- Hong Kong

- /

- Tech Hardware

- /

- SEHK:1401

Risks Still Elevated At These Prices As Sprocomm Intelligence Limited (HKG:1401) Shares Dive 30%

To the annoyance of some shareholders, Sprocomm Intelligence Limited (HKG:1401) shares are down a considerable 30% in the last month, which continues a horrid run for the company. Of course, over the longer-term many would still wish they owned shares as the stock's price has soared 152% in the last twelve months.

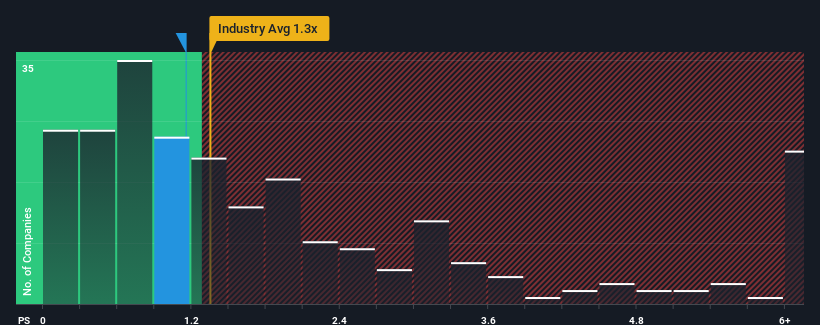

Even after such a large drop in price, when almost half of the companies in Hong Kong's Tech industry have price-to-sales ratios (or "P/S") below 0.4x, you may still consider Sprocomm Intelligence as a stock probably not worth researching with its 1.2x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Sprocomm Intelligence

What Does Sprocomm Intelligence's P/S Mean For Shareholders?

As an illustration, revenue has deteriorated at Sprocomm Intelligence over the last year, which is not ideal at all. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/S from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

Although there are no analyst estimates available for Sprocomm Intelligence, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Sprocomm Intelligence?

The only time you'd be truly comfortable seeing a P/S as high as Sprocomm Intelligence's is when the company's growth is on track to outshine the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 33%. The last three years don't look nice either as the company has shrunk revenue by 53% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

In contrast to the company, the rest of the industry is expected to grow by 16% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

In light of this, it's alarming that Sprocomm Intelligence's P/S sits above the majority of other companies. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

What Does Sprocomm Intelligence's P/S Mean For Investors?

Sprocomm Intelligence's P/S remain high even after its stock plunged. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Sprocomm Intelligence revealed its shrinking revenue over the medium-term isn't resulting in a P/S as low as we expected, given the industry is set to grow. With a revenue decline on investors' minds, the likelihood of a souring sentiment is quite high which could send the P/S back in line with what we'd expect. Unless the the circumstances surrounding the recent medium-term improve, it wouldn't be wrong to expect a a difficult period ahead for the company's shareholders.

Having said that, be aware Sprocomm Intelligence is showing 4 warning signs in our investment analysis, and 3 of those make us uncomfortable.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1401

Future Machine

An investment holding company, engages in the research and development, design, manufacture, and sale of mobile phones, PCBAs for mobile phones, and IoT related products in the People’s Republic of China, India, Algeria, Bangladesh, and internationally.

Mediocre balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives