- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:1611

Slammed 28% Sinohope Technology Holdings Limited (HKG:1611) Screens Well Here But There Might Be A Catch

Sinohope Technology Holdings Limited (HKG:1611) shares have retraced a considerable 28% in the last month, reversing a fair amount of their solid recent performance. The last month has meant the stock is now only up 2.8% during the last year.

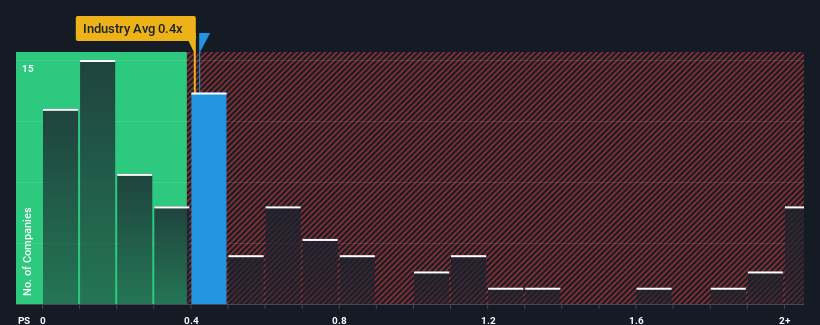

Although its price has dipped substantially, there still wouldn't be many who think Sinohope Technology Holdings' price-to-sales (or "P/S") ratio of 0.4x is worth a mention when it essentially matches the median P/S in Hong Kong's Electronic industry. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Sinohope Technology Holdings

What Does Sinohope Technology Holdings' P/S Mean For Shareholders?

As an illustration, revenue has deteriorated at Sinohope Technology Holdings over the last year, which is not ideal at all. One possibility is that the P/S is moderate because investors think the company might still do enough to be in line with the broader industry in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

Although there are no analyst estimates available for Sinohope Technology Holdings, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The P/S Ratio?

Sinohope Technology Holdings' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 69%. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, despite the drawbacks experienced in the last 12 months. Therefore, it's fair to say the revenue growth recently has been superb for the company, but investors will want to ask why it is now in decline.

Comparing that to the industry, which is only predicted to deliver 17% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

With this information, we find it interesting that Sinohope Technology Holdings is trading at a fairly similar P/S compared to the industry. It may be that most investors are not convinced the company can maintain its recent growth rates.

The Final Word

Sinohope Technology Holdings' plummeting stock price has brought its P/S back to a similar region as the rest of the industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Sinohope Technology Holdings currently trades on a lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. There could be some unobserved threats to revenue preventing the P/S ratio from matching this positive performance. It appears some are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

We don't want to rain on the parade too much, but we did also find 4 warning signs for Sinohope Technology Holdings (3 are concerning!) that you need to be mindful of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1611

Sinohope Technology Holdings

An investment holding company, provides cryptocurrency trading and technology solution services in the People’s Republic of China.

Flawless balance sheet with slight risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026