- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:1415

The Cowell e Holdings Share Price Is Down 47% So Some Shareholders Are Getting Worried

Want to participate in a short research study? Help shape the future of investing tools and receive a $20 prize!

This month, we saw the Cowell e Holdings Inc. (HKG:1415) up an impressive 43%. But in truth the last year hasn't been good for the share price. The cold reality is that the stock has dropped 47% in one year, under-performing the market.

View our latest analysis for Cowell e Holdings

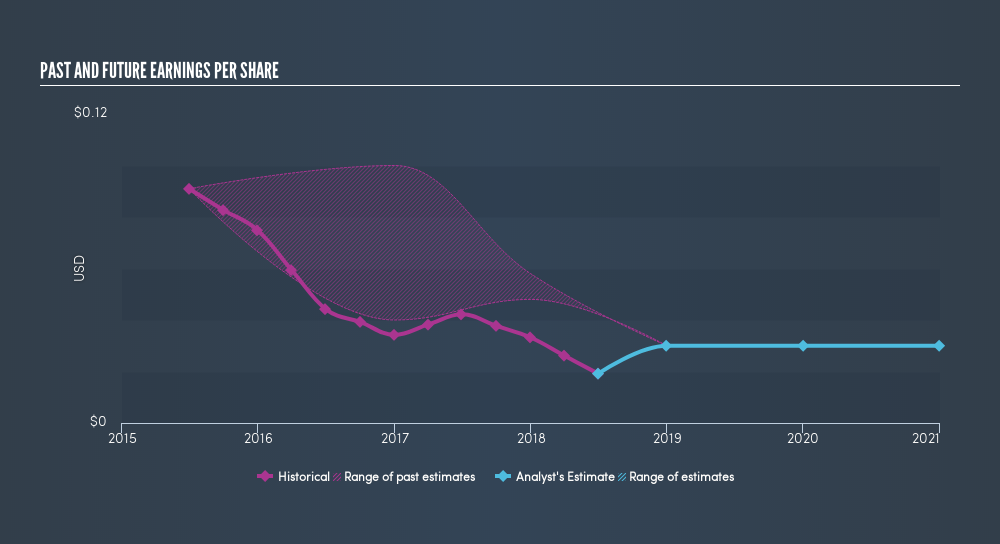

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Unhappily, Cowell e Holdings had to report a 55% decline in EPS over the last year. This proportional reduction in earnings per share isn't far from the 47% decrease in the share price. Therefore one could posit that the market has not become more concerned about the company, despite the lower EPS. Rather, the share price is remains a similar multiple of the EPS, suggesting the outlook remains the same.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

It might be well worthwhile taking a look at our freereport on Cowell e Holdings's earnings, revenue and cash flow.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between Cowell e Holdings's total shareholder return (TSR) and its share price change, which we've covered above. The TSR attempts to capture the value of dividends (as if they were reinvested) and any discounted capital raisings offered to shareholders. Its history of dividend payouts mean that Cowell e Holdings's TSR, which was a 46% drop over the last year, was not as bad as the share price return.

A Different Perspective

The last twelve months weren't great for Cowell e Holdings shares, which performed worse than the market, costing holders 46%. Meanwhile, the broader market slid about 9.0%, likely weighing on the stock. The three-year loss of 17% per year isn't as bad as the last twelve months, suggesting that the company has not been able to convince the market it has solved its problems. Although Warren Buffett famously said he likes to 'buy when there is blood on the streets', he also focusses on high quality stocks with solid prospects. Before deciding if you like the current share price, check how Cowell e Holdings scores on these 3 valuation metrics.

If you are like me, then you will not want to miss this freelist of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About SEHK:1415

Cowell e Holdings

An investment holding company, engages in the design, development, manufacture and sale of modules and system integration products for smartphones, multimedia tablets and other mobile devices.

High growth potential with proven track record.

Market Insights

Community Narratives