- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:1335

Sheen Tai Holdings Group Company Limited's (HKG:1335) Share Price Is Still Matching Investor Opinion Despite 26% Slump

To the annoyance of some shareholders, Sheen Tai Holdings Group Company Limited (HKG:1335) shares are down a considerable 26% in the last month, which continues a horrid run for the company. The good news is that in the last year, the stock has shone bright like a diamond, gaining 160%.

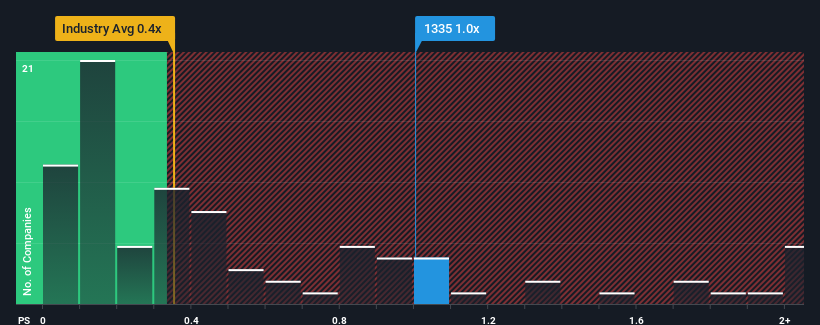

Although its price has dipped substantially, given close to half the companies operating in Hong Kong's Electronic industry have price-to-sales ratios (or "P/S") below 0.4x, you may still consider Sheen Tai Holdings Group as a stock to potentially avoid with its 1x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

View our latest analysis for Sheen Tai Holdings Group

How Has Sheen Tai Holdings Group Performed Recently?

As an illustration, revenue has deteriorated at Sheen Tai Holdings Group over the last year, which is not ideal at all. One possibility is that the P/S is high because investors think the company will still do enough to outperform the broader industry in the near future. If not, then existing shareholders may be quite nervous about the viability of the share price.

Although there are no analyst estimates available for Sheen Tai Holdings Group, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as high as Sheen Tai Holdings Group's is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered a frustrating 26% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 251% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Comparing that to the industry, which is only predicted to deliver 23% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

With this information, we can see why Sheen Tai Holdings Group is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Final Word

Despite the recent share price weakness, Sheen Tai Holdings Group's P/S remains higher than most other companies in the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

It's no surprise that Sheen Tai Holdings Group can support its high P/S given the strong revenue growth its experienced over the last three-year is superior to the current industry outlook. At this stage investors feel the potential continued revenue growth in the future is great enough to warrant an inflated P/S. Barring any significant changes to the company's ability to make money, the share price should continue to be propped up.

It is also worth noting that we have found 2 warning signs for Sheen Tai Holdings Group that you need to take into consideration.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1335

Sheen Tai Holdings Group

An investment holding company, engages in the trading of semi-conductors in Hong Kong and Mainland China.

Flawless balance sheet low.

Market Insights

Community Narratives