As global markets show signs of easing trade tensions, U.S. equities have experienced a rebound, bolstered by positive corporate earnings and constructive trade headlines. This environment of cautious optimism provides a backdrop for exploring investment opportunities in smaller or newer companies, often referred to as penny stocks. Despite the term's old-fashioned connotation, these stocks can offer a blend of affordability and growth potential when backed by solid financials.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.42 | SGD170.22M | ✅ 4 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.25 | SGD8.86B | ✅ 5 ⚠️ 0 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.75 | SEK281.19M | ✅ 4 ⚠️ 3 View Analysis > |

| SKP Resources Bhd (KLSE:SKPRES) | MYR0.885 | MYR1.38B | ✅ 5 ⚠️ 2 View Analysis > |

| NEXG Berhad (KLSE:NEXG) | MYR0.37 | MYR1.03B | ✅ 4 ⚠️ 3 View Analysis > |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.505 | MYR2.51B | ✅ 5 ⚠️ 0 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.08 | HK$668.81M | ✅ 4 ⚠️ 2 View Analysis > |

| Warpaint London (AIM:W7L) | £4.05 | £327.19M | ✅ 5 ⚠️ 3 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £3.71 | £419.25M | ✅ 4 ⚠️ 1 View Analysis > |

| QinetiQ Group (LSE:QQ.) | £3.844 | £2.11B | ✅ 5 ⚠️ 1 View Analysis > |

Click here to see the full list of 5,634 stocks from our Global Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Sprocomm Intelligence (SEHK:1401)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Sprocomm Intelligence Limited is an investment holding company involved in the research and development, design, manufacture, and sale of mobile phones across China, India, Algeria, Bangladesh, and other international markets with a market cap of HK$1.65 billion.

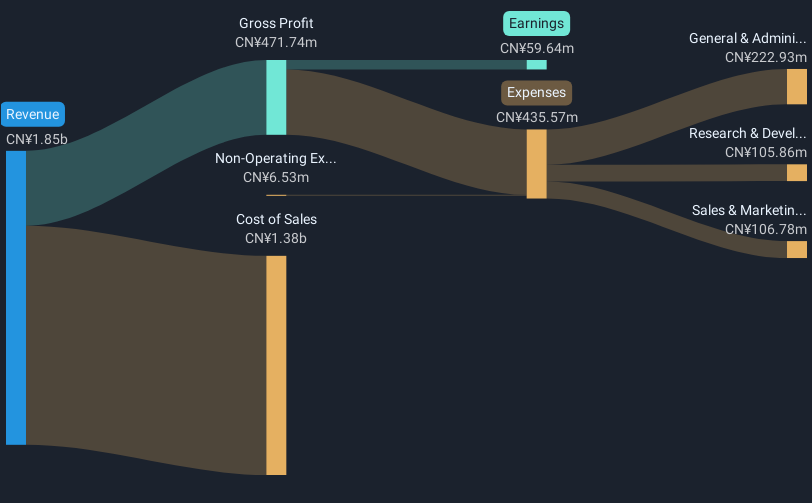

Operations: The company generates revenue primarily from its Wireless Communications Equipment segment, amounting to CN¥2.92 billion.

Market Cap: HK$1.65B

Sprocomm Intelligence's financial performance highlights a mixed outlook. The company's revenue from its Wireless Communications Equipment segment reached CN¥2.92 billion, yet net income declined to CN¥16.34 million from the previous year's CN¥32.37 million, reflecting a strategic decision to lower gross profit margins to secure sales orders. Despite stable weekly volatility and satisfactory debt levels with a net debt-to-equity ratio of 18.6%, the company has experienced negative earnings growth over the past year and low return on equity at 4.3%. Recent board changes include appointing Ms. Wang Huihui as an independent non-executive director, bringing legal expertise in financial regulations and compliance.

- Click here to discover the nuances of Sprocomm Intelligence with our detailed analytical financial health report.

- Understand Sprocomm Intelligence's track record by examining our performance history report.

Giordano International (SEHK:709)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Giordano International Limited is an investment holding company involved in the retail and distribution of fashion apparel and accessories for men, women, and children across Mainland China, Hong Kong, Macau, Taiwan, Southeast Asia and Australia, the Gulf Cooperation Council countries, and globally; it has a market capitalization of approximately HK$2.39 billion.

Operations: The company's revenue is primarily derived from Southeast Asia and Australia (HK$1.51 billion), Mainland China (HK$661 million), the Gulf Cooperation Council (HK$697 million), Taiwan (HK$427 million), Hong Kong and Macau (HK$366 million), and wholesale to overseas franchisees (HK$260 million).

Market Cap: HK$2.39B

Giordano International's recent performance presents a complex picture for investors. With a market capitalization of HK$2.39 billion, the company reported sales of HK$3.92 billion for 2024, but net income fell to HK$216 million from HK$345 million the previous year. While trading at 71.8% below its estimated fair value suggests potential undervaluation, negative earnings growth and reduced profit margins are concerns. The dividend yield of 8.11% is not well covered by earnings, though debt levels are manageable with more cash than total debt and short-term assets covering liabilities comfortably. Management and board inexperience may impact strategic direction.

- Jump into the full analysis health report here for a deeper understanding of Giordano International.

- Understand Giordano International's earnings outlook by examining our growth report.

Zhuzhou Tianqiao Crane (SZSE:002523)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zhuzhou Tianqiao Crane Co., Ltd. specializes in the manufacturing and sale of material handling equipment for industries such as electrolytic aluminum, steel, construction machinery, and non-ferrous sectors both in China and internationally, with a market cap of CN¥4.82 billion.

Operations: Zhuzhou Tianqiao Crane Co., Ltd. does not report specific revenue segments.

Market Cap: CN¥4.82B

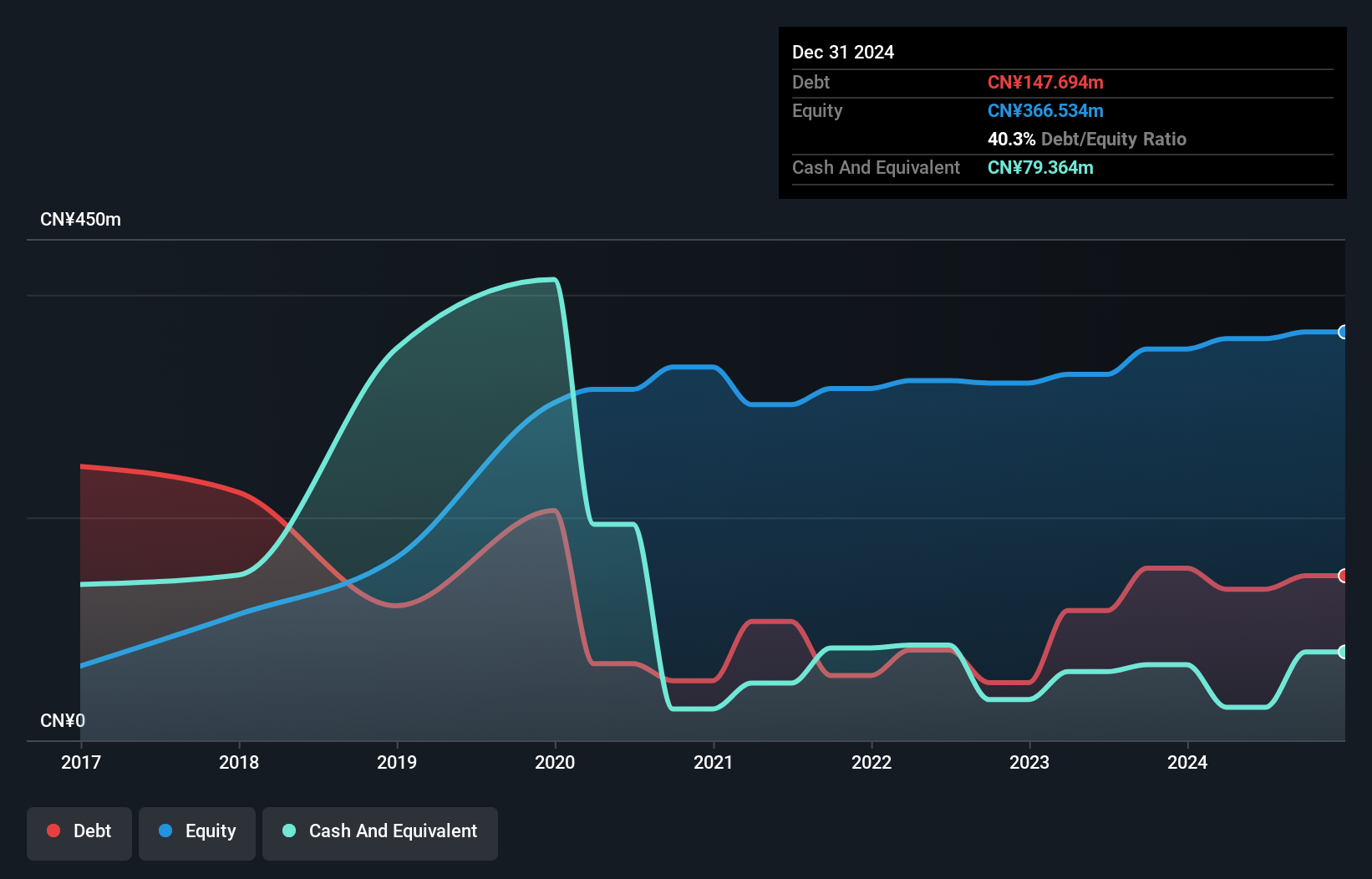

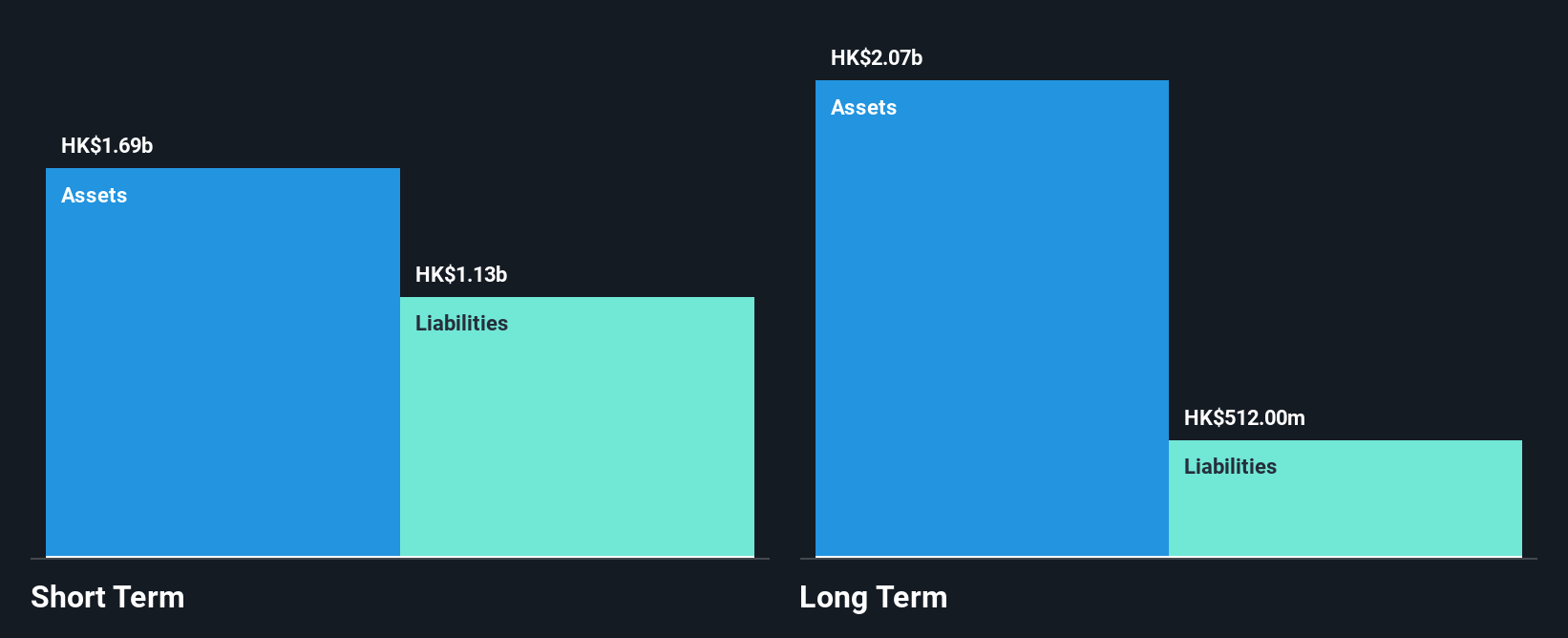

Zhuzhou Tianqiao Crane Co., Ltd. shows mixed signals for penny stock investors. Despite a market cap of CN¥4.82 billion, its Return on Equity remains low at 1.6%. The company demonstrates financial stability with short-term assets covering both short and long-term liabilities, and it has more cash than total debt, indicating sound debt management. Earnings have surged by 87.9% over the past year, outpacing industry growth; however, this includes a significant one-off loss of CN¥36.1 million impacting recent results. Recent Q1 earnings reveal improved net income to CN¥22.81 million from CN¥5.01 million year-on-year, suggesting potential recovery momentum despite board inexperience concerns.

- Get an in-depth perspective on Zhuzhou Tianqiao Crane's performance by reading our balance sheet health report here.

- Evaluate Zhuzhou Tianqiao Crane's historical performance by accessing our past performance report.

Key Takeaways

- Embark on your investment journey to our 5,634 Global Penny Stocks selection here.

- Looking For Alternative Opportunities? We've found 23 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhuzhou Tianqiao Crane might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002523

Zhuzhou Tianqiao Crane

Manufactures and sells material handling equipment for electrolytic aluminum, steel, construction machinery, and non-ferrous industries in China and internationally.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives