- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:1050

Karrie International (SEHK:1050) Margin Slides to 6.2%, Undermining Recent Earnings Growth Narrative

Reviewed by Simply Wall St

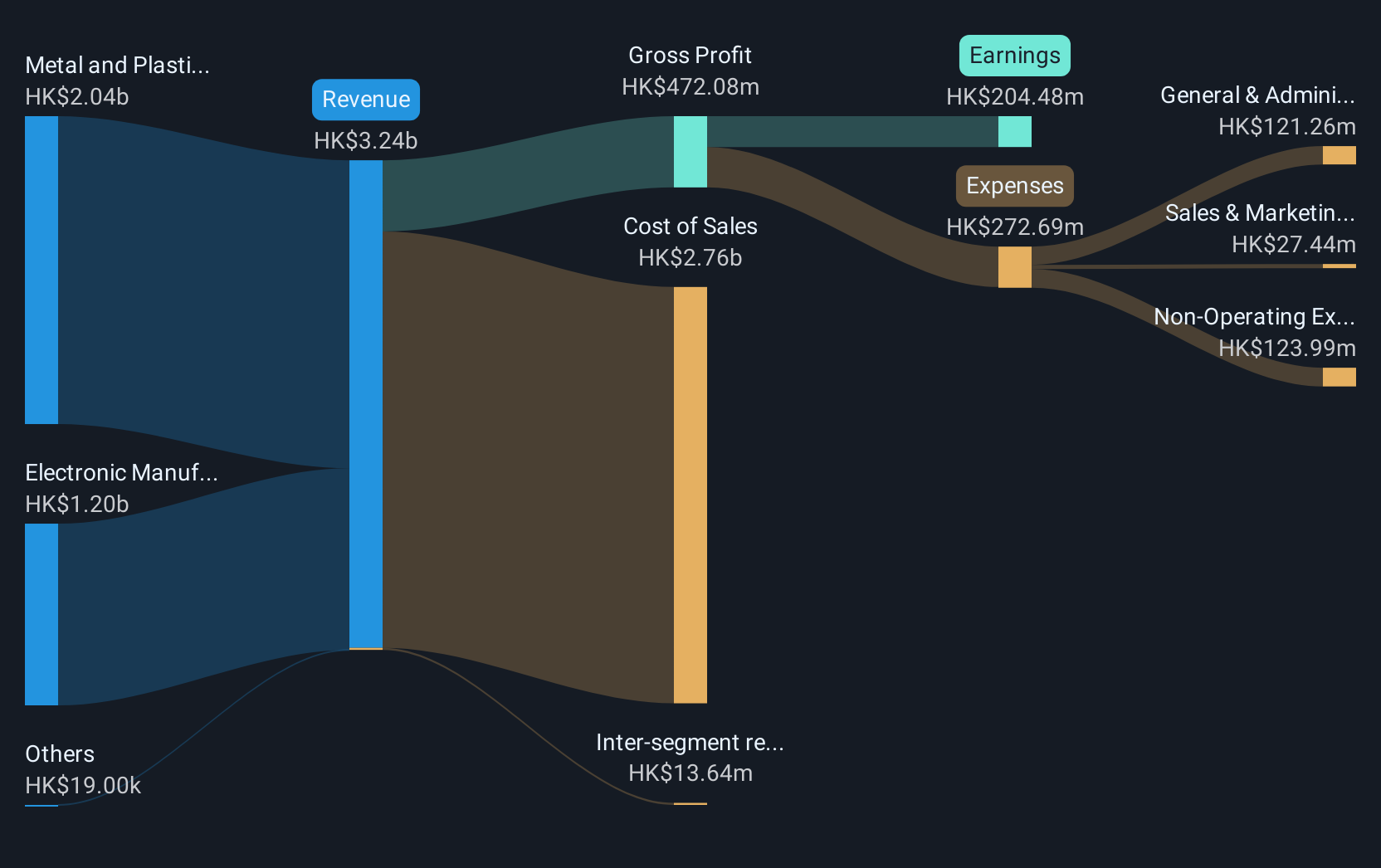

Karrie International Holdings (SEHK:1050) just posted its first-half 2026 results, reporting revenue of HK$1.7 billion and basic EPS of HK$0.051. The company’s revenue has steadily ticked up over recent periods, increasing from HK$1.5 billion in 1H 2025 and HK$1.5 billion in 2H 2024, while basic EPS has remained broadly stable in the HK$0.05 range. Margins have been compressed, so investors are likely to focus on whether this improvement in annual earnings growth can offset the drag from weaker profitability trends in recent years.

See our full analysis for Karrie International Holdings.Next, we compare these headline numbers with the broader market narratives on Karrie International Holdings to see which stories match reality and which might need to be reconsidered.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margin Slides to 6.2%

- Karrie International’s net profit margin for the last twelve months is 6.2%, down from 6.6% in the previous year and impacted by a one-off HK$77.4 million loss.

- Market analysis highlights margin compression as a key challenge that is limiting the company’s ability to outperform industry peers.

- The margin decline reinforces ongoing concerns about the business’s ability to sustain profitability, especially considering a five-year average annual earnings decline of 20.8%.

- Recent annual earnings growth of 3.3% year-on-year stands out compared to the longer history of declining profits, creating a contrast in how investors perceive progress versus persistent challenges.

Valuation Premium Versus Industry

- With a Price-To-Earnings ratio of 27.1x, Karrie shares are trading at more than double the Hong Kong electronics average of 12.4x and also above their DCF fair value of HK$1.13, while the current share price is HK$2.74.

- The relatively high valuation places Karrie in a challenging position:

- Although it is less expensive than its immediate peers’ average of 36.9x, some investors note that a premium rating provides less margin for error if growth slows or margins do not recover.

- Recent price volatility and high debt levels are also cited as reasons to be cautious about paying a premium for a company still undergoing transition.

Annual Earnings Growth Rebounds

- The company reported 3.3% annual earnings growth over the past year, a sharp reversal from the five-year average annual decline of 20.8%, which is a notable change after several years of contraction.

- This rebound has gained attention as analysts observe that, despite structural challenges, steady revenue growth and improved profitability in the latest period could provide a basis for further positive developments if cost pressures lessen.

- This growth is supported by diversified revenue streams spanning electronics, metal, and plastic manufacturing, which offer some protection from individual market downturns.

- However, net profit levels remain below those of five years ago, indicating that a return to previous highs may require sustained improvement over a longer period.

For a broader breakdown of the company’s risks and rewards, and how this year compares to its long-term performance, see the full AI-generated market analysis.

Have a read of the narrative in full and understand what's behind the forecasts.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Karrie International Holdings's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite a recent rebound, Karrie International still faces compressed profit margins and valuation challenges. These factors make its long-term earnings recovery uncertain.

Looking for stocks with more attractive entry points and stronger value upside? Discover these 932 undervalued stocks based on cash flows that could offer better market opportunities right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Karrie International Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1050

Karrie International Holdings

An investment holding company, manufactures and sells metal, plastic, and electronic products in Hong Kong, Japan, Mainland China, Asia, North America, and Western Europe.

Excellent balance sheet with slight risk.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.