- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:3393

Exploring Three High Growth Tech Stocks In Hong Kong

Reviewed by Simply Wall St

As global markets experience varied performances, with Hong Kong's Hang Seng Index recently seeing a notable decline amid waning optimism about Beijing's stimulus measures, investors are increasingly focusing on high-growth tech stocks that might offer potential opportunities in this dynamic environment. In the context of these market conditions, identifying companies with strong innovation capabilities and robust growth strategies can be crucial for navigating the evolving landscape of Hong Kong's tech sector.

Top 10 High Growth Tech Companies In Hong Kong

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Wasion Holdings | 22.37% | 25.47% | ★★★★★☆ |

| MedSci Healthcare Holdings | 48.74% | 48.78% | ★★★★★☆ |

| Inspur Digital Enterprise Technology | 25.31% | 39.04% | ★★★★★☆ |

| RemeGen | 26.30% | 52.19% | ★★★★★☆ |

| Innovent Biologics | 21.80% | 59.60% | ★★★★★☆ |

| Akeso | 33.44% | 53.00% | ★★★★★★ |

| Cowell e Holdings | 31.68% | 35.44% | ★★★★★★ |

| Biocytogen Pharmaceuticals (Beijing) | 21.53% | 109.17% | ★★★★★☆ |

| Beijing Airdoc Technology | 37.47% | 93.35% | ★★★★★☆ |

| Sichuan Kelun-Biotech Biopharmaceutical | 24.70% | 8.53% | ★★★★★☆ |

Click here to see the full list of 43 stocks from our SEHK High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

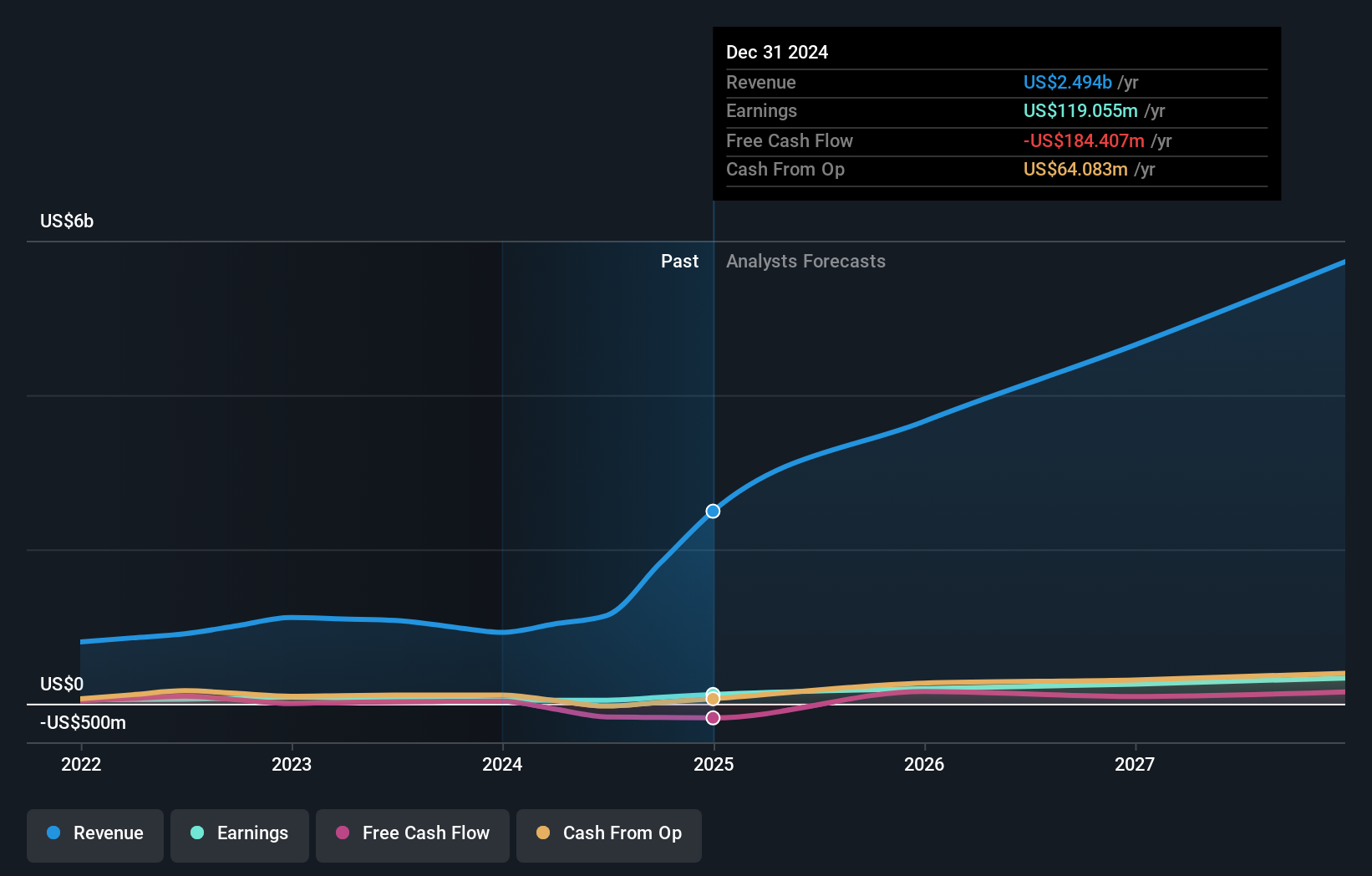

Cowell e Holdings (SEHK:1415)

Simply Wall St Growth Rating: ★★★★★★

Overview: Cowell e Holdings Inc. is an investment holding company that focuses on designing, developing, manufacturing, and selling optical modules and systems integration products for smartphones and other mobile devices across several countries including China, India, and Korea, with a market capitalization of approximately HK$20.22 billion.

Operations: Cowell e Holdings generates revenue primarily from the sale of photographic equipment and supplies, amounting to $1.14 billion. The company's operations span across China, India, and Korea, focusing on optical modules and systems integration products for mobile devices.

Cowell e Holdings, amidst a challenging environment, reported a significant increase in sales to USD 585.93 million from USD 366.73 million year-over-year, although net income slightly decreased to USD 16.04 million from USD 18.03 million. Despite this dip, the company's commitment to innovation is evident with R&D expenses aligning closely with its revenue growth of 31.7% per year, outpacing the Hong Kong market's average of 7.3%. Looking ahead, Cowell e Holdings is poised for robust future earnings growth projected at an impressive rate of 35.4% annually, signaling strong potential in its technological advancements and market positioning.

- Click here and access our complete health analysis report to understand the dynamics of Cowell e Holdings.

Evaluate Cowell e Holdings' historical performance by accessing our past performance report.

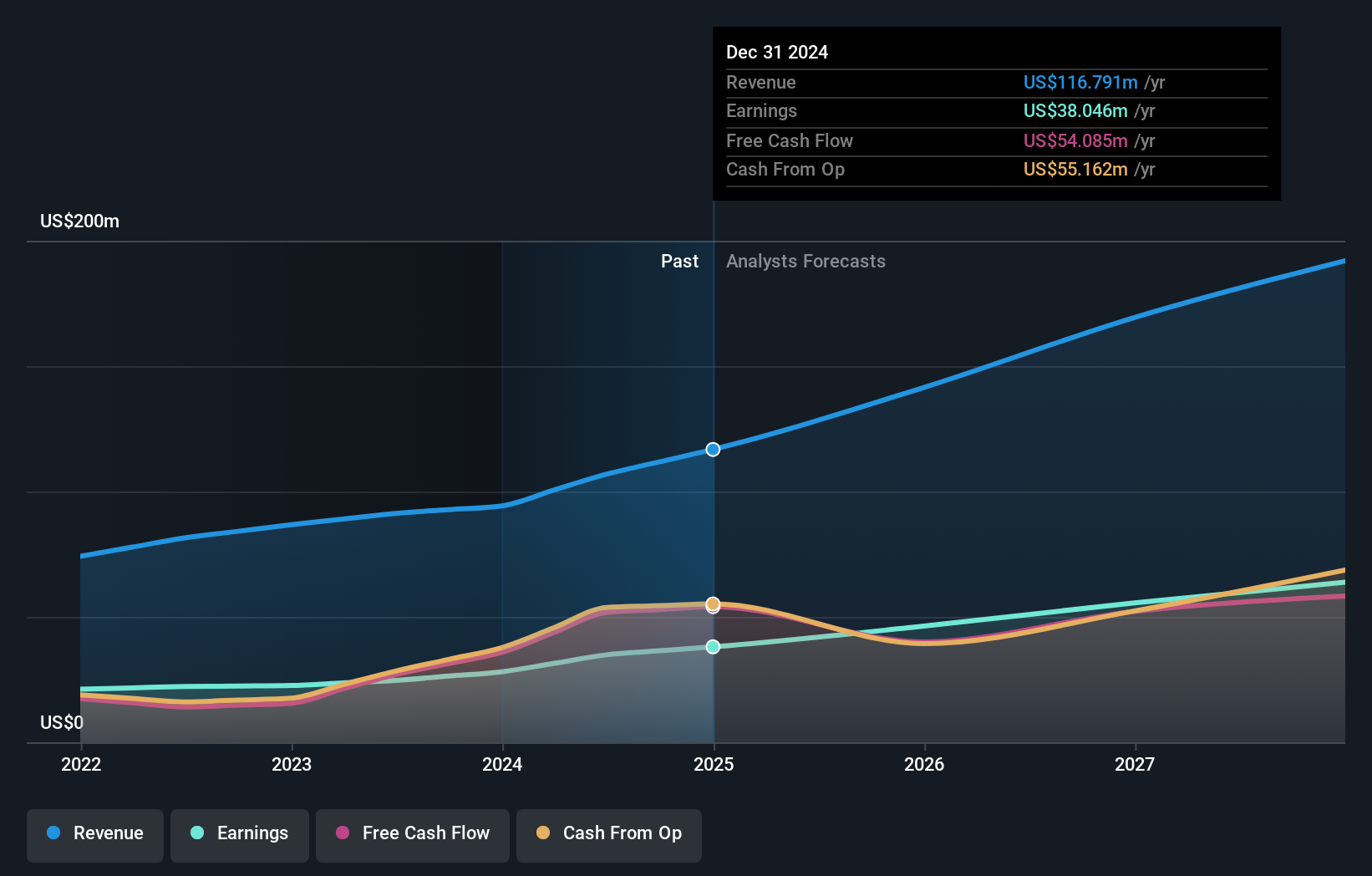

Plover Bay Technologies (SEHK:1523)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Plover Bay Technologies Limited is an investment holding company that designs, develops, and markets software-defined wide area network routers, with a market cap of HK$5.22 billion.

Operations: The company generates revenue primarily from the sales of SD-WAN routers, with mobile-first connectivity contributing $59.87 million and fixed-first connectivity adding $15.19 million. Additionally, it earns from software licenses and warranty and support services, which amount to $31.86 million.

Amidst a robust financial backdrop, Plover Bay Technologies has demonstrated notable growth, with a revenue increase from USD 44.63 million to USD 57.3 million and net income rising sharply by 55% to USD 19.1 million in the first half of 2024. This performance is underscored by an aggressive R&D strategy that aligns closely with its revenue growth rate of 16.9%, significantly outpacing the broader Hong Kong market's average of 7.3%. Additionally, the appointment of Ms. Chiu as an executive Director reflects a strategic enhancement in governance that could bolster the company’s legal and intellectual property prowess, essential for sustaining innovation and competitive advantage in high-growth tech sectors.

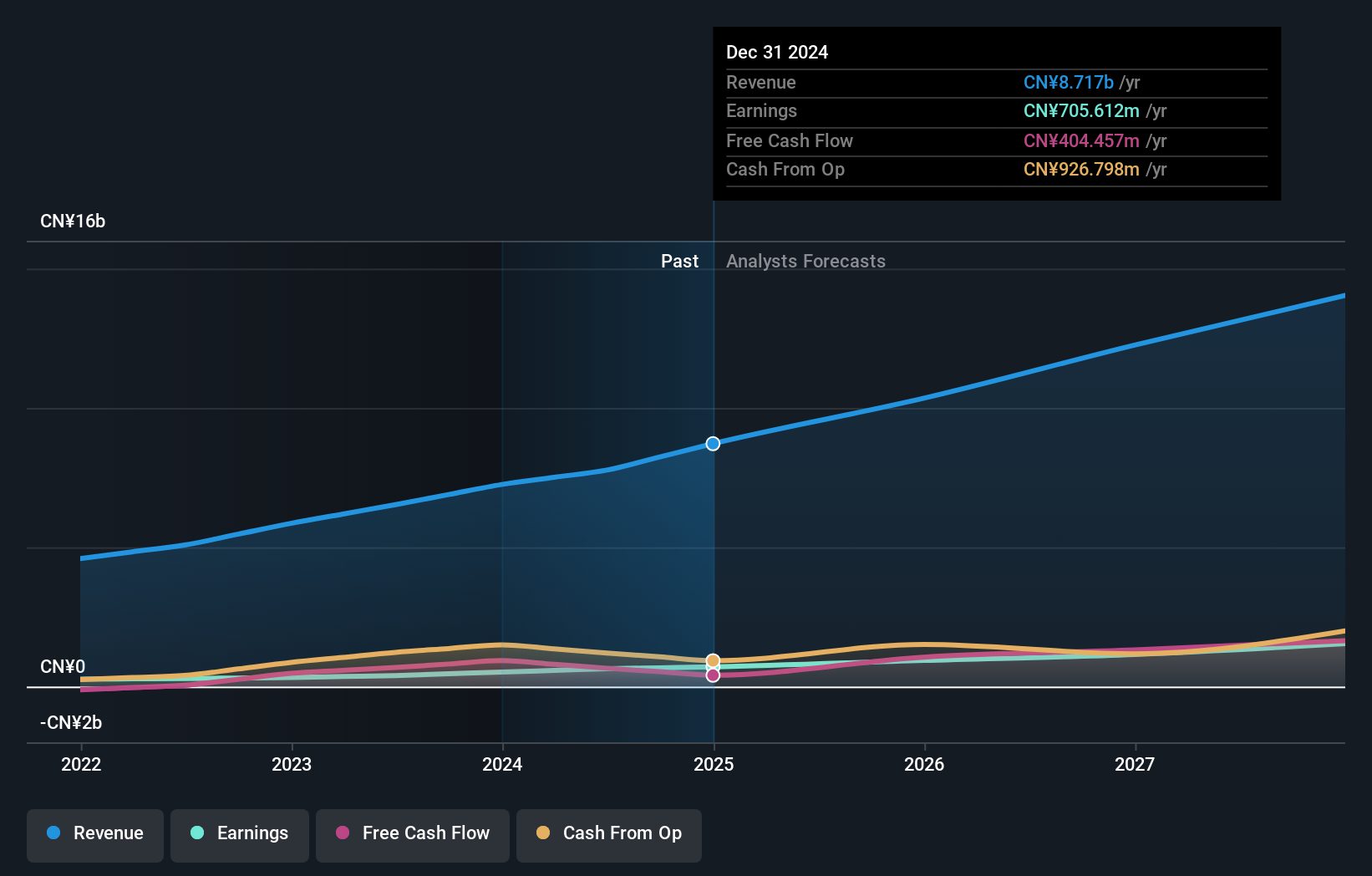

Wasion Holdings (SEHK:3393)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Wasion Holdings Limited is an investment holding company that focuses on the research, development, production, and sale of energy metering and energy efficiency management solutions for energy supply industries across various regions including China, Africa, the United States, Europe, and Asia, with a market capitalization of HK$6.22 billion.

Operations: The company generates revenue primarily through three segments: Power Advanced Metering Infrastructure (CN¥2.99 billion), Communication and Fluid Advanced Metering Infrastructure (CN¥2.42 billion), and Advanced Distribution Operations (CN¥2.51 billion).

Wasion Holdings has demonstrated robust growth with a 22.4% increase in revenue year-on-year, surpassing the Hong Kong market average of 7.3%. This surge is supported by strategic moves like securing substantial contracts in Hungary and Southeast Asia, emphasizing its expanding international footprint and strong client recognition. Furthermore, the company's R&D commitment is evident as it aligns with a projected annual profit growth of 25.5%, indicating a proactive approach to innovation and market adaptation. These factors collectively suggest Wasion's potential to sustain momentum amidst dynamic tech landscapes, although challenges remain in scaling operations globally without compromising profitability.

Summing It All Up

- Delve into our full catalog of 43 SEHK High Growth Tech and AI Stocks here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wasion Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3393

Wasion Holdings

An investment holding company, engages in the research and development, production, and sale of energy metering and energy efficiency management solutions for energy supply industries in the People’s Republic of China, Africa, the United States, Europe, and rest of Asia.

Solid track record with excellent balance sheet and pays a dividend.