- Hong Kong

- /

- Metals and Mining

- /

- SEHK:3939

Discovering Hong Kong's Hidden Stock Gems In October 2024

Reviewed by Simply Wall St

As global markets experience mixed sentiments, with U.S. indices reaching new highs and Chinese equities facing downturns, the Hong Kong market presents a unique landscape for investors seeking hidden opportunities. In this context of fluctuating global economic indicators, identifying promising stocks often involves looking beyond immediate market trends to uncover companies with strong fundamentals and potential for growth amidst broader uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals In Hong Kong

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Lion Rock Group | 16.91% | 14.33% | 10.15% | ★★★★★★ |

| PW Medtech Group | 0.06% | 22.33% | -17.56% | ★★★★★★ |

| COSCO SHIPPING International (Hong Kong) | NA | -3.84% | 16.33% | ★★★★★★ |

| Sundart Holdings | 0.92% | -2.32% | -3.94% | ★★★★★★ |

| China Leon Inspection Holding | 8.55% | 21.36% | 22.77% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| S.A.S. Dragon Holdings | 60.96% | 4.62% | 10.02% | ★★★★★☆ |

| Carote | 2.36% | 85.09% | 92.12% | ★★★★★☆ |

| Chongqing Machinery & Electric | 27.77% | 8.82% | 11.12% | ★★★★☆☆ |

| Pizu Group Holdings | 48.34% | -4.53% | -19.78% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Sprocomm Intelligence (SEHK:1401)

Simply Wall St Value Rating: ★★★★★☆

Overview: Sprocomm Intelligence Limited is an investment holding company involved in the research and development, design, manufacture, and sale of mobile phones across various international markets including China, India, Algeria, and Bangladesh with a market cap of HK$5.31 billion.

Operations: The company generates revenue primarily from the sale of wireless communications equipment, amounting to CN¥3.27 billion.

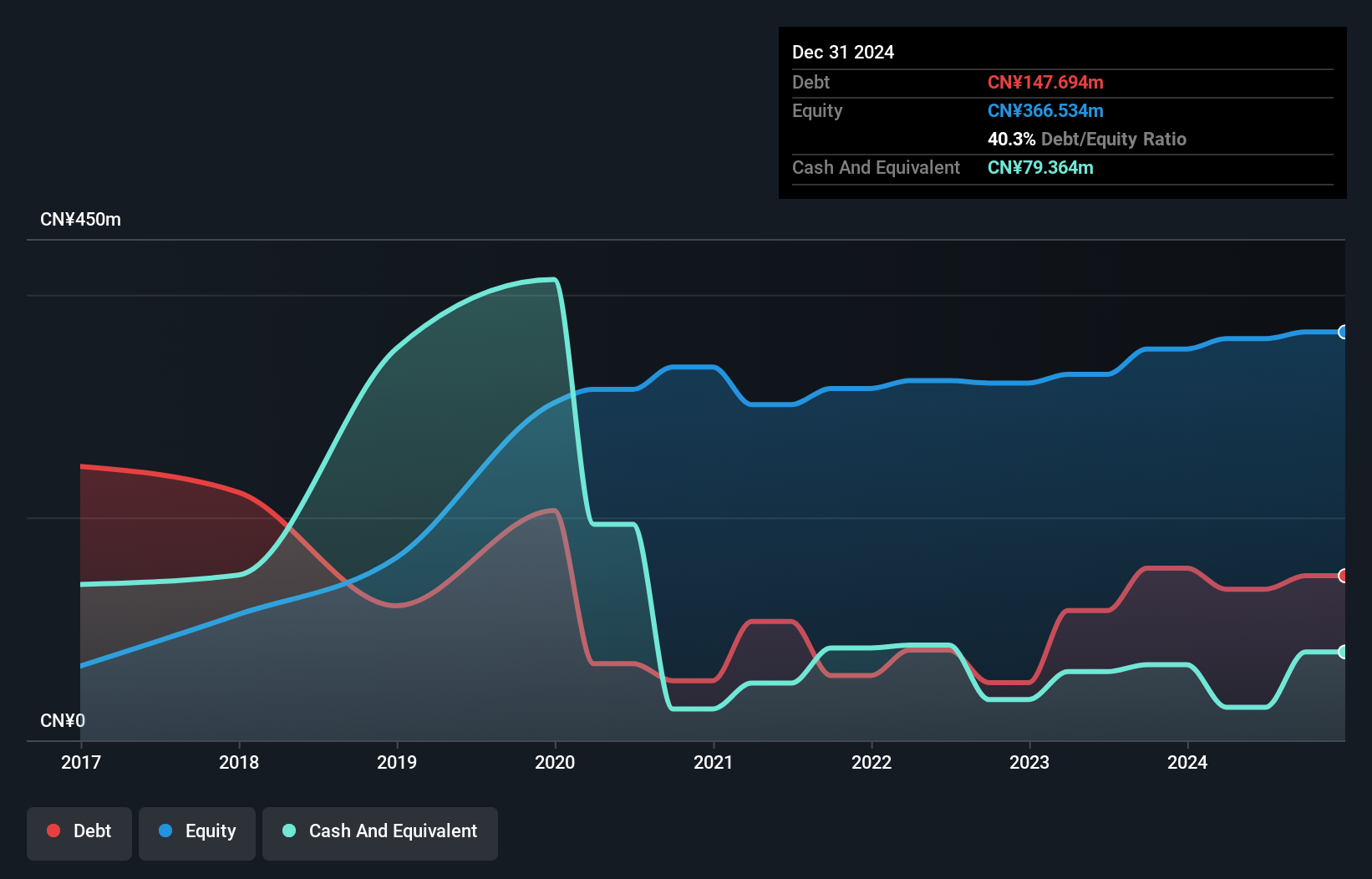

Sprocomm Intelligence, a relatively small player in the tech sector, has shown significant earnings growth of 301% over the past year, outpacing the industry average. The company's debt to equity ratio has impressively decreased from 73.8% to 37.6% over five years, indicating improved financial health. Recent transactions reveal a HK$200 million stake acquisition by an undisclosed buyer, highlighting investor interest. Despite these positives, interest payments are not well covered by EBIT at just 1.8 times coverage.

- Delve into the full analysis health report here for a deeper understanding of Sprocomm Intelligence.

Plover Bay Technologies (SEHK:1523)

Simply Wall St Value Rating: ★★★★★☆

Overview: Plover Bay Technologies Limited is an investment holding company that designs, develops, and markets software-defined wide area network routers, with a market capitalization of HK$5.40 billion.

Operations: Plover Bay Technologies generates revenue through the sales of SD-WAN routers, with mobile-first connectivity contributing $59.87 million and fixed-first connectivity adding $15.19 million, alongside software licenses and warranty support services totaling $31.86 million.

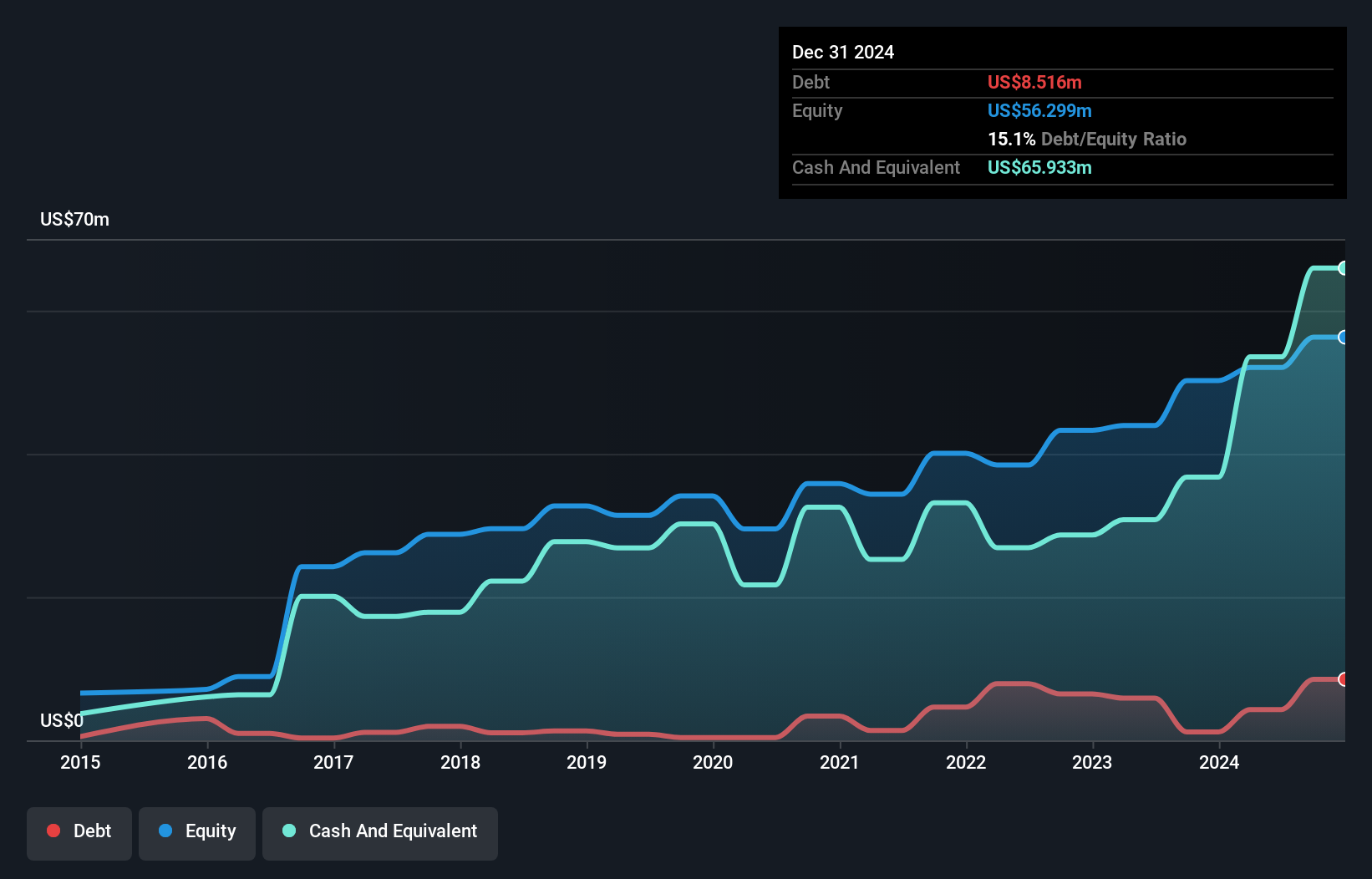

Plover Bay Technologies, a smaller player in the tech scene, has shown impressive financial performance with earnings growth of 41% over the past year. Trading at 51.5% below its estimated fair value, it presents an intriguing opportunity for investors. Recent results highlight sales of US$57 million and net income reaching US$19 million for the first half of 2024. Additionally, a dividend increase to HKD0.1083 per share underscores its commitment to shareholder returns while enhancing board diversity through new executive appointments.

Wanguo Gold Group (SEHK:3939)

Simply Wall St Value Rating: ★★★★★☆

Overview: Wanguo Gold Group Limited is an investment holding company involved in mining, ore processing, and the sale of concentrate products in China and the Solomon Islands, with a market capitalization of HK$8.52 billion.

Operations: The company generates revenue primarily from its Yifeng Project and Solomon Project, with the latter contributing CN¥912.63 million.

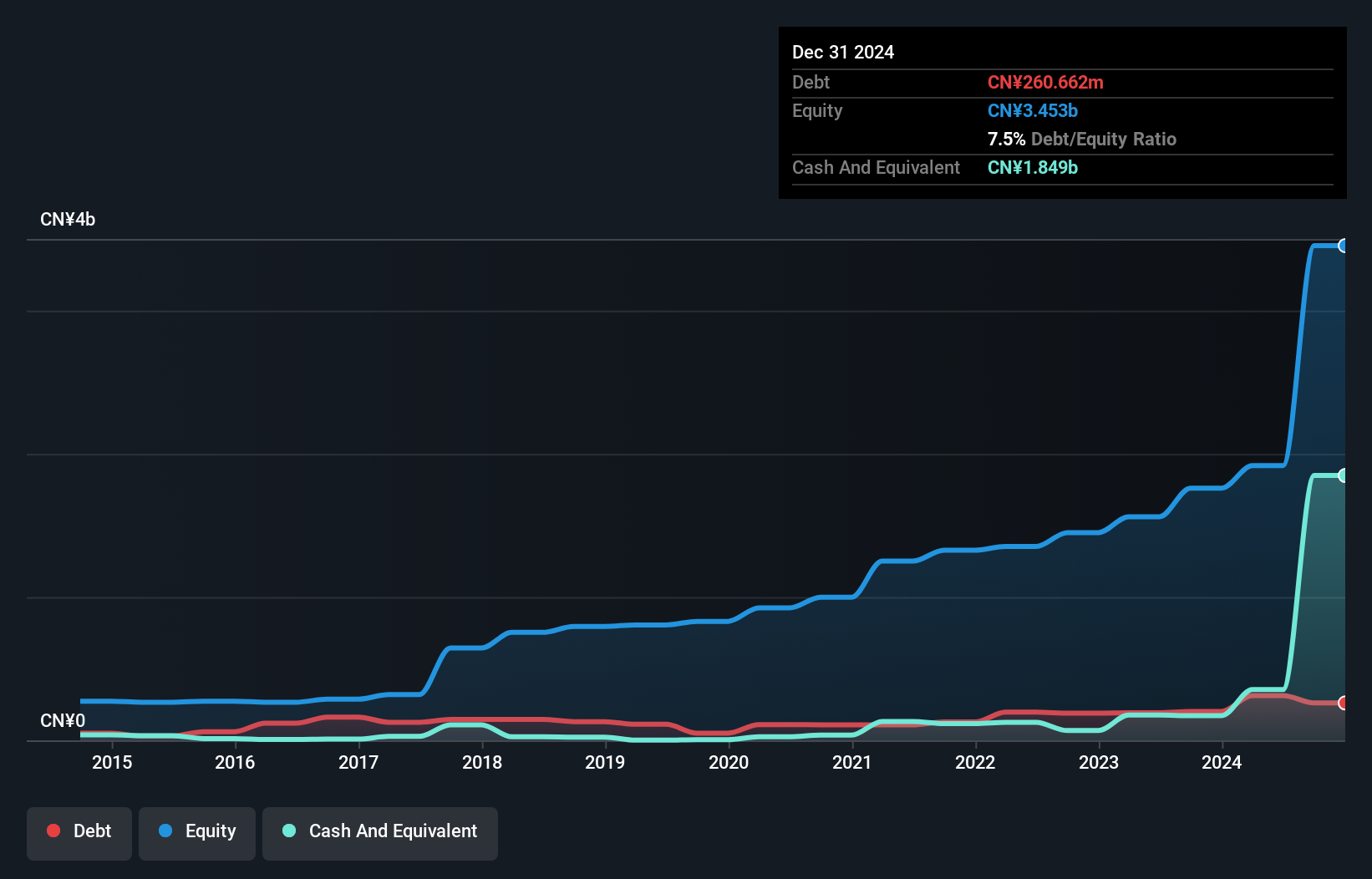

Hong Kong's Wanguo Gold Group, a notable player in the mining sector, has recently been added to the S&P Global BMI Index. The company reported impressive earnings growth of 89.9% over the past year, significantly outpacing industry averages. Despite an increase in its debt-to-equity ratio from 13.9% to 16.3% over five years, Wanguo maintains robust interest coverage at 91.7 times EBIT and boasts high-quality earnings with positive free cash flow reaching HKD 217 million recently.

- Get an in-depth perspective on Wanguo Gold Group's performance by reading our health report here.

Explore historical data to track Wanguo Gold Group's performance over time in our Past section.

Summing It All Up

- Dive into all 168 of the SEHK Undiscovered Gems With Strong Fundamentals we have identified here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wanguo Gold Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3939

Wanguo Gold Group

An investment holding company, engages in mining, ore processing, and sale of concentrate products in the People’s Republic of China and Solomon Islands.

Exceptional growth potential with outstanding track record.

Market Insights

Community Narratives