- Hong Kong

- /

- Medical Equipment

- /

- SEHK:2172

3 SEHK Stocks Estimated To Be Trading At Discounts Of 43.5% To 50%

Reviewed by Simply Wall St

In the midst of global economic uncertainties, including rising oil prices and Middle East tensions, the Hong Kong stock market has shown resilience with a notable surge in its benchmark Hang Seng Index. This environment presents potential opportunities for investors to explore undervalued stocks that may be trading at significant discounts, offering a chance to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Hong Kong

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Giant Biogene Holding (SEHK:2367) | HK$50.60 | HK$97.66 | 48.2% |

| MicroPort NeuroScientific (SEHK:2172) | HK$10.14 | HK$18.97 | 46.5% |

| XD (SEHK:2400) | HK$24.00 | HK$47.62 | 49.6% |

| Semiconductor Manufacturing International (SEHK:981) | HK$27.20 | HK$53.47 | 49.1% |

| Shanghai INT Medical Instruments (SEHK:1501) | HK$31.90 | HK$56.42 | 43.5% |

| COSCO SHIPPING Energy Transportation (SEHK:1138) | HK$9.62 | HK$19.01 | 49.4% |

| Q Technology (Group) (SEHK:1478) | HK$5.50 | HK$11.00 | 50% |

| Nayuki Holdings (SEHK:2150) | HK$1.67 | HK$3.33 | 49.8% |

| Akeso (SEHK:9926) | HK$68.30 | HK$134.80 | 49.3% |

| Digital China Holdings (SEHK:861) | HK$3.15 | HK$5.99 | 47.4% |

Let's take a closer look at a couple of our picks from the screened companies.

Q Technology (Group) (SEHK:1478)

Overview: Q Technology (Group) Company Limited is an investment holding company that designs, develops, manufactures, and sells camera and fingerprint recognition modules in Mainland China, Hong Kong, India, and internationally with a market cap of approximately HK$6.51 billion.

Operations: The company generates revenue primarily from its camera modules segment, which accounts for CN¥13.79 billion, and its fingerprint recognition modules segment, contributing CN¥781.23 million.

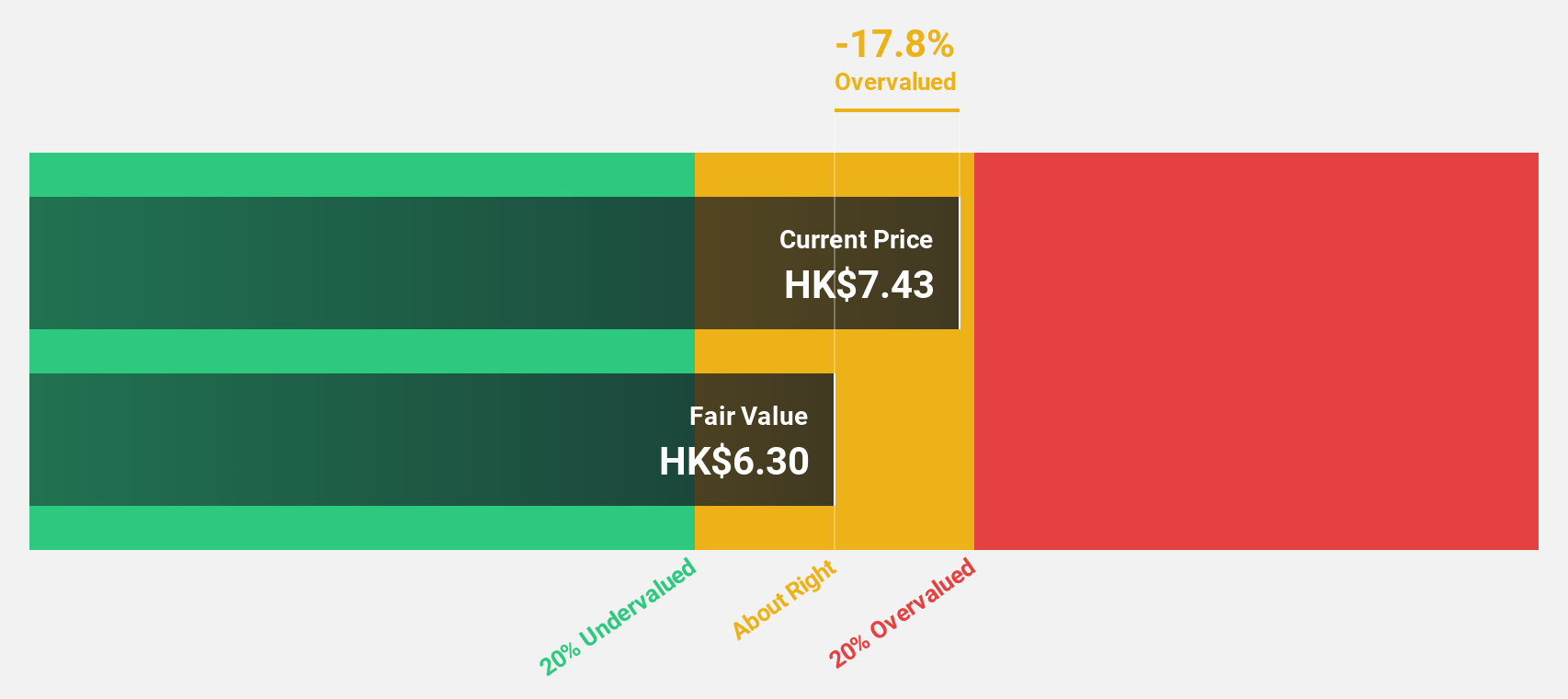

Estimated Discount To Fair Value: 50%

Q Technology (Group) is trading at HK$5.5, significantly below its estimated fair value of HK$11, suggesting it may be undervalued based on cash flows. Earnings have grown by a very large percentage over the past year and are forecast to continue growing at 36% annually, outpacing the Hong Kong market's average growth rate. Recent results show increased sales and net income for the first half of 2024, strengthening its financial position further.

- Our growth report here indicates Q Technology (Group) may be poised for an improving outlook.

- Navigate through the intricacies of Q Technology (Group) with our comprehensive financial health report here.

Shanghai INT Medical Instruments (SEHK:1501)

Overview: Shanghai INT Medical Instruments Co., Ltd. operates in the medical instruments sector and has a market cap of approximately HK$5.61 billion.

Operations: The company's revenue from the Cardiovascular Interventional Business is CN¥718.71 million.

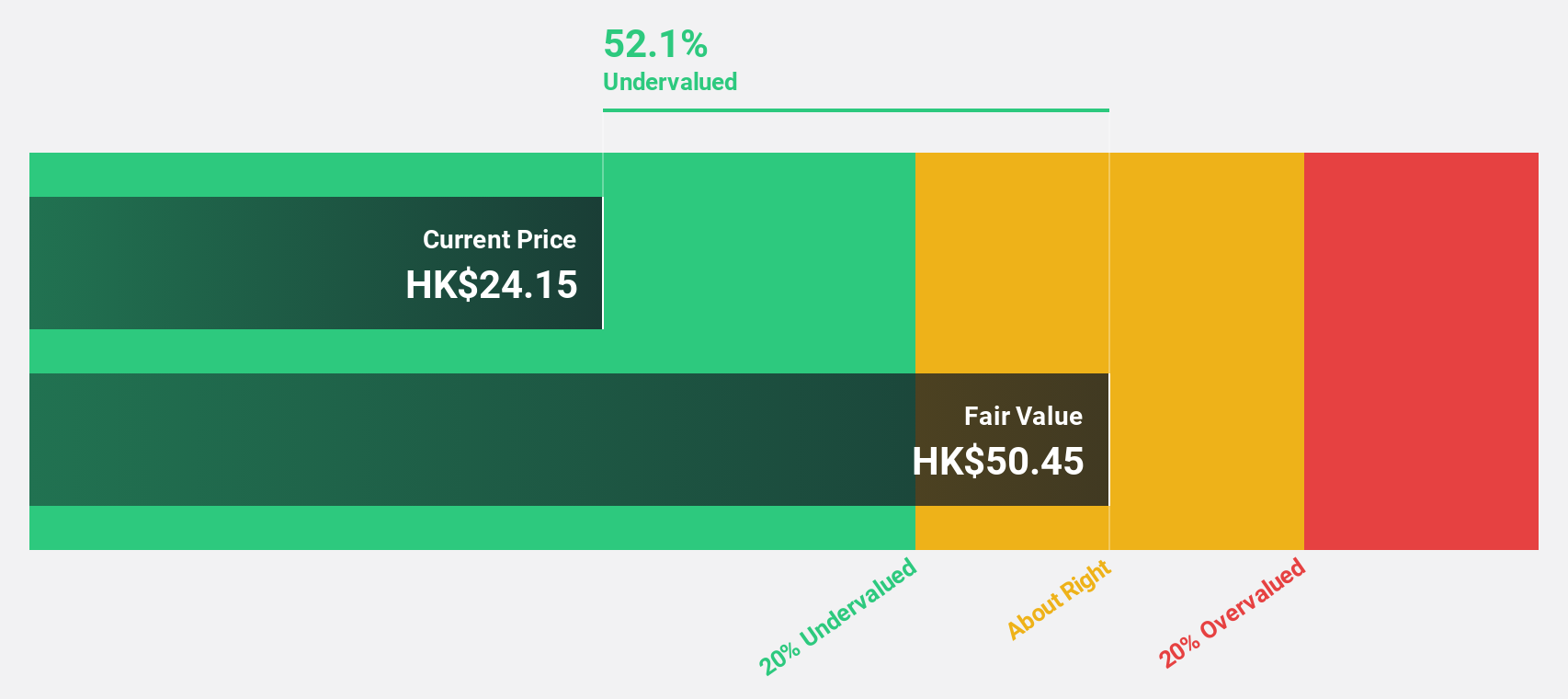

Estimated Discount To Fair Value: 43.5%

Shanghai INT Medical Instruments is currently trading at HK$31.9, substantially below its estimated fair value of HK$56.42, highlighting potential undervaluation based on cash flows. The company's recent earnings report shows sales increased to CNY 392.32 million and net income rose to CNY 100.54 million for the first half of 2024, reinforcing its financial health. Earnings are projected to grow significantly at 27.2% annually, surpassing the broader Hong Kong market's growth rate expectations.

- The growth report we've compiled suggests that Shanghai INT Medical Instruments' future prospects could be on the up.

- Get an in-depth perspective on Shanghai INT Medical Instruments' balance sheet by reading our health report here.

MicroPort NeuroScientific (SEHK:2172)

Overview: MicroPort NeuroScientific Corporation focuses on the research, development, production, and sale of neuro-interventional medical devices in China and internationally, with a market cap of approximately HK$5.92 billion.

Operations: The company generates revenue of CN¥774.66 million from its Surgical & Medical Equipment segment.

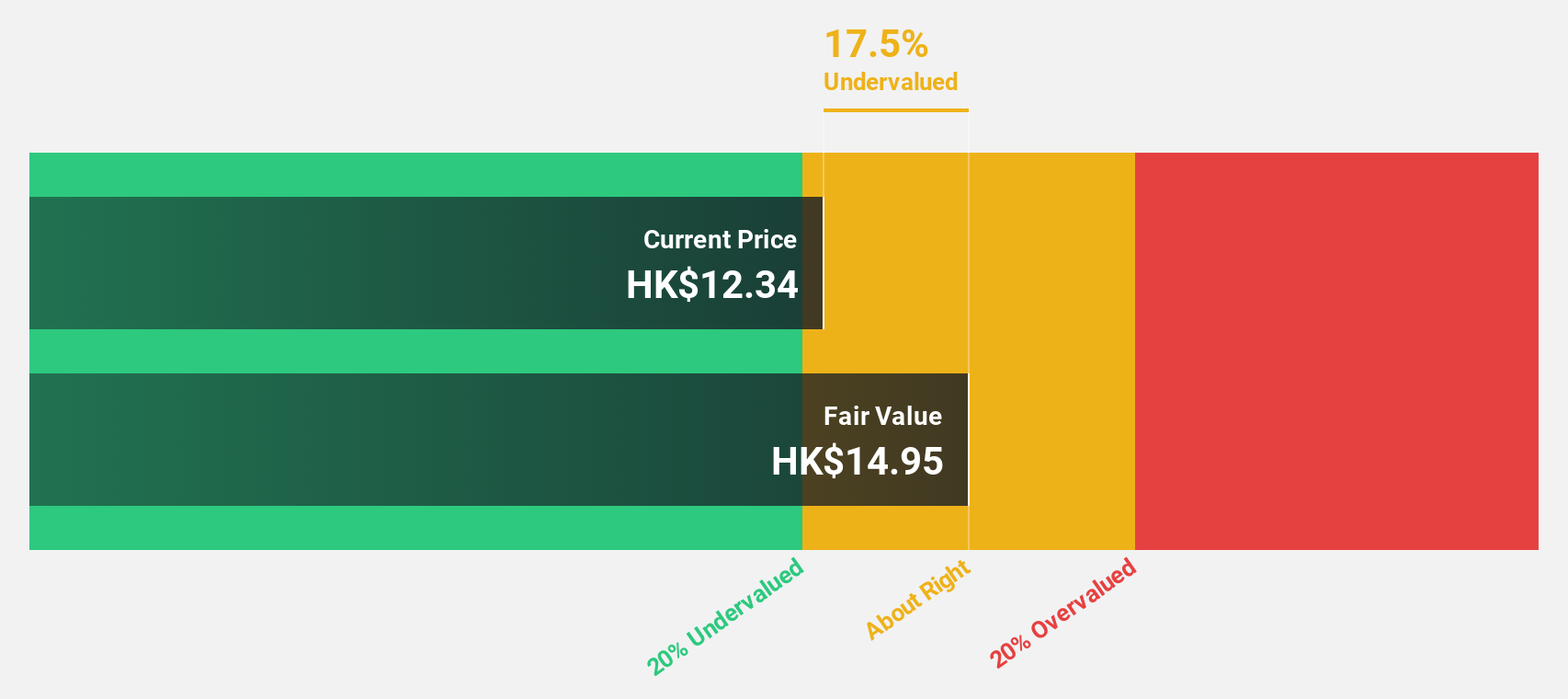

Estimated Discount To Fair Value: 46.5%

MicroPort NeuroScientific is trading at HK$10.14, significantly below its estimated fair value of HK$18.97, suggesting undervaluation based on cash flows. The company's earnings grew by 67.1% over the past year and are forecast to grow 25.3% annually, outpacing the Hong Kong market's growth rate. Recent share repurchase announcements aim to enhance net asset value per share and earnings per share, further strengthening its financial position amidst robust revenue growth projections of 22.1%.

- Our earnings growth report unveils the potential for significant increases in MicroPort NeuroScientific's future results.

- Unlock comprehensive insights into our analysis of MicroPort NeuroScientific stock in this financial health report.

Seize The Opportunity

- Take a closer look at our Undervalued SEHK Stocks Based On Cash Flows list of 39 companies by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2172

MicroPort NeuroScientific

Engages in the research and development, production, and sale of neuro-interventional medical devices in the People’s Republic of China and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives