- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:1415

Here's Why We Think Cowell e Holdings (HKG:1415) Is Well Worth Watching

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

In contrast to all that, many investors prefer to focus on companies like Cowell e Holdings (HKG:1415), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

See our latest analysis for Cowell e Holdings

How Fast Is Cowell e Holdings Growing?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. That makes EPS growth an attractive quality for any company. Recognition must be given to the that Cowell e Holdings has grown EPS by 50% per year, over the last three years. That sort of growth rarely ever lasts long, but it is well worth paying attention to when it happens.

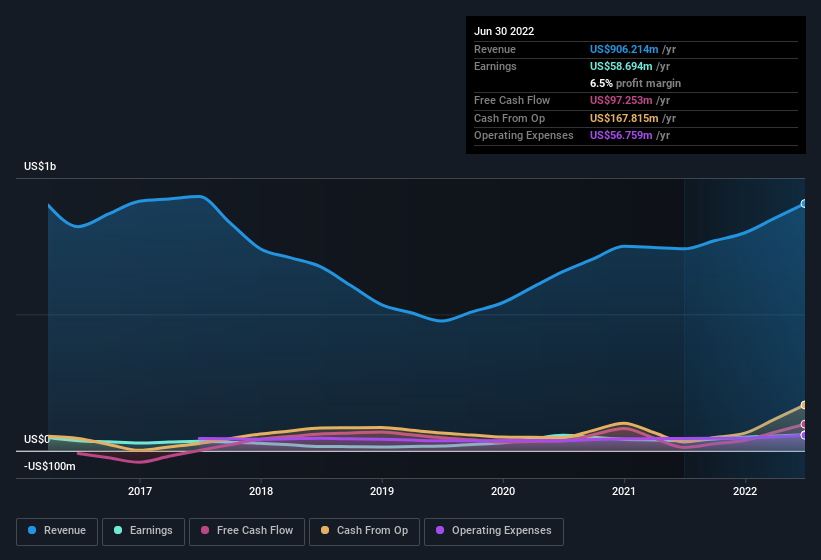

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. EBIT margins for Cowell e Holdings remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 22% to US$906m. That's encouraging news for the company!

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for Cowell e Holdings' future EPS 100% free.

Are Cowell e Holdings Insiders Aligned With All Shareholders?

Prior to investment, it's always a good idea to check that the management team is paid reasonably. Pay levels around or below the median, can be a sign that shareholder interests are well considered. Our analysis has discovered that the median total compensation for the CEOs of companies like Cowell e Holdings with market caps between US$1.0b and US$3.2b is about US$588k.

Cowell e Holdings' CEO only received compensation totalling US$236k in the year to December 2021. You could consider this pay as somewhat symbolic, which suggests the CEO does not need a lot of compensation to stay motivated. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Should You Add Cowell e Holdings To Your Watchlist?

Cowell e Holdings' earnings per share have been soaring, with growth rates sky high. Such fast EPS growth prompts the question: has the business reached an inflection point? Meanwhile, the very reasonable CEO pay is a great reassurance, since it points to an absence of wasteful spending habits. It will definitely require further research to be sure, but it does seem that Cowell e Holdings has the hallmarks of a quality business; and that would make it well worth watching. We don't want to rain on the parade too much, but we did also find 1 warning sign for Cowell e Holdings that you need to be mindful of.

The beauty of investing is that you can invest in almost any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1415

Cowell e Holdings

An investment holding company, engages in the design, development, manufacture and sale of modules and system integration products for smartphones, multimedia tablets and other mobile devices.

Outstanding track record and undervalued.

Market Insights

Community Narratives