Discovering Undiscovered Gems in Hong Kong This October 2024

Reviewed by Simply Wall St

As global markets experience varied movements, with Hong Kong's Hang Seng Index recently seeing a decline amid broader economic shifts, investors are increasingly looking towards small-cap stocks for potential opportunities. In this dynamic environment, identifying promising stocks involves assessing factors such as growth potential and resilience to market fluctuations, which can reveal hidden gems in the Hong Kong market.

Top 10 Undiscovered Gems With Strong Fundamentals In Hong Kong

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Lion Rock Group | 16.91% | 14.33% | 10.15% | ★★★★★★ |

| E-Commodities Holdings | 21.33% | 9.04% | 28.46% | ★★★★★★ |

| Changjiu Holdings | NA | 11.84% | 2.46% | ★★★★★★ |

| Sundart Holdings | 0.92% | -2.32% | -3.94% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Xin Point Holdings | 1.77% | 10.88% | 22.83% | ★★★★★☆ |

| S.A.S. Dragon Holdings | 60.96% | 4.62% | 10.02% | ★★★★★☆ |

| Billion Industrial Holdings | 3.63% | 18.00% | -11.38% | ★★★★★☆ |

| Chongqing Machinery & Electric | 27.77% | 8.82% | 11.12% | ★★★★☆☆ |

| Time Interconnect Technology | 151.14% | 24.74% | 19.78% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Kinetic Development Group (SEHK:1277)

Simply Wall St Value Rating: ★★★★★☆

Overview: Kinetic Development Group Limited is an investment holding company focused on the extraction and sale of coal products in the People’s Republic of China, with a market capitalization of HK$14.33 billion.

Operations: Kinetic Development Group generates revenue primarily from the extraction and sale of coal products in China. The company's financial performance is influenced by fluctuations in coal prices and production costs, impacting its net profit margin.

Kinetic Development Group has shown impressive growth, with earnings surging 39% over the past year, outpacing the Oil and Gas industry. Trading at 55% below its estimated fair value, it seems to offer good value for investors. The company's net debt to equity ratio stands at a satisfactory 4.7%, indicating prudent financial management. Recent results highlight strong performance, with sales reaching CNY 2.53 billion and net income climbing to CNY 1.1 billion for the first half of 2024. Additionally, Kinetic declared both interim and special dividends of HKD 0.04 per share each in August 2024, reflecting robust cash flow generation capabilities.

Sprocomm Intelligence (SEHK:1401)

Simply Wall St Value Rating: ★★★★★☆

Overview: Sprocomm Intelligence Limited is an investment holding company involved in the research and development, design, manufacture, and sale of mobile phones across China, India, Algeria, Bangladesh, and other international markets with a market capitalization of HK$7.27 billion.

Operations: Sprocomm Intelligence generates revenue primarily from the sale of wireless communications equipment, amounting to CN¥3.27 billion.

Sprocomm Intelligence, a smaller player in the tech sector, has shown impressive earnings growth of 301% over the past year, outpacing the industry average. Despite this surge, its earnings have decreased by 5.5% annually over five years. The company is trading significantly below its estimated fair value and maintains a satisfactory net debt to equity ratio of 29%. However, interest payments are not well covered by EBIT at just 1.8 times coverage. Recent transactions saw a combined 33% stake change hands for HK$200 million in September 2024, indicating active market interest.

- Get an in-depth perspective on Sprocomm Intelligence's performance by reading our health report here.

Explore historical data to track Sprocomm Intelligence's performance over time in our Past section.

YiChang HEC ChangJiang Pharmaceutical (SEHK:1558)

Simply Wall St Value Rating: ★★★★★★

Overview: YiChang HEC ChangJiang Pharmaceutical Co., Ltd. is a company engaged in the development, manufacturing, and sale of pharmaceutical products with a market cap of approximately HK$7.93 billion.

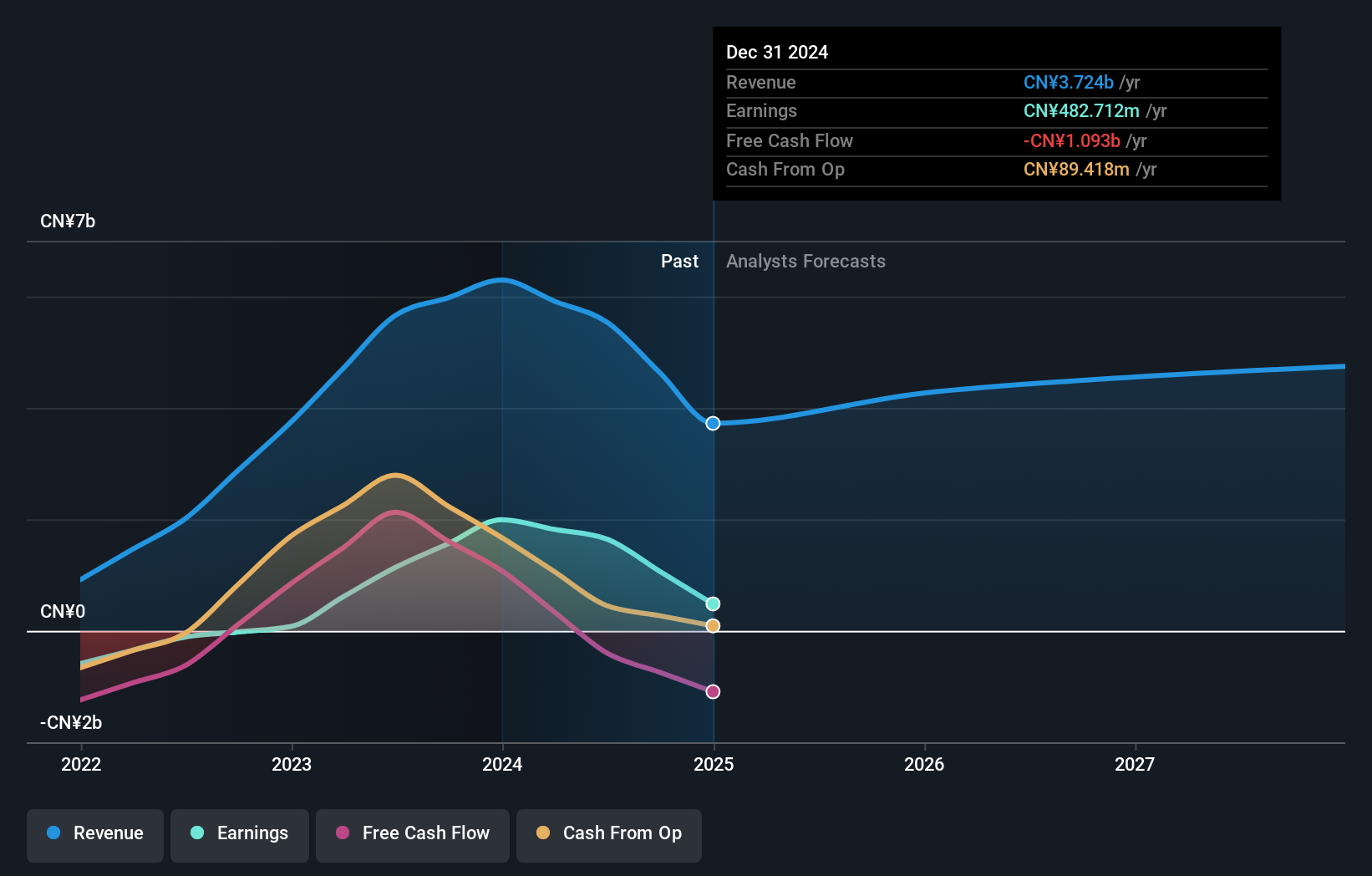

Operations: YiChang HEC ChangJiang generates revenue primarily from the sales of pharmaceutical products, amounting to CN¥5.54 billion.

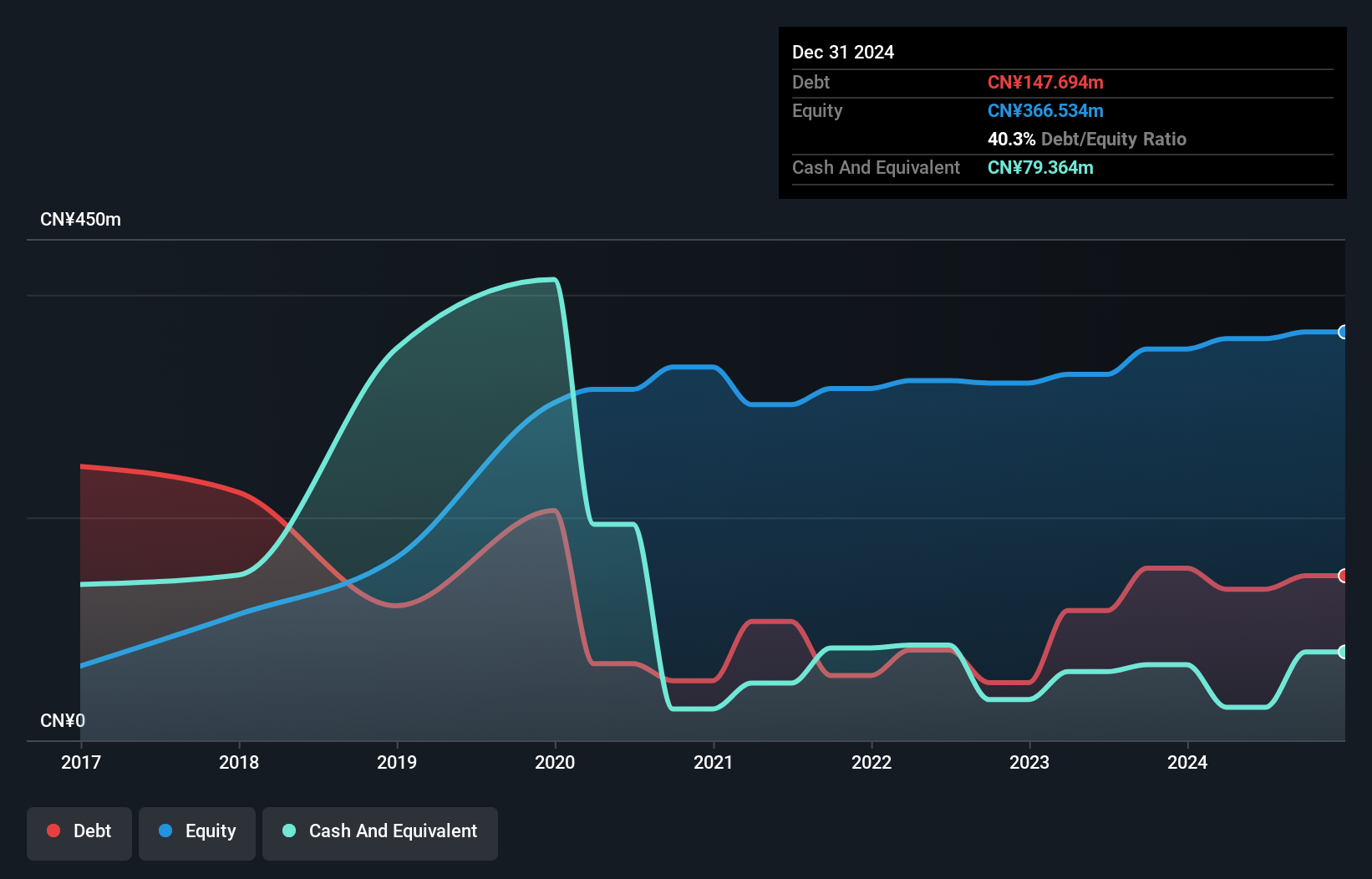

YiChang HEC ChangJiang Pharmaceutical, with its smaller market presence, has shown mixed financial performance. Over the past year, earnings surged by 44.7%, outpacing the industry growth of 6.4%. Despite this, earnings have declined annually by 2.1% over five years. The company's net debt to equity ratio stands at a satisfactory 6.3%, having decreased from 74.6% to 23.9% in five years, indicating improved financial health and reduced leverage risk. Recent half-year results show sales of CNY 2.45 billion and net income of CNY 684 million, both lower than last year's figures due to various market challenges likely impacting performance negatively.

- Delve into the full analysis health report here for a deeper understanding of YiChang HEC ChangJiang Pharmaceutical.

Understand YiChang HEC ChangJiang Pharmaceutical's track record by examining our Past report.

Key Takeaways

- Click through to start exploring the rest of the 164 SEHK Undiscovered Gems With Strong Fundamentals now.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1558

YiChang HEC ChangJiang Pharmaceutical

YiChang HEC ChangJiang Pharmaceutical Co., Ltd.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives