Kong, and internationally.

Flawless balance sheet with very low risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion